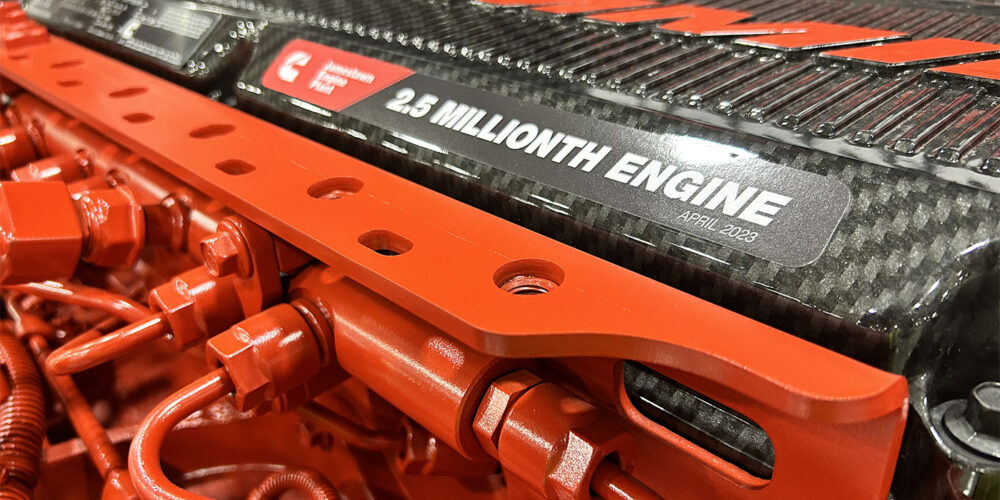

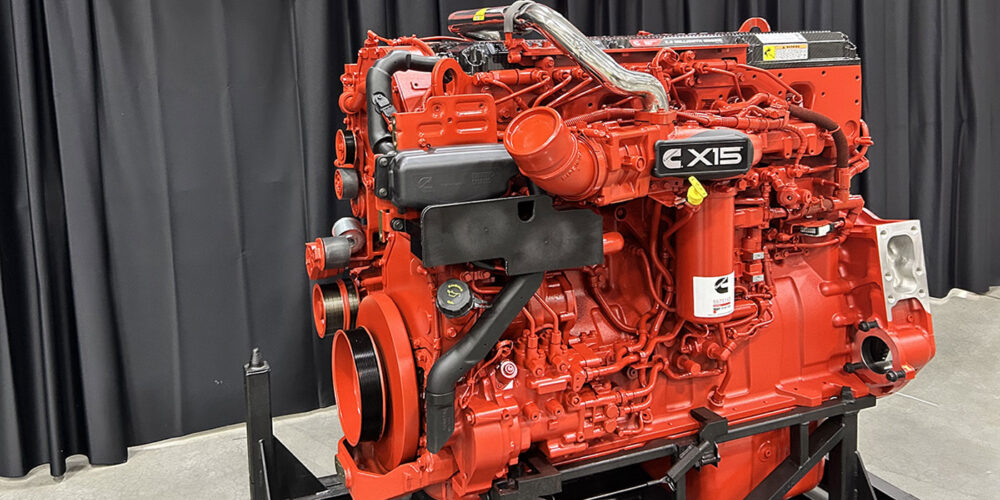

Cummins Inc. announced the production of its 2.5 millionth engine, produced in April at its Jamestown Engine Plant (JEP) in Lakewood, New York during a recent celebration held at the plant. The engine was an X15, which the company displayed blinged-out with black and chrome detail against the rest of the engine’s iconic red paint.

Eventually, the milestone engine will be installed in a Kenworth Legacy W900 truck and provided to Palmer Kenworth, for use by First Class Services in Kentucky. Kenworth is celebrating its 100th anniversary and has been operating since 1923.

In addition to celebrating the milestone, Cummins also announced that it is investing $452 million into the 998,000-square-foot JEP to produce the first of the three engines from the next generation of Cummins’ heavy-duty fuel-agnostic internal combustion engine family – the X15N – that leverages a range of lower carbon fuel types, including natural gas. The company says this engine is the first natural gas engine to be specifically designed for heavy-duty truck applications with an up to 500 horsepower output.

