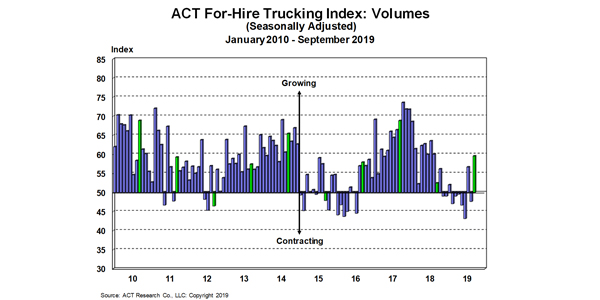

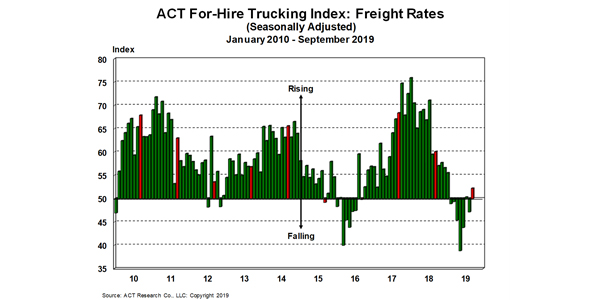

The latest release of ACT’s For-Hire Trucking Index, with September data, showed an even stronger surge than July, with the Volume Index up to 59.6 (SA), from 47.6 in August. The September Pricing Index rebounded as well, if to a lesser degree, rising to 52.2 (SA), from 47.1 in August.

“We remain mindful of shippers’ duty to manage tariff risk, but this is likely also being driven by strong consumer trends,” said Tim Denoyer, ACT Research’s vice president and senior analyst. “With still-aggressive private fleet growth and a weak U.S. manufacturing sector, choppy results will likely continue, but the past few months suggest a bottoming process is underway. It won’t be linear, as record U.S. Class 8 tractor retail sales in September tell us capacity is still being added rather quickly, but capacity rebalancing will unfold over the course of next year.”

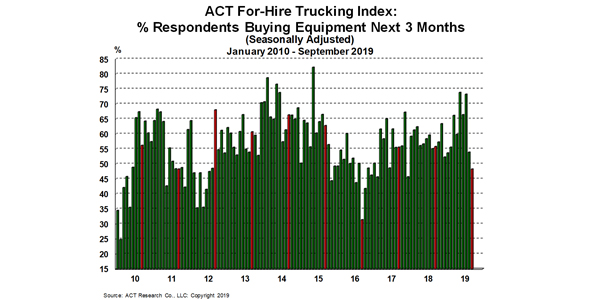

Buying intentions pulled back materially in September, falling to 48.3% of respondents planning to buy trucks in the next three months, from 53.9% in August (SA).

“The unsustainable pattern of low orders with long backlogs supporting record purchasing is set to end right around the new year,” Denoyer said, “and notably it’s the private fleets, not the for-hire carriers, that are still adding capacity.”