In the classic 1967 movie, The Graduate, Ben Braddock (played by a young Dustin Hoffman) is pulled aside by a well-meaning friend of the family who offers one word of career advice: “plastics,” he says confidentially. If that film were remade today, the mentor would probably be quietly suggesting “telematics.”

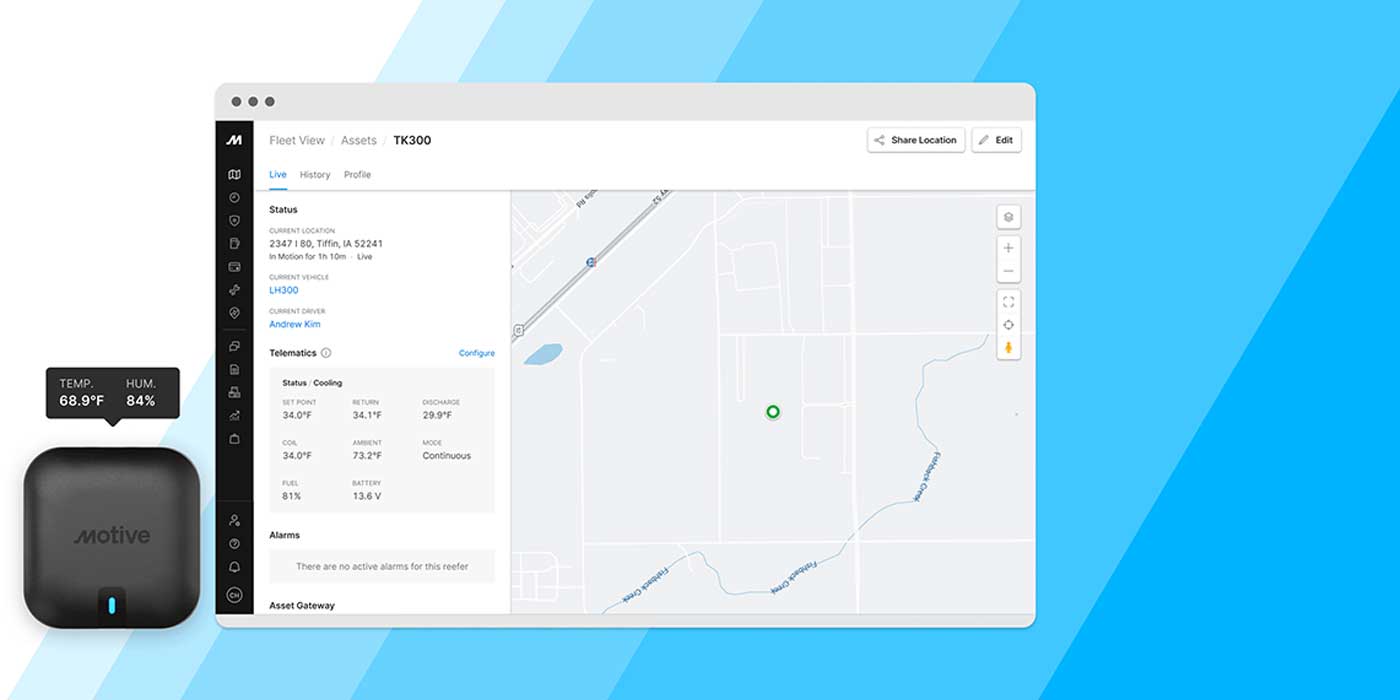

Telematics, a word cobbled together from telecommunications and infomatics, is the long-distance transmission of computer-based information. As anyone who owns a “smart phone” knows, it’s a rapidly growing field these days because people want immediate access to an increasingly wide assortment of information—in any location.

Refrigerated transport telematics technology has been available slightly more than a decade. During that time, the level of sophistication has risen dramatically and prices have fallen. In recent years, a lot of the communications have migrated from satellites to cellular networks, which offer greater bandwith and lower costs. Reporting has changed, too. Most providers now deliver subscriber data through Web-based applications, almost eliminating the need for end-of-trip downloading.

The benefits of these systems seem obvious: better fleet utilization, greater cargo and equipment security, enhanced maintenance abilities and proof of compliance with shippers’ temperature requirements. Still, it’s estimated that only 5% to 10% of refrigerated trailers on the road today have active telematics capabilities. One issue is entry price, which is always a consideration for an industry operating on razor-thin margins. Poor timing is also to blame. A lot of the coolest features were introduced at about the same time that market conditions deteriorated. During the past 18 to 24 months, many carriers have struggled to cover their existing operating expenses.

