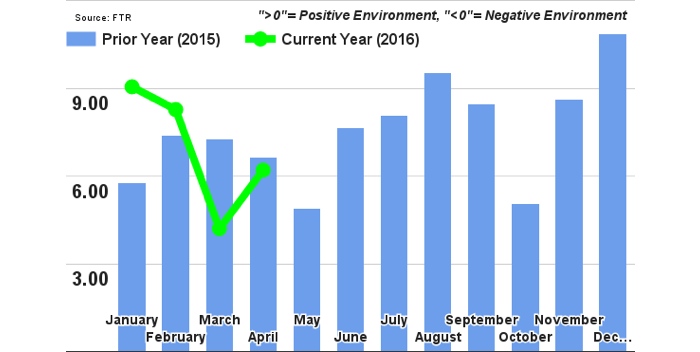

FTR’s Trucking Conditions Index (TCI) for April at a 6.2 reading, while up month-over-month, reflects soft market conditions affecting the trucking sector. The market is mired in a slowdown with truck freight growth slowing and a modest amount of excessive equipment. FTR is currently forecasting a transition to moderate growth toward the end of the year, but sees some downside risk that freight could slow further. FTR does not expect any freight-driven capacity restraints on the sector over the next several years, saying that those are only likely to come from regulatory action.

Details of the April TCI are found in the June issue of FTR’s Trucking Update. The ‘Notes by the Dashboard Light’ commentary in the current issue takes a close look at market conditions and what might be expected going forward.

“There is enough uncertainty swirling around the trucking markets right now to force a manager or business owner to keep the antacids handy. Spot market rates are still negative, contracts rates are moving in that direction, and freight growth has stalled out for several segments,” said Jonathan Starks, FTR’s chief operating officer. “Luckily, not all of the news is bad. The driver shortage is no longer the immediate concern it once was, and the economy continues to trudge along. I am watching inventory right now because of its quick impact on freight demand. Inventory levels are at highs that we haven’t seen outside of a recession since the turn of the 21st century. Does that mean we are heading into a recession? Perhaps, but not definitively. The other conclusion is that higher inventory is the new norm, and it’s just going to take some time for supply chains to optimize their inventories. That could slow freight growth but wouldn’t put the brakes on truck demand.”