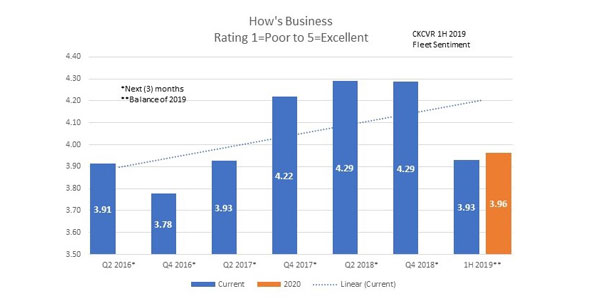

Responses to the latest CK Commercial Vehicle Research Fleet Sentiment survey reflects some softening in the trucking environment.

Key results from the first-half 2019 FSR survey include:

- Analysis of the 2019 equipment demand for the survey group indicates fewer trucks will be delivered to them this year compared to elevated 2018 levels.

- Freight (or work) demand for this group has softened from second-half 2018 levels.

- Driver shortage continues to negatively impact a majority. Most think the ability to hire good, quality drivers is getting worse. In some cases, this situation keeps fleets from buying more new trucks.

- Automated transmissions and air disc brakes (for all axle positions) are being adopted by more fleets.

- Parts purchasing practices are changing to adapt to the environment (some shortages but also more viable options available to purchase).

- There is plenty of attention at commercial vehicle fleets as to how they can address new challenges including how products will move in the future, how to maintain ever-more complex vehicles, and how to use new technology to their benefit.

- Disproportionate downtime and high maintenance costs associated with diesel engines and their after-treatment requirements impact nearly every fleet reporting.

Even with some slowing in the overall environment for the trucking companies that responded to the survey, a majority of them are still very healthy with a good outlook for 2019.

“Because of some of the questions we asked in this survey regarding downtime and maintenance issues, it’s apparent that diesel engine technology, past and present, continues to negatively impact the productivity of trucking fleets,” commented Chris Kemmer, consultant at CK Commercial Vehicle Research. “Clearly going back to dirtier emission engines is not an option, but to me, there should be a strong incentive to embrace electric trucks as an option to really address this issue.”

The 57 fleets represented in the first-half 2019 survey represent a varied mix of fleet demographics; and in total, operate more than 36,000 medium and heavy-duty trucks (primarily Class 8) and 85,000 trailers.