How will electrification impact my business? How can I better use data to improve my operations? What investments should I be making to outpace my competition?

Nearly every fleet is wrestling with these questions, and to answer the big questions you have to start by looking inward—collaborating with the people you work with every day and discovering the answers together. That’s what Navistar did with its Vision 2025 experience. And just like the OEM that’s making a major strategic shift, you might be surprised by the answers you find.

* * *

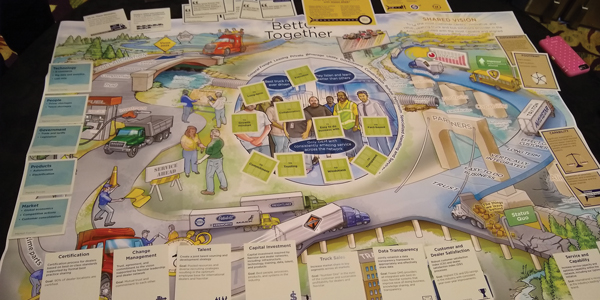

Friedrich Baumann stands in front of a circular table that holds a poster-sized drawing of a road where International Trucks face a series of twists and turns, possibilities and pitfalls. Around one corner is a fueling station that offers both diesel pumps and electric charging; meeting increasing uptime demands is around another. Navistar International Corp.’s president of aftersales and alliance management is flanked by a Navistar dealer, other internal Navistar leaders and a bevy of media members, all crowded around the table and focused on the picture that portrays everything that faces Navistar on the road ahead.

Terry Minor, chief executive officer of Cumberland International Trucks, a dealership based in Nashville, is handed a card marked Strategic Priorities and asked to read it aloud.

“Change management,” he recites. “Trust, agreement and commitment to the vision supported by Navistar leadership and dealer network.

“The goal: Mutual trust and commitment to each other.”

He places the card on the poster where it joins other Strategic Priorities, Market Forces, OEM and Dealership Goals and Company Pillars on the road toward what Navistar calls Vision 2025, a joint company and dealer network strategy that aims to put Navistar back in pole position. As more cards are read and placed on the image, citing opportunities and challenges alike, it all circles around the customer.

“When we first did this exercise,” Minor says, “we looked at what the artist had drawn—his visual representation of our conversation—and it was a picture of Navistar on one side, the dealers on the other side, and a very small representation of the customer. He was basically peeking over the corner of the picture. The customer may have only been mentioned one time through that first day’s conversation. That was a big revelation for both groups. We had lost sight of our most valuable asset. So in the final map, the customer is the big focus in the center of the map.”

“We had to change our mindset from a survivor mode to a mindset of growth, innovation and long-term perspective. Vision 2025 demonstrates the dedication from both the OEM and dealers to this process,” Baumann said. “We brought everybody that would influence those groups into a room for a one-day workshop to look at what has changed, what doesn’t work and talk about how we can create a much more productive process.”

Look where you’re going

Step one was getting everyone on the same page and starting Navistar and its dealerbase moving in the right direction. But it’s one thing to decide on the path and another thing to walk it. One of the brightest examples of Navistar’s Vision 2025 in action is the OEM’s and dealers’ abilities to put themselves on a shared parts inventory platform to start improving uptime before an International truck hits a service center.

According to Navistar, industry-wide data shows that approximately 45% of trucks that enter a service location remain there for more than 24 hours. A large part of Vision 2025 is Navistar’s goal of driving that number down to 20% or lower.

“So how do we do it?” asked Chintan Sopariwala, Navistar’s vice president of uptime, during his Vision 2025 presentation. “We completely updated our dealer inventory system, launching what we call Dealer Inventory Alliance [DIA] ‘Version 2.0’ that is built using a proprietary in-house built algorithm. We completed our rollout of DIA 2.0 in the March/April timeframe of this year and since then we have seen a 40% reduction in the volume of emergency orders.”

(As in: A truck is at the dealership, they don’t have the part, and they have to order it emergency.)

That’s a huge improvement in a small amount of time, but don’t mistake this for another mind-bending technology success story. Investments were made by both Navistar and its dealers. Justin Fink of Summit Truck Group, a Navistar dealer in Lewisville, Texas, noted that the platform investment totaled approximately $1 million per dealership, and he runs three.

“Not having the parts is the No. 1 frustration of some of our largest customers,” he said. “We thought long and hard about moving to the DIA 2.0, but once we did it, our emergency orders went down 30%, our unplanned orders went down 20%, and we started seeing less frustration from our customers related to parts.

“It’s all about reducing parts depth and increasing the breadth,” he added.

“I let it manage 98% of my parts inventory today,” Minor agreed with a nod.

Okay, but how does it work and how do you, as the fleet customer, benefit from it?

Here’s Minor with an example:

“It shows where the parts inventory is throughout the network. Historically, if I knew it’s a part that’s in high demand, I may hide it under a rock so they don’t know I have it because I want to keep it for myself. With the new system, the visibility has changed. We know where the parts are. So dealerships can source the part that they need, have visibility into their own inventory, or another dealer’s inventory, and they see where the parts are.”

And if Minor can’t get the parts he needs in time, he can send the truck along to the Navistar service center that does have it, much to his personal chagrin as he and Fink trade friendly competitive crosstalk jabs. But both dealers know that a rising tide raises all ships, and if Navistar can help them and they can help Navistar and then help each other, then they will all start winning in a big way. That’s what Vision 2025 has shown them.

Zoom out

There’s an even larger picture, and it’s filled with zeroes and ones. Technology permeated all of Navistar’s Vision 2025 conversations. Data-driven solutions built off the OEM’s open-architecture OnCommand Connection platform will drive much of the change ahead and inform nearly every decision going forward. Sopariwala explained how his team is building on the success of the parts inventory platform to develop a predictive parts inventory platform that will tie together Navistar dealer inventory, parts distribution center delivery capabilities and the telematics and remote diagnostics that are streaming off International trucks.

“We have mapped 2 million vehicles to every PDC in terms of responsibility,” Sopariwala said. “As new trucks are built at the factory today, they are also being mapped at a specific distribution center. We know this vehicle is going to be operating in the Pacific Northwest or in Canada. We have built a complex proprietary algorithm in house, and all of these part numbers and specific inventory are entered into the dashboard, and then parts are sent in different quantities to each PDC. This is a state-of-the-art approach to determining which parts will be required in what quantities and where.”

While Navistar is bolstering its back-end systems to get parts where they need to be faster than ever, dealers like Minor are leveraging the remote diagnostics within Navistar’s OnCommand Connection platform and enacting its Live Action Plans—a series of suggested, specific service steps to take once a fault code is triggered—and informing his fleet customers about upcoming service needs and solutions; sometimes before the fleet even knows there’s an issue.

“I had a customer who had a clutch that needed to be replaced,” Minor began. “I called him at seven o’clock in the morning about the issue. I knew his trucks were in California and the clutches were sitting at a dealership. I knew where his trucks were before he knew where his trucks were, and I was able to tell him where he could go to get the trucks fixed before he had to think about it.”

Make no mistake that technology will play a huge role in how you grow your business, but it’s still second to the people who will act on the information and recommendations that technology provides. After all, you have enough to think about. It’s time to manage the change together, and any help you can get from the OEMs and dealerships you partner with can only help propel toward your own vision of what you see on the road ahead.