The technology might be new, but the equipment investment question isn’t: When will I break even and start making money with electric trucks? Consider that an electric truck doesn’t have an engine or aftreatment system, they don’t go through brakes like their diesel counterparts thanks to regenerative braking, and some fleets are anticipating a battery electric truck first lifecycle of six to10 years. Sounds pretty good. Now, the maintenance questions are traded for the questions of up-front charging infrastructure capital expenditures.

For fleets pushing pencils to do the math of when they’d see their ROI from a battery electric truck and infrastructure investment, here’s one more electric vehicle cost-savings thought from Mike Calise, President of the Americas at Tritium, a technology company that designs and manufactures DC charging equipment for EVs.

“One of the big things we talk about is very simple: The price of fuel. If you’re paying $3 a gallon for diesel, the EV energy–depending on the utility, depending on the lot–is a $1 per gallon equivalent,” he said. “When you put the decreased maintenance and fuel costs together, fleets are able to see that massive step change by switching to electric vehicles. Operators would then realize how dramatically their business could grow because they could drive more routes and be more productive, while having less maintenance, more uptime, and cheaper energy.’”

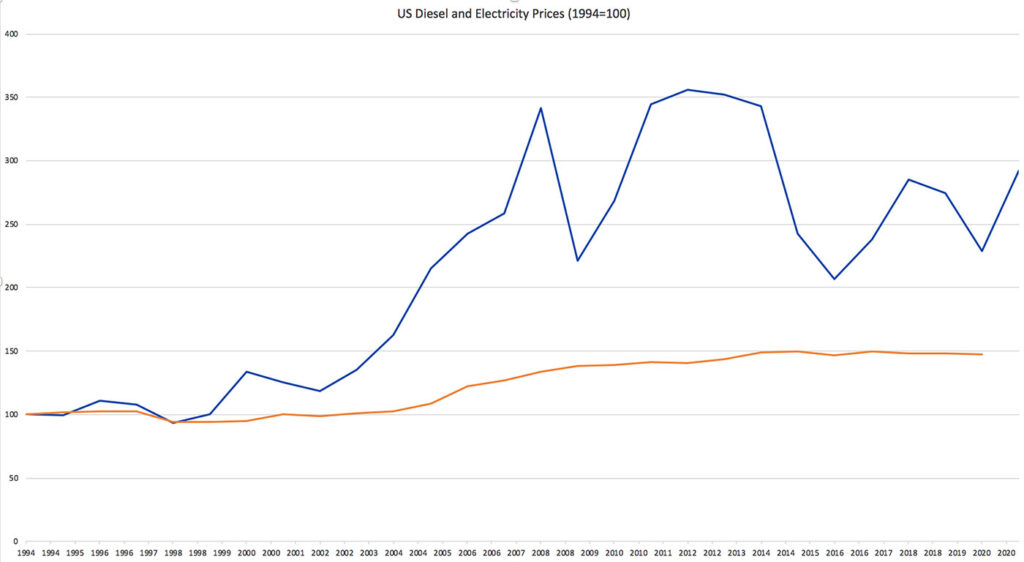

Calise’s comments on the cost of electricity check out. Here’s the data. You can see the cost of electric energy versus the cost of diesel, historically, in the chart below. Fuel is volatile, while electric energy tends to be relatively steady.

All of that is great, in theory, but that’s technically money you would have spent (but have saved) in the operation of electric trucks after the installation of charging infrastructure. If you’re a fleet looking to invest in electric trucks, where can you find additional capital to help with the large capital expenditure it takes to get started?

Calise has thoughts on that as well. First, a bit of electric infrastructure street cred: Tritium boasts more than 5,200 installations of DC fast chargers (DCFC) and high-power chargers (HPC) in over 41 countries, including across the U.S., and has worked with the likes of Manhattan Beer Distributors, which installed charging infrastructure and put Volvo Trucks VNR electric vehicles to work. Now here’s his advice for fleet managers interested in electric trucks, Calise comments:

“Fleet managers have to ask themselves, ‘Who are the stakeholders that will help me with this transition to electric vehicles?’ These fleet operators should also be looking into grant offsets and money they can apply to that capital expense. This could come from a local utility, and/or a state or local air management district and will help subsidize the cost.’”

