What do the trucks of tomorrow look like? This year the industry showed us a glimpse. The trucks of tomorrow will be even more connected, many of them will be electric or make use of other alternative power sources, and featured ever-evolving levels of automated driving systems.

The foundation is laid at the OEM level to advance trucking technology, but suppliers can drive progress forward. After all, someone has to design the dashboards that connect trucks, the axles that power electric vehicles, and the safety technology that forms the building blocks of automated driving systems. That’s why 2019’s Fleet Equipment Trucking Trend of the Year is the new innovations and products being put forward by the trucking industry’s suppliers.

The role of suppliers in trucking innovation

The rapid advancement of trucking technology has, without question, put additional pressure on suppliers to keep up. But the suppliers say they welcome the challenge.

“This is, without a doubt, one of the most dynamic and exciting times to be a part of our industry,” says Richard Beyer, vice president of engineering and R&D for Bendix. “Because a commercial vehicle is a rolling asset that generates profit, fleets are highly focused on cost per mile and lowest TCO for their application. This emphasis on TCO sets commercial vehicles apart from cars, where buyers typically may follow a different set of buying criteria, such as environmental concerns.”

This, Beyer says, informs the way in which Bendix designs its new products.

“It requires close partnerships with our OEM customers and end users as we consider the products for the upcoming generation of vehicles,” he says. “This effort requires a very careful, strategic understanding of how emerging technologies will impact and be integrated with critical safety elements such as air management, brake control and wheel-end systems.”

John Bennett, vice president and chief technology officer for Meritor, goes over some of the pressures being felt by suppliers:

“For one, our customers, the vehicle manufacturers, are requesting more efficient products [e.g. axles and brakes]. The trend toward e-mobility has also created an urgency to develop completely new product lines, which require significant investments. As OEMs continue to explore different drivetrain and powertrain options, as a supplier, it is critical to develop new technologies to stay ahead of trends and establish our presence as first movers in the sector, even with low initial volumes.”

Robb Janak, director of new technology for Jacobs Vehicle Systems, says that while the pressures on suppliers are increased, this also offers the opportunity for supplier-developed technology to support the market needs.

“The improvements required by world governments and people necessitate a broad spectrum of improvements to every aspect of the vehicle. Therefore, technology development suppliers such as ourselves are needed to bring our best-proven ideas to market,” he says.

“Innovation can hide in the least likely places,” opines Omar Fernandez, director of marketing for Hendrickson Trailer Commercial Vehicle Systems. “So while Hendrickson always strives to bring revolutionary new designs to market, we don’t overlook simple improvements that can make a big impact on reducing maintenance and total cost of ownership.”

Suppliers in 2019

All year, suppliers have been making headlines with advanced trucking technology and components. You could see it at the recent North American Commercial Vehicle show, where in a busy news week, suppliers made many of the biggest headlines. Here’s a sampling of said headlines:

- Allison Transmission launches new transmission, partnership with Freightliner Trucks;

- Bendix Wingman Fusion upgrade to offer new collision mitigation, steering capabilities;

- Cummins expands X15 diesel engine portfolio in 2020;

- Eaton to launch a heavy-duty transmission for electric commercial vehicles;

- Hendrickson launches Watchman trailer wheel-end sensing technology;

- Maxion unveils new commercial steel wheel;

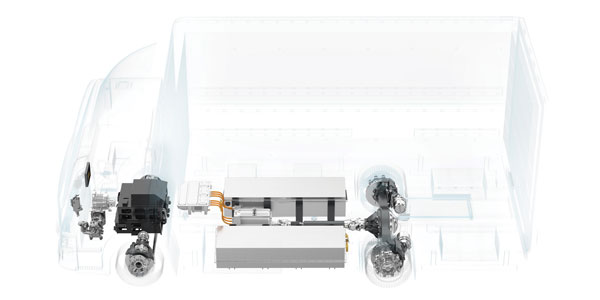

- Meritor expands electric-drive systems with medium-duty 12Xe powertrain, heavy-duty 17Xe;

- SAF-Holland launches SMAR-te Tire Pilot;

- ZF announces that AxTrax electric axle is on the Freightliner Innovation Fleet eCascadia.

Suppliers putting in this kind of work tells fleet managers two things: That suppliers are confident in these future solutions and that they’re working to make them the best that they can be.

“We recognize that this is not an industry where we can continue to work in a siloed fashion,” says Jason Brown, global technology manager for heavy-duty diesel engine oil will Shell Lubricants. “This company is one that believes in partnerships. It believes in working with the industry to improve it. Working in a silo may develop the best thing that you can do, but working in collaboration with our OEM partners and with third parties that are in the industry to make improvements is actually going to give us a harmonized improvement in what we do.”

