Whenever a new CEO takes over any company, there’s plenty of hyperbole about approaching evolving markets, understanding the shifting needs of customers and redefining the company’s role in the industry. But this time it’s different. This time it’s not hyperbole. It’s reality. Daimler Trucks North America (DTNA)’s President and CEO John O’Leary takes the reins at a time when electric trucks are no longer a question of “What if,” but one of “How many do you want?” Holistic sustainability is a talking point with legs for fleets across the country. Heavy-duty truck demand is at near-record levels with no end in sight when supply chain issues challenge nearly every company in every sector.

It’s a precarious time in trucking, but also a time filled with innovation and industrious evolution of trucking equipment and solutions. For DTNA it’s also a time of reinvention. Last year saw the company shift its focus (and internal structure) from brand to application. This year, the company will go even further as Daimler Trucks will separate its business from Mercedes-Benz.

I caught up with O’Leary just shy of his 100-day mark as DTNA’s CEO. These were the top three takeaways.

1. The electric truck long game

The excitement for electric trucks is a double-edged sword. It’s necessary for building orders and gaining fleet interest, but it can quickly spin into something it’s not: an immediately world-altering technology.

“Sometimes when you have conversations with people about battery electric trucks, it turns into this almost all-or-nothing decision. As if the expectation is that in the next three or four years, everything is going to be electric. It’s not going to happen that way; it’s going to take a long period of time,” O’Leary said. “There’s still plenty of room for internal combustion engines for many years. That’s why we’re still highly interested in medium-duty with our partnership with Cummins. On the heavy-duty side, we have an amazing product there with our Detroit DD13 and DD15 engines.

“For us, it’s not an either-or thing. It’s both,” he continued. “You have to have the existing product because that’s what customers want. A truck is just a tool to make money with, and so we’re providing these tools to customers. If a guy wants a wrench, you don’t hand him a screwdriver.”

Right now, it’s still early days in electric truck development that is still eclipsed by diesel demand. O’Leary noted that continued electric truck development will be driven by customer demand.

What about hydrogen electric fuel truck development? Daimler Trucks AG (DTNA’s parent company led by Martin Daum) and Volvo Group, two staunch competitors in the market, came together to create a joint venture to develop hydrogen fuel cells for commercial use. Where does O’Leary see this play out?

“I would say hydrogen, right now, is more of a European concept in terms of the investment that’s being made by the industry players. I don’t mean just the OEMs, but also… some of the other companies over there. They see that as a real pathway forward,” he said. “I think, ultimately, hydrogen fuel-cell will come to the U.S. I think for long-haul, it makes a lot of sense just in terms of the energy density that hydrogen has versus battery-electric. Ultimately that will come, but I think it’s going to be slower. Again, as long as you have diesel products that can cover thousands of miles, there’s no real need for hydrogen right away. But again, it will ultimately come over time. I have no doubt about that.”

