Want to know more about telematics?

Take our survey to tell us what you know, and what you want to know, about truck telematics—and win a gift card.

Take our survey to tell us what you know, and what you want to know, about truck telematics—and win a gift card. Take the survey here.

Watch: Finding the right truck tire balance with IMI

A look at IMI’s recently released its Equal Flexx wheel balancer, which reduces wheel end vibration and improves fuel economy and cost efficiency. Watch the full video here. Related Articles – Watch Fleet Equipment’s On the Road webseries – Are you ready for the ELD mandate? This infographic might help – Minimizer releases Slick Plate

Watch Fleet Equipment’s On the Road webseries

Fleet Equipment is turning on its out-of-office messages, setting voice mails and hitting the road, cameras in tow, to talk to the industry’s best and brightest equipment manufacturers and bring you an inside look at trucking’s latest and greatest. We’re calling it Fleet Equipment’s On the Road, a video web series that follows our truck traveling

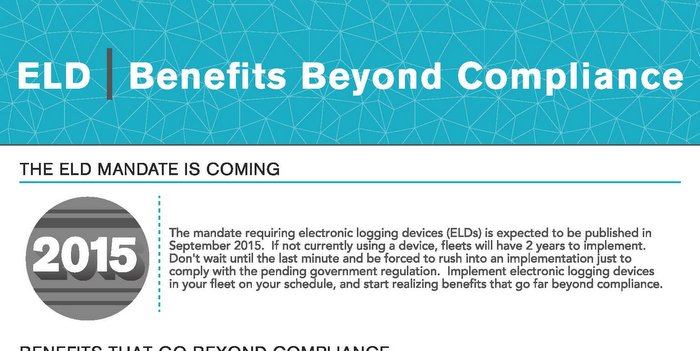

Are you ready for the ELD mandate? This infographic might help

Omnitracs LLC has created an educational infographic, entitled “ELD Benefits Beyond Compliance,” to provide fleet managers and drivers with pivotal information about the Federal Motor Carrier Safety Administration’s (FMCSA) highly-anticipated electronic logging devices (ELD) mandate. In advance of the mandate publish date, the easy-to-read infographic sheds light on benefits of the pending government regulation, while

Minimizer releases Slick Plate

Minimizer‘s new Slick Plate promises to get rid of grease. Made of poly plastic, the newest maintenance line product, the Slick Plate, removes the need for grease and prolongs the life of the fifth wheel. Less friction also makes for easier handling and maneuverability, the company explained. Related Articles – VDO TPMS Catalog features expanded REDI-Sensor

Other Posts

Bridgestone launches all-position steer radial

Designed for severe service and on-highway applications, the R244 All-Position Steer Radial Tire from Bridgestone Commercial Solutions was developed to meet the demands of dump truck and concrete mixer applications with trucks that spend a higher percentage of time in on-highway use. The tire’s wide base ribbed steer pattern, the company noted, performs in both

Mack delivers Capitol Christmas tree

After a journey of more than 5,000 miles, a Mack Pinnacle delivered the 2013 Capitol Christmas Tree to the U.S. Capitol. The tree traveled from the Colville National Forest in the state of Washington to the west lawn of the U.S. Capitol, making stops in communities across the country. The 88-ft. Engelmann Spruce was hand-selected

Mack Trucks named Stephen Roy North American president

Mack Trucks Inc. announced that Stephen Roy has been named president of North American Sales and Marketing, effective Jan. 1, 2014. Roy has led the company’s aftermarket business since 2008, and will succeed Kevin Flaherty, who is retiring after more than 40 years of dedicated service.

Freightliner Custom Chassis showcases bus chassis technologies

The newest version of the S2C commercial bus chassis from Freightliner Custom Chassis (FCCC) can be powered by a 300-HP Cummins ISB 6.7 engine rated at 660 lb./ft. of torque. The S2C chassis is designed for cutaway bus bodies.