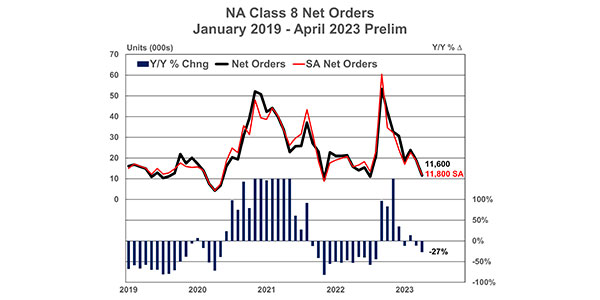

Trucking industry demand was quite healthy in March, despite the turmoil experienced in the banking sector and yet another interest rate increase, ACT Research says. Pent-up demand remains resilient, and cancellations continue at miniscule levels for both heavy-duty (HD) and medium-duty (MD). Curbing the enthusiasm somewhat, HD and MD orders declined double digits Y/Y, according to ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“As supply conditions have slowly improved, so has output. Supporting this trend, March HD and MD production each exceeded build plans,” said Eric Crawford, vice president, senior analyst, ACT Research. “The Class 8 build rate in March was 1,361 units produced, 4.2% above the industry build plan, with the industry producing 31,306 units. Classes 5-7 build averaged 1,090 units produced, 13% above build plan, with 25,065 units produced.”

Regarding backlog, Crawford stated that given the relatively weak environment for orders, combined with a healthier supply chain, the Class 8 backlog is expected to be on a downward trajectory until 2024 order boards open. The March backlog was down 12.5k units M/M to 218.3k, making it no exception to the trend.

“Coupled with March’s stronger build rate, the HD backlog-to-build ratio declined 100 basis points m/m to 7.6 months (8.1 seasonally adjusted). Of note, 122.4k units in backlog are scheduled for 2H’23, considerably below the 142.4k units scheduled for 2H’22 this time last year,” Crawford concluded.