People who work for telematics companies say they expect demand for their products will surge once the nation’s economic picture improves. While this might be true, it’s important to note that telematics executives are perpetual optimists who have predicted dramatic growth in their businesses since about 2000. They could be right this time, however.

“We’ve seen signs of improvement,” says Steve Fields, director of account management at StarTrak Systems in Morris Plains, N.J. “There are many more fleet operators in the market now. Also, there’s a growing awareness among shippers about the capabilities of telematics. Early-adopter fleets are touting this as a sales advantage, and that’s putting pressure on those who might have been on the sidelines.”

Brad Bartlett, director of business development at CoolTrax in Atlanta, Ga., echoes that sentiment. “We’re already seeing shippers demanding more in-transit information from their carriers,” he says. “They want to see accurate temperature reports. If you add to that all the things fleets can do nowadays with telematics systems, the ‘value proposition’ is so high I think we’re headed for explosive growth, both short and long term. I’d expect to see 20% market penetration within the next three years.”

A number of high-profile refrigerated fleets have recently signed up for trailer telematics: C.R. England, KLLM Transport and Marten Transport, to name just three. Although their initial reasons for adopting this technology might differ, they all agree that the investment was worthwhile and ROI will be short.

David Meyer, director of maintenance at Marten Transport, says his company has already used the service to recover a stolen trailer, within an hour of the theft, while it was still on the road. Management has also been able to quickly correct numerous incidents in which unit temperatures did not match shippers’ specifications. All of these issues were resolved because of automatic alerts generated by their telematics provider, GE Equipment Services.

Meyer says managers at Marten had goals in mind while designing their system. They wanted to collect a broad spectrum of mechanical, operational and logistical data, of course, but they also wanted that information fully integrated with the company’s existing operations and tractor-telematics software.

Careful planning is key when choosing a provider, a service package and specific features, says Craig Montgomery, a senior vice president at SkyBitz in Sterling, Va. With such a wealth of options and data available, one could easily be overwhelmed. “Our company alone offers customers up to 50 distinct reports,” he says.

SkyBitz joined forces with PAR Logistics Management Services last year to assemble a service plan for C.R. England. Montgomery says his company tries to offer customers maximum flexibility with their packages. For example, it uses an open “application program interface” (API) that enables SkyBitz subscribers to view types of asset tags (the sensors collecting information) within their fleets. This ability can be quite useful when carriers using different brands of tags merge.

“Eventually, carriers would probably want to migrate to one system—and obviously we hope it’s SkyBitz—but in the meantime, our API allows customers to monitor all types of tags,” Montgomery says.

Despite the multitude of benefits telematics offers, there are concerns (however unfounded) about the security of these systems. Could malicious hackers attack a fleet’s reefer units? Highly unlikely, says Mark Fragnito, electronics products manager for Carrier. “All of the data transmissions are all encoded,” he says, “and the information is delivered to subscribers through a variety of secure methods.”

John Habermann, telematics product manager, Thermo King, agrees. “It would be very difficult to hack into a system,” he says. “We use an interface called iBox to talk to our microprocessor. It provides the security we need.”

It’s a safe bet that Tom Pronk at C.R. England isn’t worried about the vulnerability of telematics—or any other similar equipment. As corporate vice president of recruiting, training and safety, he’s on the edge of his company’s electronic frontier. “I’ll evaluate a new technology probably once a month and decide where we’re going next,” he says.

C.R. England deploys an array of gadgets in its trucks and trailers to monitor individual vehicle performance and fleet activity. Pronk says the many tools at his disposal constitute just one part of a greater effort to run a profitable operation. “I believe that we can’t rely on technology alone, but more information (as long as it’s not overly intrusive) is better. It allows us to respond to events more quickly—and even proactively in certain situations such as safety and load security.”

There’s also the peace of mind from knowing that everything is running smoothly, says Robert Pfeffer, owner of Pace Airfreight in Plainfield, Ind. He has fitted 15 of his 35 reefers with telematics devices. “When I’m not getting any alerts on my phone,” he says, “I’m a happy guy.” FE