“We know that the need to evolve is constant, but knowing where to focus that evolution in technology is key,” says Hendrickson’s Fernandez. “We spend time listening to our customers’ needs and regularly host customer councils and attend industry meetings to ensure that our focus is aligned with our customers’ needs. Our investment in advanced research and development gives us the ability to design, test and iterate new product concepts in a controlled and repeatable fashion to ensure the utmost quality and durability.”

“I think we can all agree that the transportation industry overall is at the crossroads of major change,” says Bendix’s Beyer. “The ways we move goods in a connected environment, in addition to the vehicles which will be moving the goods, are changing and at a highly accelerated pace. That means we must intelligently move at that same pace as well.”

“The current advancement of technology application is certainly sweeping the industry. SAF-Holland as a component supplier is already actively developing and adapting technology to existing products,” says Carl Mesker, vice president of sales, Americas for SAF-Holland. “These future technologies will benefit fleet operations in exponential ways. For instance, when axles are equipped with sensors and networked together, we can determine the overall condition of a trailer from the collected vehicle data. The condition can be easily reported to the driver as well as the back office, where the fleet equipment manager resides. All of this is focused on adding electrification and sensorization to our components with digital connection technology in mind to meet a fleet’s future vehicle enhanced operation efficiency and telemetry needs.”

Suppliers in the 2020s

What’s next for suppliers as we take the first step into a new decade? How are they planning to keep up with the next decade’s innovations and advancements?

One predicted trend of the next decade is an increased prevalence of alternative fuels in trucking. We’ve seen some of these solutions start to take shape, and the next decade may be the one in which power sources such as electrification really take off.

Shell’s Brown names hydrogen, electricity, natural gas, biofuels and nature-based sources as among those areas that Shell is looking at and investing in, noting the oil company’s commitment to changing with the times.

“They’re all areas that we have to invest in,” he says. “Now, your question might be, well, why? You guys are fuels; oil and gas.

“We can’t be that going forward. I think one of the things that Shell has been very good about is stating the fact that one, there is an energy challenge. Two, we are part of that challenge, but the third and most important part is we can be part of the solutions as well. And I say solutions, plural, because not any one of these things is probably going to be the silver bullet of the future for the energy challenge. It’s going to take a combination of all of them and we feel as an organization that the best way to do that is to invest in all of them,” he says.

“We’re still going to have diesel engines for quite a while,” Brown continues. “Thank goodness for people who want to move a lot of weight; that’s going to keep this industry going for a while.

“But along the way, we’re definitely going to have hybrids. And the needs and points of lubrication in hybrids are going to change.”

Electric vehicles, he notes, while devoid of an engine, still require many lubricants and greases to operate. They will need cooling fluids to keep the batteries from overheating; greases for the wheels; and many of them will require transmission fluids as well.

Steve Slesinski, director of global product planning for Dana, also talked about the coming of alternative fuels, noting that depending on customer duty cycles, hybrid and electric vehicles have reached the point where they can be cost-justified to bottom-line-wary fleets.

“One of the biggest challenges facing electrification is that fleets and vehicle operators tend to experience sticker shock over the initial investment,” he says. “Once the total cost of ownership is evaluated, truck operators will quickly understand how electrification can save both time and money from a fuel savings and maintenance perspective while reducing greenhouse gas emissions.”

“Meritor has a long-term product technology roadmap that is prioritized for investments,” shares Meritor’s Bennett. “We remain proactive in the product development process and continue to work with our customers, so that we remain their solution of choice—whether it is a standard drivetrain or an ePowertrain. Our evolutionary strategy allows us to continue to evolve our current product offering while enabling future investments in long-term technology offerings.”

“Hendrickson stays in close connection with new technologies and industry regulations that have the potential to change the commercial vehicle landscape,” says Hendrickson’s Fernandez. “We understand that as equipment is added to trucks and trailers to meet new regulations, the overall vehicle weight continues to be a prominent factor, which drives us towards increasingly lighter designs that do not sacrifice durability.”

SAF-Holland’s Mesker brings up the importance of considering data as well.

“It’s not only the products that the technology is applied to, it’s the data that is available now and all the questions that come with that,” he points out. “Questions like, ‘What data is important, what do we do with it, and who owns the data?’” (Ed. Note: For more on these and other data-related questions, read our here.)

With the decade coming to a close, Fleet Equipment also explored the trucking trends of the decade. Click here to read more.