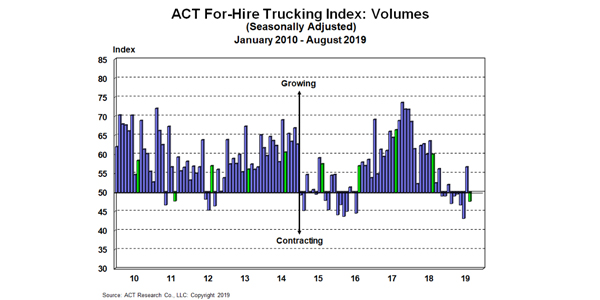

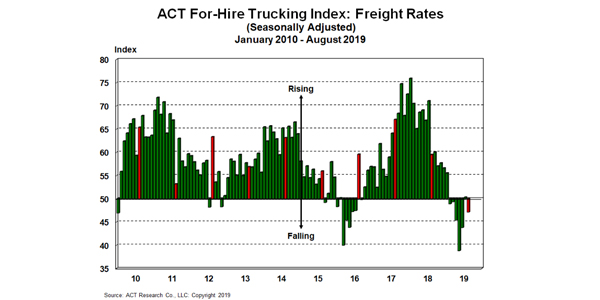

The latest release of ACT’s For-Hire Trucking Index, with August data, retrenched to contraction in all categories, after the large and partly anomalous improvement in July, ACT Research reports. The Volume Index pulled back to 48.0 in August, from 56.7 in July (SA). The August Pricing Index, at 47.1 (SA), also returned to negative territory, after stabilizing to 50.3 in July.

The ACT For-Hire Trucking Index is a monthly survey of mainly for-hire truckload service providers and some LTLs. ACT Research converts responses into diffusion indexes, where the neutral or flat level is 50.

Tim Denoyer, ACT Research’s vice president and senior analyst said, “While the strong consumer plus pre-tariff inventory building could still help volumes into the holidays, it appears inconsistent in the for-hire market, due in part to the weak manufacturing sector. We think the addition of private fleet capacity is also partly responsible. Our for-hire respondents have stopped adding capacity, yet retail tractor sales data tell us capacity is growing. This will likely keep peak season muted in the for-hire market, with seasonal strength still likely closer to the holidays.”

Regarding the Rate Index, Denoyer said, “The respite provided by the improved July volume environment appears to be dissipating. There is a capacity rebalancing story to unfold next year, which should eventually be positive for rates, but we’re not there yet. Because capacity additions are continuing, it’s probably too early to view this summer’s pickup as a green shoot of the next up-cycle.”