Electrification is the story of the year in the trucking world. From Cummins to Fuso to Chanje to Tesla, serious moves were made by various OEMs to begin the process of bringing what was previously a theoretical concept to the real world. No one can deny that electrification is coming.

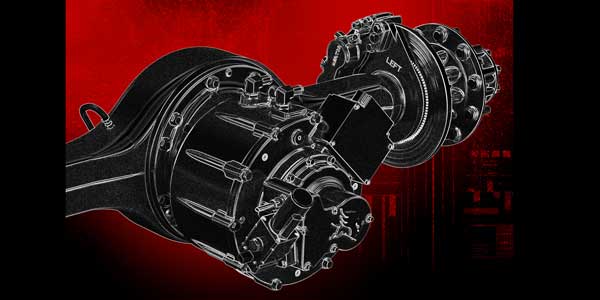

With new priorities for OEMs come new challenges for suppliers. There’s one particular component that holds a place of supreme importance in electric trucks, and that’s the axle. Yes, the axle is always crucial, but with the absence of a diesel engine, an electric drivetrain is even more reliant on its axle to make the whole thing run.

“For a conventional diesel truck, the power supplied to move the vehicle comes from a conventional diesel engine, with design and control remaining with the engine manufacturer,” says Ryan Laskey, vice president of driveline and commercial vehicle engineering for Dana. “The biggest difference for Dana with an electrified powertrain is that the axle controls the power that moves the vehicle. Dana takes a broader ownership of meeting the application requirements for all the markets we intend to serve.”

For a real-world example of this, take the recently announced Hyliion 6X4HE hybrid electric system. The Hyliion 6X4HE adds an electric axle, developed by Dana, and a battery pack to the conventional diesel powertrain in a Class 8 truck. The system evaluates whether the engine is working hard or downshifting versus when it is coasting, and uses its algorithms to decide when to apply electric power and when to store it. This, the company says, results in a total of 30% fuel and emissions savings.

The axle for Hyliion’s 6X4HE system was developed by Dana. Hyliion Chief Executive Officer Thomas Healy says that the two companies worked together very closely in the development process to optimize the axle for the system.

“A critical part of our business is that we work with companies that are already established rather than trying to do everything ourselves,” Healy says. “When we were looking at developing this technology, we could have gone and designed and developed our own axles, or we could leverage components that are already out there and on the shelf, such as Dana’s axle.”

In short, Healy says, Hyliion didn’t want to worry so much about a component like the axle when they had the whole system to design.

“Dana knows more about axles than we could ever hope to know,” he says. “So we might as well leverage their knowledge base, and keep our knowledge base on the core of the technology.”

Another example came in September, when Nikola Motor Co. and Bosch announced that they have joined forces to develop a fully electric powertrain for the Nikola One and Two, a pair of electric-drive Class 8 trucks due for release by 2021.

The eAxle developed by Bosch is a scalable, modular platform with the motor, power electronics and transmission in one compact unit. This, Bosch says, makes it suitable for vehicles of all kinds, from small passenger cars to light trucks. Nikola and Bosch say they will use this knowledge to commercialize a true dual-motor commercial-vehicle eAxle for a long-haul truck.

The eAxle will use commercial vehicle electric machine technology and separate motor generator (SMG) motors from Bosch, and will be paired with a custom-designed fuel cell system, also being developed jointly between Nikola and Bosch, designed to deliver benchmark vehicle range.

Similarly, Meritor has also confirmed that it is working on electric axles for Class 5-8 trucks. According to John Bennett, general manager of global product strategy and advanced engineering for Meritor, the axles will be multi-speed capability units, with a single motor, electrified carrier integrated into the axle assembly and electric drive systems at the wheel. Bennett says these will be flexible systems that will work across various suspension types including rigid axle, trailing arm, independent and double wishbone independent setups.

Fuel savings

Decreased operating costs are, of course, the number one reason to make the switch to hybrid or electric vehicles. Considering that a hybrid system substantially reduces the need to burn diesel, while an electric truck completely eliminates it, the potential savings are significant, even considering the up-front costs of an electric or hybrid system. The fact that fuel is the biggest cost for any fleet should make the possible savings enough to turn the heads of even the biggest electric-truck skeptics.

