Conventional 2022 trucking industry predictions basically boil down to, “Meet the New Year, same as the old year.” At least in the first quarter to through the first half, strong demand will continue, as well supply constraints. We’ve heard it from ACT Research, and Hendrickson’s newly appointed president and CEO, Matt Joy, doubled down on the trucking market strength in a recent conversation.

“We’re very bullish on the market, on both the truck and the trailer; basically the commercial vehicle market in general,” Joy noted during a quick video call just before the holidays. “ We firmly believe demand will remain strong.”

What about supply challenges?

“We see that the production constraints will start easing in the second half of next year,” he said. “Hopefully we’ll see more availability of chips, but we’ll continue doing the right things for our customers. We do also anticipate a big increase on the vocational truck side thanks to the Infrastructure Bill. We’re preparing for that as well in terms of how we plan for capacity. We’re absolutely looking forward to that.”

Truer words have never been spoken from the trucking industry, as we’ve been waiting for the bill since early 2021. This year, we’re on the road to productivity. Hendrickson, for its part, employs a dual sourcing strategy (much like many suppliers) but one of its strengths is a domestic sourcing component.

“We’re not reliant as much on importing product, and so we aren’t getting stuck with some of the supply chain constraints that others are facing,” Joy said. “It’s been a challenge like everybody else, but we’re doing a good job of meeting customer demands.

“On the truck side, there have been more limitations due to the chip shortage, but Hendrickson has high on-time deliveries rates with our OEM customers. We’re obviously carrying more inventory than we historically have, but that’s part of our strategy, and we’ve been doing that for about 12 months.”

While meeting demand and dealing with supply is the immediate challenge, Joy’s new position brings a wide view of the company, from strengthening OEM relationships to becoming a supplier of equipment data. All of which he spoke to during our conversation.

Strengthening OEM relationships

The strength of Hendrickson’s OEM relationships is most recently demonstrated with the launch of the Western Star X-Series. There was deep collaboration between the two to bring that truck with the latest in Hendrickson suspension systems to the market. And that’s just one example.

“On both the truck and the trailer side, we have great relationships with our customers, and we do a combination of things with them: Continue innovating new products, which are Hendrickson proprietary products, and we also work with their proprietary products in terms of how we support their systems,” Joy explained. “The biggest pieces in that relationship are that they want quality parts, they want them on time and they want something that adds value to their vehicle or their offering. We excel in all those cases.

“We also support our product in the field; I think that’s a critical piece as a supplier to them, whether it’s the proprietary part or our own part,” he continued.

Working with telematics providers to deliver Hendrickson equipment data to fleets

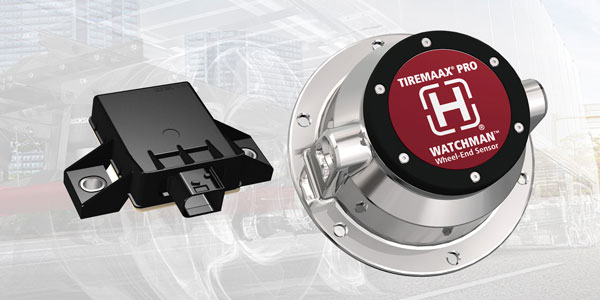

Trailer telematics is a growing field with the aim of OEMs, third-party providers and suppliers working together to get critical data into fleet hands. It’s new territory in the trailer space, but when you talk with OEM and third-party trailer telematics providers alike, many of them speak highly of working with Hendrickson and its new Watchman wheel-end sensor technology for trailers.

So what’s Hendrickson’s strategy for developing partnerships across platforms?

“As we step into this newer market for us, we believe that customers own that data. We’re going to fashion a way to best support them in that gathering of their data,” Joy said. “Watchman is agnostic as we look at telematics partners. We’ll work with providers to deliver the easiest solution for them as far as getting our information. That creates a lot of appeal to the end user–they have that option of how they want to manage their systems going forward. It’s not limited by us.”

What the ‘advanced technology group’ is developing

Joy referred to Hendrickon’s “advanced technology group,” and R&D incubator that is working on the next generation of productions and solutions, but he was tight-lipped as to what those solutions actually are.

“Our advanced technology group is working on solutions three to five years out; [the solutions] will add some additional opportunities for us as we look at the market,” he said. “We are connected with the OEMs on the engineering side, especially where we share some solutions with them today that’s not public. So the future is bright for us.”