In the release of its Commercial Vehicle Dealer Digest, ACT Research reported that the setup for the entire commercial vehicle industry remains unchanged, noting that industry capacity remains range-bound across a broad front of supply-chain constraints. The report, which combines ACT’s proprietary data analysis from a wide variety of industry sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets.

Regarding industry constraints, Kenny Vieth, ACT’s president and senior analyst said, “While the focus is on silicon and semiconductors, it is really an ‘everything’ shortage. Those constraints are not localized CV industry-specific challenges, but continue as pandemic-driven failures in a globally reliant web of interrelated supply chains. Rebuilding complex global networks requires the system to spin at roughly the same speed, which it is decidedly not doing at present.

“Just like heightened inflation, the current situation in North American commercial vehicle manufacturing is transient: The issues impacting production will pass. Of course, while transient implies a return to a normalized, demand-driven, state of activity, the word does not imply either magnitude or duration,” Vieth added. “Were this a traditional cycle, soaring market indicators and already massive backlogs would put us in the easiest part of the cycle to forecast as carrier profitability is at the heart of the vehicle demand equation.”

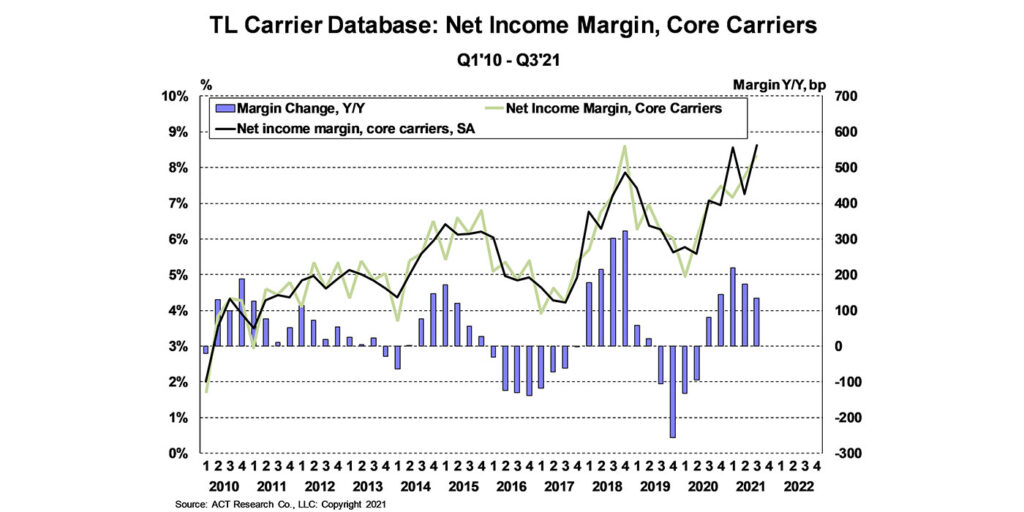

Regarding carrier profits and freight, he continued, “To that end, the publicly traded TL carriers saw profitability land just short of best-ever profit margins in Q3, with seasonal adjustment boosting net profits to a record 8.6%, eclipsing the previous record set in Q1’21. Additionally, we tend not to view freight as a backlog business, but rather a real-time expression of economic activity. In this unusual period, an actual freight backlog argues for strong freight fundamentals well into 2022.”