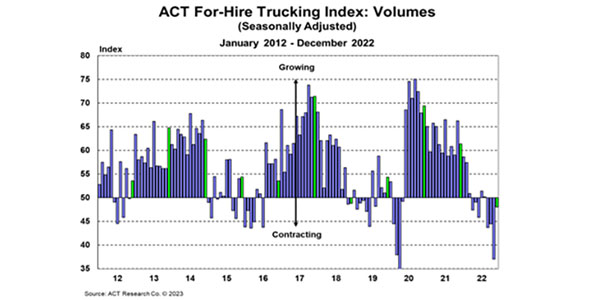

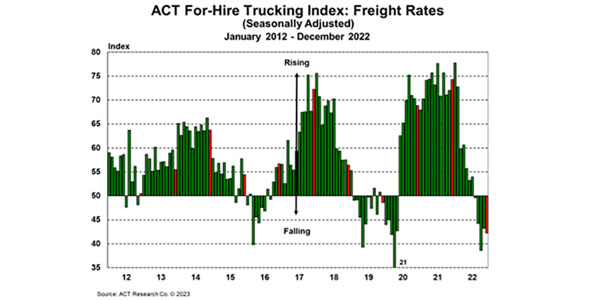

According to the latest release of ACT’s For-Hire Trucking Index, volumes and supply-demand balance increased in December while freight trucking rates continue to decline.

“We’re now nine months into this freight volume soft patch with lower goods spending, overstocked retail inventories, and declining imports,” said Tim Denoyer, vice president & senior analyst, ACT Research. “The good news is that from a historical perspective, that means we’re closer to the end than the start.”

On rates, Denoyer noted, “Pricing power clearly shifted to shippers in 2022, but the recent stabilization hints the bottoming process is beginning. Capacity continues to grow, with pent-up equipment demand still red hot, and freight demand is down, leaving the market balance loose near-term.

“Our driver availability index remained at a cycle high of 57.7, reflecting medium and large fleets who act as safe havens in times like these. We also find the sharp slowdown in BLS trucking employment data interesting with regards to the industry at large,” he added.

According to Denoyer, the current supply and demand balance of 40.8 is an improvement from the recent low levels of 37 to 38, indicating the freight market is beginning to improve. With a decrease in capacity and an eventual increase in demand, the market is expected to become more balanced in the near future, he said.

ACT’s full-year 2022 forecasts for DAT dry van and reefer spot rates, net fuel, were 93%-94% accurate on average for the 21-month forecast period, with our 2022 forecasts from Q2’21 (19-21 months out) 99.7% accurate for dry van and 98.5% for reefer. DAT dry van spot rates, net fuel, finished 2022 at $2.06 per mile, in line with our forecasts to the penny from 18 and 19 months out (June and July 2021).