Given the increased focus on creating sustainable energy and improving air quality, fleets are just a piece of this puzzle. It’s your responsibility to buy and operate the truck, but utility companies and state and local governments have skin in the sustainability game, too.

Bringing the power into your charging location is the utility’s responsibility and one that utilities are investing in on their end as well. Calise pointed to an example of a client Tritium installed 25 stations at the hub of a New York City-based Revel, an electric vehicle rideshare company. Revel partnered with Con Edison to make it happen.

“Con Edison said not only are we going to give you some money, but we’re going to bring in that power to help offset that cost. This demonstrated that partnering with a utility could be a sweet deal for the fleet,” Calise said. “The utility benefits for several reasons including being able to rate base, source excess power when needed, implement a utility demand fee when demand is high and monetarily tailor the offer down when demand is low. Finally, they can give the incentive to work out the charging infrastructure installation costs.”

Your fleet, in a sense, becomes a big partner as you shift your fuel costs from the diesel pump to the utility’s grid. Utility companies, in turn, a huge incentive to earn your business, and as the charts above indicate, you have the chance to save big on fuel costs.

On top of that, there are also federal government grants and rebates that could help offset your up-front costs. Here’s a guide to federal funding and financing options for plug-in electric vehicles, for example.

It sounds easy, but it’s not. You’re also not alone in this.

Of course, these are ideal situations and every fleet’s operation, equipment demands, local sustainability investment and political climate will be different. And this is not to say that if you overcome the upfront investment costs that electric trucks are a set-it-and-forget-it money maker. You still have to manage the equipment and the charging strategy.

Luckily, software handles the bulk of the charging choices, and you don’t have to sit there and manage your charging strategy. Calise likened it to current fuel management software. However, instead of managing diesel fuel consumption and costs, the charging software manages energy costs and demands. It is important to note that demand charges are real and something the fleet managers will have to keep an eye on.

“When utilities have peak demand requirements, for them to fairly deliver the quality of energy services and guarantee the energy, they are going to hit fleets with demand fees, and that’s going to make the operator’s total cost of operation a little sketchy,” Calise noted. “It is common for fleet owners to say, ‘It all looks good on paper, but what am I really going to spend on energy? You talked about that nice, flat curve, but, man, I got spiked at five to 10 times the demand charge on my monthly bill. I can’t manage a business that way.’ Utilities recognize this.”

Sure, a bulk of utilities are still managing demand charges “the old way,” as Calise called it, but he has also seen larger progressive utilities mitigate demand fees for early adopters with predetermined rate contracts.

“Things are getting way better than they used to be five years ago, when fleet managers would get hit automatically with a demand fee. However, it is still imperative for operators to check with their local utility in order to see if they have that predetermined rate contact program” Calise stressed.

Again, it comes back to talking with the stakeholders, not just the ones inside your fleet, but the local utility, your OEM and charging equipment provider of choice, even federal, state and local governments. All have a vested interest in making electric vehicles work. That’s the biggest takeaway: Start talking with them.

“The technologies are converging: The cost of batteries is coming down dramatically to sub-100 kilowatt per hour. Once you’re there, you’re almost at parity with gas-powered trucks. Ultimately, the cost of electricity is coming down,” Calise said. “Our cost in installation and application distribution allows us to easily model these installations and make it easier for the fleet operator to do.”

“I understand that many fleet managers are still nervous because it’s a different language to them, and some of them feel a little threatened by it. But they should really feel threatened by not acting versus feeling threatened by acting. It’s better to start now before your competition acts quicker and now you’re afraid for your business’s survival. If you look at all the disruptive innovations that put people out of business historically, it’s usually because they didn’t act quickly enough.”

Electric trucks aren’t just a big headline that gets a lot of “that’s interesting” pageview reactions. Fleets are actively investing in and operating electric trucks. (We’ve published five fleet electric truck experience stories this summer with several more in the pipeline for the fall.) If your fleet falls into the 200-mile or less route range and they return to your location at night. It’s worth starting the electric truck conversation now. The ROI might work out sooner than you think.