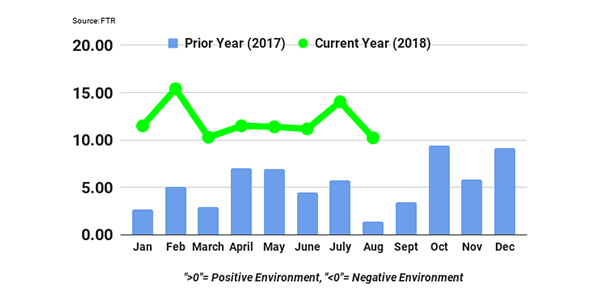

Although FTR’s August Trucking Conditions Index, at a reading of 10.24, fell from the very high reading of the previous month, it continues to reflect a very positive carrier environment. The moderation in the August TCI reflects some freight rate stabilization and continued incremental capacity additions. Freight demand remains quite strong and the TCI is forecast to hold up at the current level for the next year or more.

Avery Vise, vice president of trucking, commented, “The August TCI reading is the lowest of 2018 so far, but prior to this year the TCI had not been higher than 10.24 since December 2015. In other words, the moderation we see in trucking conditions really just highlights how phenomenal the first half of 2018 was. Based on our current forecast, trucking conditions will remain positive at least through 2019.”

The Trucking Conditions Index tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index that tracks the market conditions that influence fleet behavior. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. The index tells you the industry’s health at a glance. In life, running a fever is an indication of a health problem. It may not tell you exactly what’s wrong, but it alerts you to look deeper. Similarly, a reading well below zero on the FTR Trucking Conditions Index warns you of a problem, while readings high above zero spell opportunity. Readings near zero are consistent with a neutral operating environment, and double-digit readings (both up or down) are warning signs for significant operating changes.

Details of the July TCI are found in the October issue of FTR’s Trucking Update, published September 28, 2018. The ‘Notes by the Dashboard Light’ section in the current issue offers analysis on what a (unlikely for now) recession might look like in order to more readily recognize the signs and forecast how such a scenario might affect transportation providers and suppliers. Along with the TCI and ‘Notes by the Dashboard Light,’ the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, costs, and the truck driver situation.