Oil prices go up and down at the slightest whim. Volatility can be nerve-wracking. And while its impact on diesel is apparent, how can oil prices affect the bottom-line cost of heavy-duty truck engine oil?

“The answer is: It doesn’t really.”

That’s from Tony Negri, Phillips 66 commercial product manager.

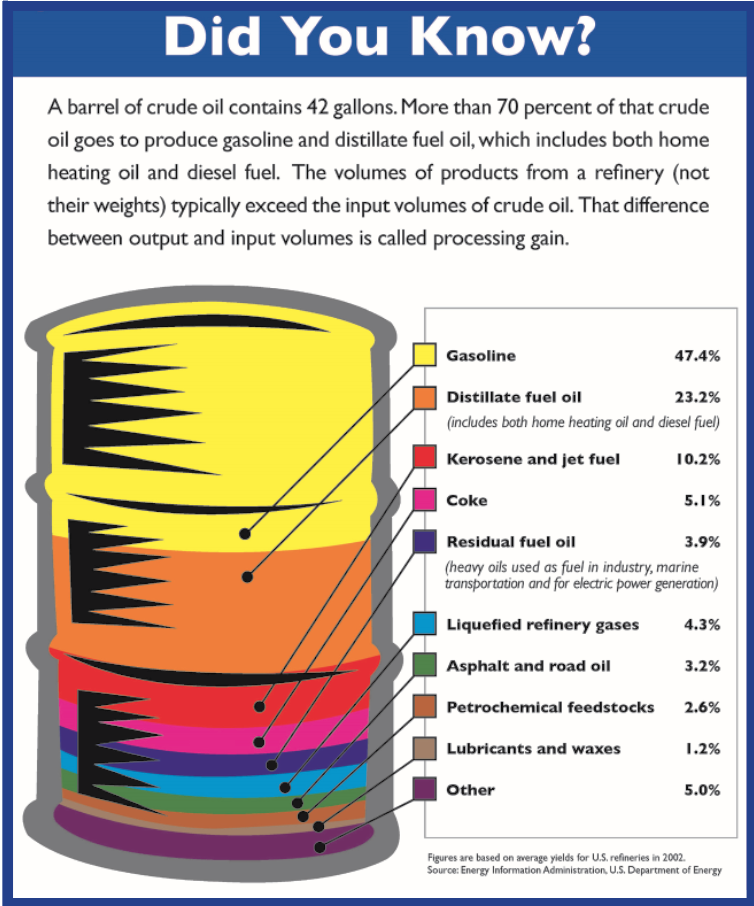

“Crude oil is overwhelmingly used for gasoline and diesel. Lubricants come from the bottom one percent,” Negri continues. “The extreme volatility you see in crude oil pricing doesn’t really relate to the economics that drive lubricant base oils. There is some fluctuation in that pricing but over time it tends to be stable. It has its own market forces. The crude oil market is oversupplied, which has helped to keep prices low.”

That isn’t to say that the prices are perfectly stable or that there aren’t outside factors that change engine oil cost.

“The price increases we’ve seen over the last two years are largely driven by end-of costs: packaging materials, plastics, cardboard, labels, paper. Those costs have all gone up. And when additives go up, everything else is affected,” he says.

The rising cost of the additives increases the price of premium blend oils, so some fleets may not like the sticker price of the oil but can enjoy the long-term effect. That premium blend, Negri says, may give more mileage than a “price-fighter-tier product.” Negri says he focuses on the new FA-4 products, and the opportunities they bring the consumer for expanding fuel economy.

There are many purchasing factors fleets will consider before spending the money, and the process differs depending on the fleet.

“Different types of fleets will look at their maintenance needs a little differently,” Negri says. “If I have a truck with over half a million miles on it, I’m probably not too concerned with extending its life because I’m probably not going to have it for long.”

Essentially, large fleets can focus more on maintaining newer trucks than squeezing every second of life out of an older unit.

“Smaller fleets are more likely to do all of their maintenance in-house, and maybe durability is a higher concern for them,” Negri says. “For those guys, they want a million miles off of all of their equipment. You want to keep them as long as you can, running as well as they can. So that might be a guy who’s looking for a premium synthetic blend product.”

Some small fleets rely heavily on older trucks and need to do what they can to keep them running as long as possible.

“The new FA-4 products were introduced in late 2016, and adoption rates have been very slow but the fuel economy returns have been very real. A fleet can save 1.5 to 3% depending on how aggressively they go after fuel economy,” Negri says. “The number one cost for operating a fleet is their diesel fuel purchases. So if you can save a couple percent out of that, that’s real money.”

“Adoption has been really slow for a number of factors. Engine builders, for the most part, tried to back away from it,” Negri went on to say. But he also says that some engine builders have made large lines of their units compatible with FA-4.

RELATED: What’s behind the slow adoption of FA-4?