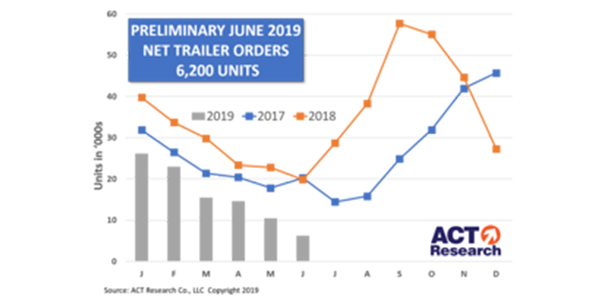

ACT Research’s preliminary estimate for June 2019 net trailer orders is 6,200 units. Final volume will be available later this month. This preliminary market estimate should be within +/- 3% of the final order tally.

“Several aspects of June trailer orders were disappointing. Total new orders continued to slide, coming in below 12,000 units. However, that weakness was exacerbated by sustained strong cancellations. Once those are taken into account, preliminary net orders came in at 6,200 trailers, the lowest monthly volume since September of 2009. Seasonal adjustment provided little support, with volume edging just over 7,000 units after adjustment,” said Frank Maly, ACT’s director of CV transportation analysis and research.

He added, “Despite indications earlier this year that fleets were anxious to place orders for 2020, discussions now indicate that fleets may have shifted to an extremely conservative stance. Softer freight volumes combined with lower rates could well be generating a reassessment of 2020 investment plans. Furthermore, cancellations continue to be strong, and that churn in the backlog is likely impacting this year’s fourth quarter. That’s an indication that this year may well close on a very weak note, setting a troublesome foundation for 2020.”

Preliminary results indicate June will likely rank as the sixth-best production month in history, with all of those top six occurring since last August, ACT Research says. Backlogs commit the industry into mid-December at current build rates.