Daimler Trucks North America President and Chief Executive Officer Roger Nielsen recently held court at a roundtable press conference discussing everything from electric trucks to DTNA’s market share. Yet, the insight into DTNA’s order strategy and openness about recent supply line challenges took center stage as the market continues to boom, with no sign of slowing down.

“Right now we see the year ending higher than 440,000 [Class 6-8] trucks. How much higher? We’ll see, but definitely the market is a lot stronger than we expected it to be,” Nielsen said.

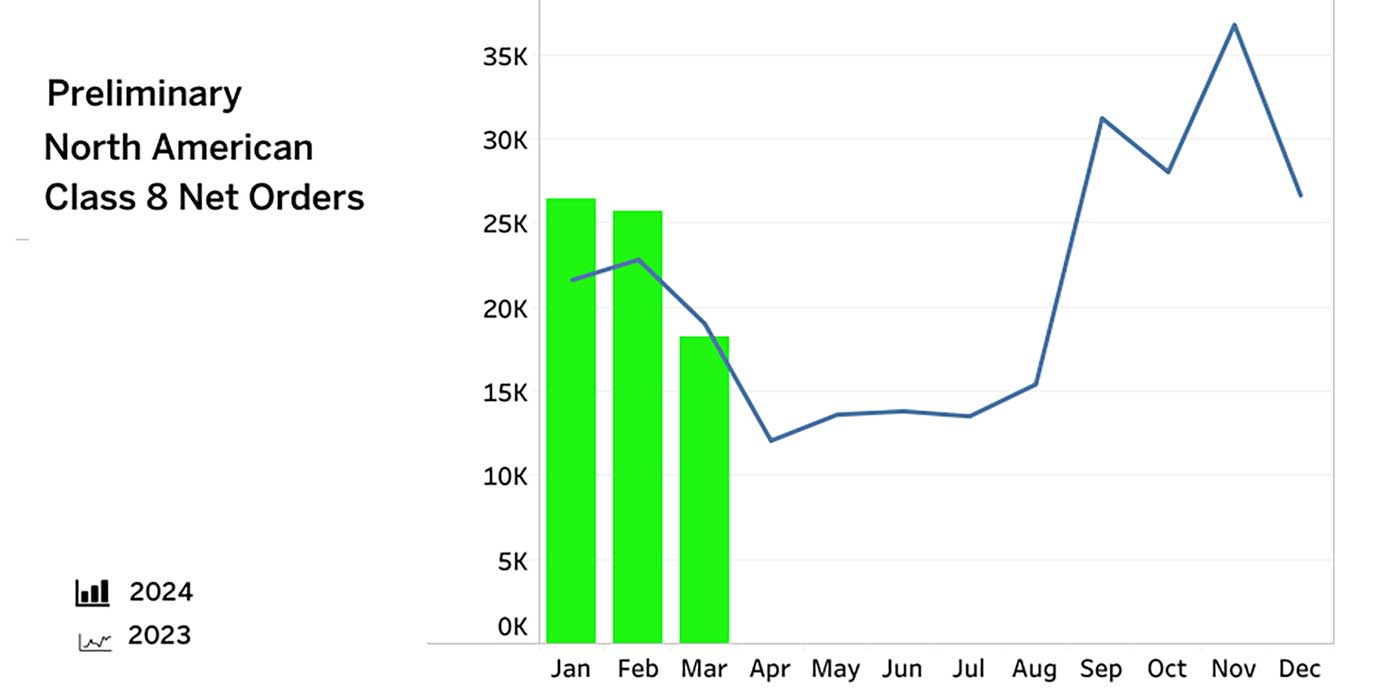

“Stronger” might even be an understatement as orders for everything from Class 8 trucks to trailers (not to mention the used truck market, where prices rose 9% year-to-date according to ACT Research) continue to defy expectations. Class 8 truck orders set an all-time record in August and though orders dipped 19% in September, it was still the seventh time in nine months in which industry orders cracked 40,000 units, according to ACT Research, which also called last month’s total net trailer orders of more than 58,000 (an 135% increase year-over-year) “epic.”

In the past year, DTNA has continued to own a lion’s share of the Class 6-8 space, with Freightliner and Western Star nameplates making up 38% of the NAFTA market. While that’s on par with DTNA’s market share numbers in the past several years, both Class 8 and Class 6 to 7 segments have seen a slight dip, the former down 1.6% with the latter down 1%. Nielsen attributed that to supply chain challenges DTNA has experienced as orders boomed.