We have a real-world example of this already: the aforementioned 30% fuel savings number from Hyliion’s hybrid system. The company says that the total fuel savings are delivered by a blend of three technologies, with 15% coming from the electric hybrid drive axle, 12% from the APU system, and 3% from aerodynamic improvements. In other words, half of the value of the system is generated simply by the axle.

In general, final fuel savings numbers will, of course, vary depending on a wide variety of factors, including vocation and duty cycle.

“In a fully electric truck, you are trading fuel cost for electric energy cost,” notes Meritor’s Bennett. “The ranges we are looking at depend on miles driven per year and how often the vehicle is in service. Depending on application, some of our payback models for the incremental cost of the system show a one- to three-year payback with government subsidies available today. We expect these payback periods to reduce noticeably over time to increase the speed of the ROI time-frame due to reduced battery and electric component cost.”

“Mild hybrids have demonstrated that 30% fuel savings are possible, with tractor applications going above 11 MPG,” says Dana’s Laskey. “Diesel engines are have BTE in the 40-45% range, with well over half of the energy being wasted due to heat loss. Pure electric vehicles that eliminate the diesel engine completely are eliminating these engine losses, so energy savings of 50% or more are possible.”

The challenges of development

Dana’s Laskey says that there are a myriad of challenges when developing hybrid and electric applications, many of which relate to basic design choices. It is important, he notes, for the supplier to provide the flexibility and options needed for each particular application.

For example, suppliers have a choice between two basic electric motor types: asynchronous induction motors, which cost less but provide less efficiency, and synchronous permanent magnet motors, which provide greater efficiency but cost more due to their use of rare earth elements in the magnets, Laskey explains.

Cooling the system is another key challenge for the electric motor, power electronics and batteries, Laskey says, noting that Dana also offers insulated gate bipolar transistor (IGBT) coolers through its Power Technologies group.

“These double-sided coolers cool both sides of the chip, making them more effective for inverter cooling,” Laskey explains. “Dana also offers battery coolers to keep the battery at optimum operating temperature.

“Lastly,” he adds, “there is a choice of integrated versus non-integrated designs. Some customers require batteries to be packaged between the frame rails or have vehicle requirements such as side steps, both of which would interfere with the driveshaft. Dana has solutions for integrated eAxles that free this design space, allowing the customers better flexibility to utilize this chassis space.

Meritor’s Bennett points out several other challenges of developing axles for hybrid and electric trucks, starting with weight and packaging. “Large commercial vehicles require large motors and associated electric components,” he says. “All of this adds weight to the vehicle.”

Adding weight to the truck also means engineers need to focus on minimizing the impact this weight will have on the truck’s ride and handling, Bennett notes.

Managing the durability of electrical components is another challenge.

“When you hit a pothole it sends a shock load to the axle,” Bennett points out. “As these are commercial vehicles that are working in harsh conditions and subjected to heavy use, they are especially sensitive. The duty cycle of gearing is different because these drivetrain systems utilize regenerative braking, which causes additional stress on gearing that you would not have on a conventionally powered truck.”

Bennett notes that reduced noise is one positive byproduct of a hybrid or electric axle, meaning that the engineers do not have to account for the axle noise they would usually plan for.

The future

Of course, the biggest focus—when it comes to hybrid or electric vehicles—is on the future, and that applies just as much to the axles that power them.

Dana’s Laskey brings up three key questions that will determine whether fleets purchase electric trucks: how far the truck can travel on a single charge; how long the recharging process takes and whether there is an infrastructure in place for recharging; and what the cost and payback period of the vehicle will be.

“Infrastructure development and vehicle cost are the key drivers that will affect how quickly electrified vehicles take to materialize in meaningful numbers,” he says. “Many companies and public entities are building charging infrastructure to enable cross-country travel.

“Regarding vehicle cost, the biggest driver is the cost of the battery, and battery costs are expected to decline from $260 per kilowatt hour [kWh] right now to $122 per kWh in 2026. This will have a marked impact on electric vehicle adoption rates, so over the next five to 10 years, 10% or more of trucks on the road could have a hybrid or full electric powertrain.”

“In some regions such as China, we are already seeing a ramp-up [of electric trucks],” Meritor’s Bennett says. “We expect China to be fully electric for the majority of buses in five to 10 years. North America and Europe are also expected to rapidly adopt these technologies, especially within the bus market. While we are seeing the quickest ramp up in the bus market, there is also strong demand in the pickup and delivery segment. Beyond this time frame, we expect many other types of electric drivetrains will find their way into other applications.”