2. Defining Daimler Trucks in the overall market

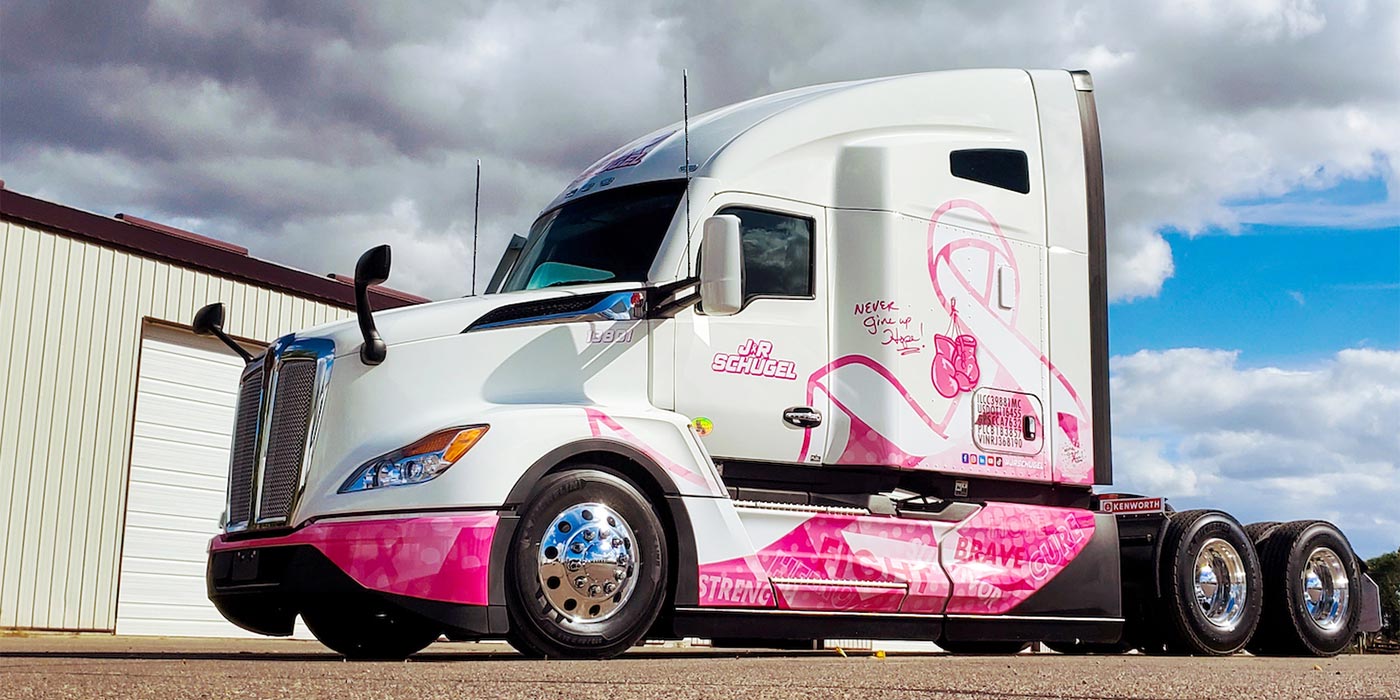

O’Leary doubled down on the importance of vocational applications to DTNA. Last fall’s Western Star 49X was just the first product launched under the OEM’s application-focused market approach. And there’s more to come.

“Historically, we had tried for a long time to convince people that it’s great that we’re an on-highway powerhouse, but we can also build a great vocational truck,” O’Leary said. “They saw us as purely a long-haul, over-the-road company. So we said, ‘Look, we have to find a better way; build a better mousetrap.’

“That means that we seriously invest [in vocational products]; the only way we can do it is to change our focus and dedicate resources,” he said. “It’s not on-highway people masquerading that they know a little bit about vocational. It means going out and hiring people, in some cases from competitors, that are super intelligent about the vocational market and bring that knowledge and that experience and those customer relationships. And then that goes into the product design.

“We’re not taking an on-highway product, adding more chrome and a different suspension, and calling it a vocational. The Western Star 49X was vocational from the ground up.”

That strategy echoes O’Leary’s broader focus on purpose-built equipment driven by customer needs.

“It’s about having conversations with customers, and it starts with listening,” he said. “You have to listen and not just try to bury them with cool new products that some engineer thinks are brilliant, but they’re not practical in use. You have to listen to what the customer wants, and then, as an organization, you have to respond accordingly.”

3. It’s as much about the people as it is the equipment

There’s been a huge shake up in the DTNA leadership ranks with announcements of promotions and position changes happening almost weekly. O’Leary noted that it reflects DTNA’s focus to increase its leadership capability.

“We have a lot of people in this company that we’ve just hired in recent years, and they deserve just amazing leadership,” he said. “The people that we now have in our operating committee have that level of capability. We’ve had a great run since 2010, and we want to keep that going.”

That momentum will carry into Daimler Trucks’ spin-off from Mercedes-Benz to become its own business entity, and potentially provide more autonomy to develop trucking products and solutions. But the impact will be felt first and foremost globally within the organization, as O’Leary explained:

“Daimler is this massive multinational global corporation that’s basically run by Mercedes-Benz car people; a tremendous passenger car company with a huge amount of history and success, but as a truck group ended up spending a lot of energy and a lot of momentum on just explaining to passenger car people what’s different about the truck industry versus cars. What’s different about the customer profile? Why should we invest where we need to? Why is it different from the thought process that they would use for investments for passenger cars? And so on. It’s a bigger deal in Europe, quite honestly, because then they get into things like systems that people are using for both cars and trucks at the dealerships and within the company and the way people are compensated.”

Context: In Europe, the dealership that’s selling the Class 8 Mercedes-Benz Actros (the MB equivalent to our Freightliner Cascadia) is also selling the S-Class; whereas here, we obviously have different dealerships for trucks and cars.

“For us in North America, it’s not so big of a deal, but it certainly helps,” O’Leary said. “We’ll take all of the help we can get in terms of having even a bigger opportunity to be laser-focused on our customers and our product.”