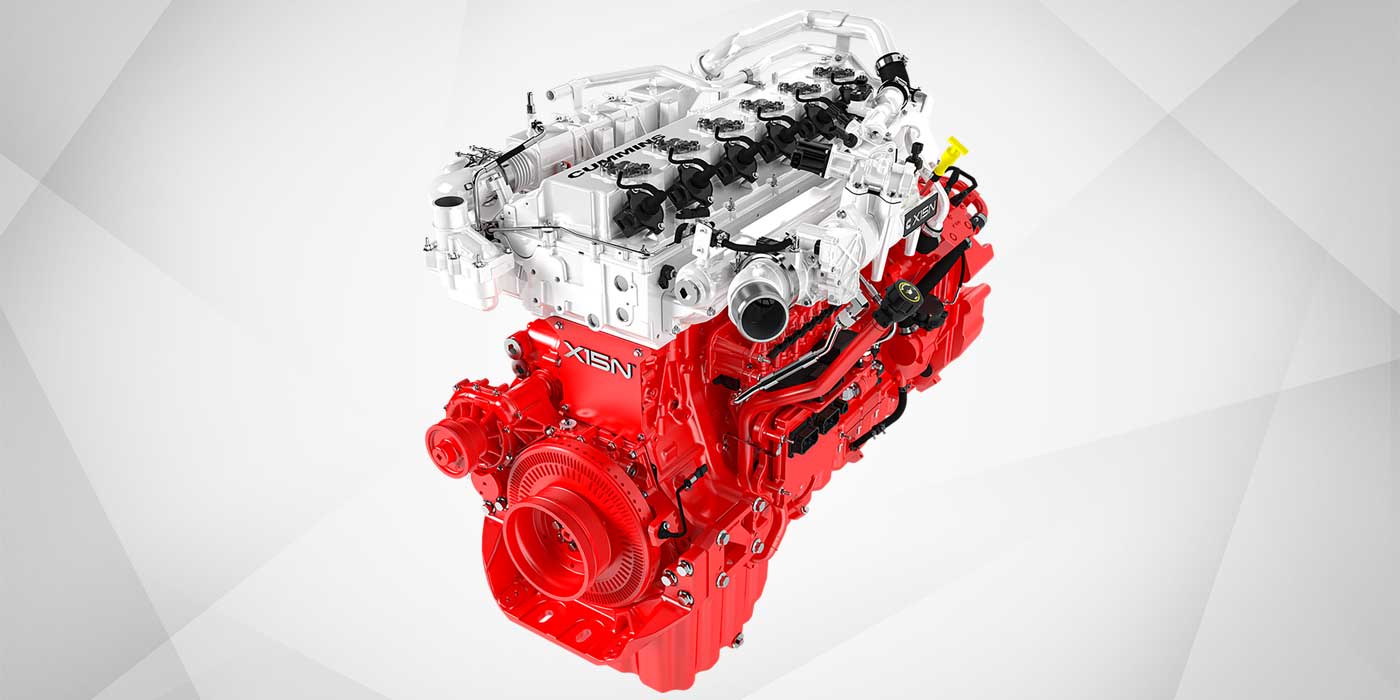

First, let’s talk about Class 8 fuel economy. I can’t see gasoline replacing diesel fuel as the major fuel source because of the durability required of Class 8 engines. Gasoline engine development has made great strides recently, but diesel engines routinely go one million miles without rebuilds, and diesels yield about 25% better fuel economy under equivalent operating conditions. Liquified natural gas (LNG) will become a major player in regional Class 8 if fuel costs remain low and the infrastructure is improved.

Weight has a unique influence on Class 8 operation since reduced weight enables higher payloads. However, weight has little influence on Class 8 line haul fuel economy when these trucks spend most of their time at constant speed. Under constant speed conditions engine efficiency, rolling resistance and aerodynamics are the major influences. Weight primarily affects fuel economy when vehicles must be accelerated (F=ma). Weight can also affect rolling resistance, but minor weight savings have little effect on overall fuel economy.

Class 8 refuse haulers and buses, however, can significantly improve fuel economy by reducing vehicle weight since these vehicles are constantly accelerating and decelerating. A 10% reduction in overall weight means 10% less force (and power) is required to accelerate the vehicle at the same rate. A lighter vehicle can utilize a smaller power plant to save fuel.

Weight also has a significant effect on fuel economy of vehicles used in P&D or stop-and-go service. The current crop of both gasoline and diesel engines using much better transmissions developed over the last few years probably doubles the fuel economy over previous P&D configurations. Weight reduction will significantly improve fuel economy in all these situations. I applaud Ford’s out-of-the-box thinking about reducing weight of the new F150 pickup.

I can’t weight (or is it wait?) to see fuel economy data from these new pickups carrying 700 lbs. less weight. If vehicle weight is reduced from 4,500 to 3,800 lbs., that represents a 15.5% weight savings. I would expect at least a 10% improvement in fuel economy.

Even though diesel engines will produce 20 to 25% better fuel economy under equivalent operating conditions, I’m beginning to favor gasoline fuel for light-duty P&D operation for a number of reasons.

First, we are seeing the introduction of direct injection (DI) gasoline engines. This enables significant improvements in in-cylinder combustion efficiency. It also enables much less complex and expensive gaseous fuels conversions. Instead of having to incorporate “mixers,” direct injection should allow gases to be injected into the combustion chambers after all the intake and exhaust valves are closed. Retrofit systems should be less complex and costly, and fuel economy should be significantly improved.

I’m also leaning toward gasoline-fuelled light-duty P&D vehicles for maintenance cost reasons. Years ago, Niels Hansen of UPS told me he thought it may actually be less expensive to operate gasoline power plants in P&D service.

The TMC’s S.14 Light- and Medium-Duty Study Group was recently shown comparative maintenance costs between gasoline engines and turbocharged diesels in service. Although diesel engine service intervals are longer, most replacement parts and labor costs are significantly higher. Some diesel filters cost ten times what the equivalent gasoline filter cost. The TMC data showed the diesel’s annual maintenance costs were essentially double those of the gasoline engines.

I also recall Neil’s comments about engine rebuilds. He said his data showed it was often less expensive to R & R a gasoline engine than it was to rebuild a diesel. To my mind, this is some serious food for thought when considering purchasing new vehicles.