Cummins says Knight-Swift Transportation, Ryder and UPS, among others, will be the first fleets to begin testing the first X15N engines.

JEP is one of Cummins’s largest manufacturing facilities. The plant has been operating for 49 years, has more than 1,500 employees and serves 1,949 active customers. Cummins says JEP is the largest private employer in Chautauqua County and the southern tier of New York.

“It took them the first 25 years to make 500,000 engines, and in the next 25 years they’ve made two more million engines from this factory,” said Srikanth Padmanabhan, vice president of Cummins and president of engine business. “That is remarkable because 50% of the heavy-duty and the medium-duty trucks that go on our highways are powered by a Cummins engine. These 2.5 million engines, along with the 5 million engines that we’ve produced at Rocky Mountain Engine Plant, are what drives today’s trucking and it drives the economy of the United States.”

“In less than 25 years, this plant has now built more than two million engines, including the 11, 12, 15-liter diesel engines and the 12-liter natural gas engine,” Anna Dibble, Cummins JEP plant manager, added. “That’s in addition to millions of engine components, camshafts, flywheels, cylinder heads, cylinder blocks and lots of others.”

Powering today’s trucks while looking to the next generation

Cummins has publicly stated that it plans to produce net-zero carbon by 2050 and plans to reduce carbon emissions by 25% (from 2018 levels) by 2030. Padmanabhan says the first step in hitting these targets is to heighten the company’s focus on producing lower- and zero-carbon emitting products such as the X15N natural gas engine and and the X15H hydrogen engine.

However, he said it’s important to realize zero-emissions trucking can’t be a reality for most fleets today as the trucking industry works through the “messy middle,” a term coined by the North American Council for Freight Efficiency referencing the time between now and when the industry will be vastly using zero-emissions technologies to move freight.

“Right now, the world is changing in front of us, and the reason that the world is changing is because of the fact of climate change,” Padmanabhan said. “To get to that net zero is going to take lower carbon fuel solutions like natural gas, like biodiesel, like renewable natural gas, and hydrogen, and this plant will make that happen because battery engine solutions are not ready yet. Fuel cell rapid solutions are not ready yet. I hope the 3 millionth engine produced here will be a hydrogen engine, a zero-carbon fuel engine.”

Padmanabhan said despite plans to produce more lower-carbon-producing engines at JEP, the plant will not be slowing down the production of diesel-powered engines. He said Cummins is the only provider of natural gas engines in North America, and as such, he says that he hopes natural gas engines will be additive to sales instead of a replacement to fleets swapping a diesel engine for natural gas. He added he anticipates natural gas engines will be a good fit for several large North American fleets today that have announced their own sustainability goals, including Amazon, FedEx, Walmart, Werner, UPS, Penske, Ryder and Knight-Swift.

“Typically, most of these fleets have similar sustainability goals, [carbon reduction] anywhere between 20% to 30% in the next 10 years, and then at 2050 or around there they will be at net zero,” he says. “[Battery-electric trucks might work for them] depending on the application that they use. If you think about PepsiCo, which carries Frito-Lay chips, they could use battery-electric today. I think it’s a close competitor. For others, they can’t use battery-electric, which means that they need to have renewable natural gas or zero-carbon hydrogen – and for the first time, we are actually offering throttle and torque requirements that are similar to diesel.”

Padmanabhan said he anticipates that over the next 10 years and beyond most fleets with aggressive sustainability goals will evolve their powertrains to match their infrastructure requirements while keeping their TCO top-of-mind.

“[Sustainability efforts] are going to evolve in terms of total cost of ownership, in terms of technology, in terms of expensive infrastructure,” he said. “These people make a living based on fuel. These fleets transitioning away from diesel need an operating infrastructure that is as significant as what you have today in terms of diesel stations. We need the same infrastructure that is required for diesel for battery-electric, and the same for fuel cells.”