“What has held everyone back this year is the whole supply chain. And it’s not just one particular component; it’s everything along the supply chain, from labor availability within our own factories and that of our suppliers and running at peak capacity which can bring hiccups—ones that require us to take extreme measures to get parts to our factories,” Nielsen said, demonstrating his operations experience—he served as DTNA’s chief operating officer from 2001 to 2016 and was a mainstay in the operations department for 15 years before that.

“We continue to push hard; we’re down a little bit compared to 2017,” he continued. “We’ve seen stabilization of the past two to three months with stable production rates. We’re satisfied with where we stand with the performance we’re getting out of our company.”

Yet, supply chain management is only part of the battle in producing and delivering trucks. Nielsen explained that managing speculative orders plays a large role in being able to deliver trucks to the customers when they need them most.

“As we go into 2019, there has been a lot of discussion of speculative orders padding the backlog—you will not see that at Daimler Trucks North America,” Nielsen said with conviction. “We’ve been diligent in weeding out speculative orders. The July order intake could have almost been six digits if we would have let every order come in and just accepted them. Aggressive orders took place and instead of putting them on our books we went back to our dealers and customers and said, ‘Calm down: Let’s not do something crazy now.’”

Nielsen reported that DTNA’s current backlog is 125,000 vehicles—a significant chunk of DTNA’s annual 200,000-unit production capacity—but he stressed that working with his dealer network and customers to avoid speculative orders to save build slots makes production management and customer deliveries easier.

“Overloading our dealers and customers is the last thing we need in this industry,” Nielsen said. “I’ve been in this industry 33 years and we know that it can turn overnight. We don’t need people holding an inventory hot potato in the dealer pipeline or vehicles sitting against the fence in a customer’s lot.

“Managing to a shorter order board lets us keep our finger on the pulse of the industry. Our customers don’t have to place speculative orders to save spots. If they get business for February, they can give us the order in October; if they get the business for March, they can give us the order in November. They don’t have to worry about being left out in the cold.”

Around the table

The hour-long roundtable covered everything from connectivity to electric truck development and the increasing investment and support in DTNA’s aftermarket network and Alliance Truck Parts (12 new product lines coming soon!). So here are more topics Nielsen weighed in on.

On the re-launch of One-Stop Warranty:

“Next year, we’re going to re-launch One-Stop Warranty,” Nielsen said. “A few years ago we stopped servicing warranty for third-party suppliers who were providing our customers for extended warranties. Whatever that component may be, it might have a base warranty of one or two years and 100,000 or 200,00 miles, and we saw suppliers offering extended warranties on top of that. It became difficult for the customer to walk into a dealership and get that warranty work done.

“It was disappointing that we got away from that; we’ve heard and learned from our customers who wanted us to take that hassle away from them. So it’s exciting for us to re-launch it.

“We decided to bring [the service for] those components back in house, and our warranty system will cover most suppliers extended warranties providing our customer with a one-stop service.”

On electric truck development:

“We brought in 30 of our top customers and their leaders to give them the opportunity to drive our electric vehicle and to help us create those vehicles,” he said. “We have a process called co-creation, which is a way to bring products and features to the market faster by getting the customer involved earlier as opposed to surprising them with a product after two to three years of development.

“We’re excited to learn more about what it takes to keep a battery electric vehicle running strong for years,” he continued. “Our customers have learned to rely on us for durable and reliable trucks. The last thing we want to do is put a vehicle in a customer’s hands with a shorter life expectancy or a poorer business case. With the feedback we’ll get from customers in our Innovation Fleet next year, we’ll be able to develop a vehicle that meets expectations.”

And the challenge of electric truck depreciation:

“Right now, customers are expecting that we should be able to provide a battery electric Class 8 truck that has that first three- to five-year first owner lifecycle; that it has not depreciated to zero when it goes to the second customer,” Nielsen said. “Customers are looking for similar depreciation values so that we don’t upset the established business case.

“As we go forward, at the moment, the cost of batteries and the systems around them are more costly than a diesel-powered truck and we believe that the scale we have worldwide will allow us to bring those prices down faster than anyone else. Part of the equation is how to spread depreciation out over more than one million miles,” he concluded.