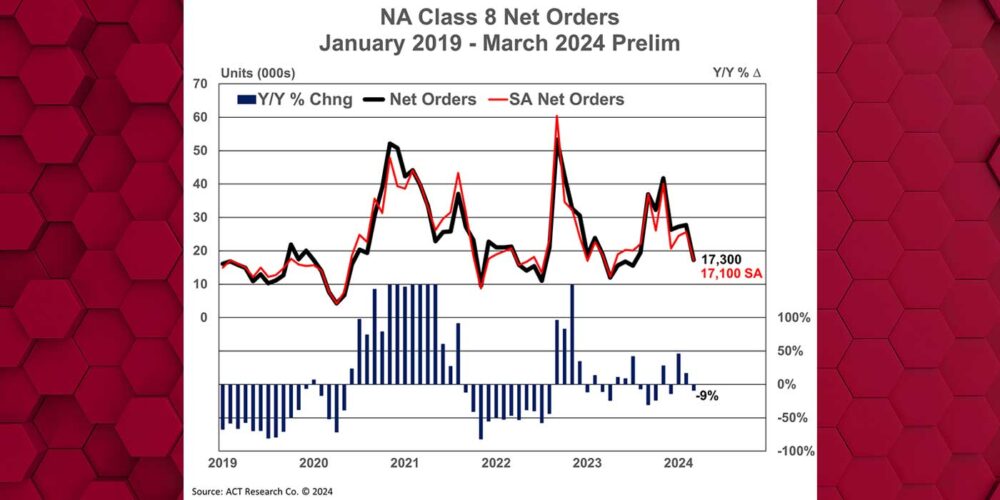

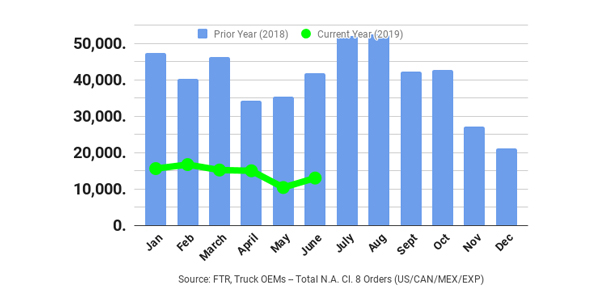

According to recent FTR and ACT Research reports, preliminary North American Class 8 orders for June are at about 13,000 units, up around 20% from May.

Including June activity, this is the weakest 6-month start to a year since 2010, FTR says.

According to Kenny Vieth, ACT’s president and senior analyst, “Weak freight market and rate conditions across North America and a still-large Class 8 backlog continue to bedevil new Class 8 orders. Seasonal adjustment lifts June’s Class 8 net orders to 15,100 units, and through the first half of 2019, Class 8 net orders were booked at a 181,000 SAAR.”

Most orders for 2019 delivery have already been placed. Fleets are moving around previously placed orders and adjusting delivery times according to business conditions and smaller fleets and dealers are placing small fill-in orders, as production slots become available in the near term. Backlogs should fall under 200,000 units for first time since May 2018. Class 8 orders for the past 12 months now total 331,000 units, according to FTR.

Regarding the medium-duty market, ACT’s Vieth explained, “The medium-duty order trend remains off the pace set in the first half of 2018, but continues to benefit from the underlying strength in the consumer economy. In June, NA Classes 5-7 net orders were 19,200 units, down 30% y/y and 5.7% from May. While we have to go back 23 months to find a weaker MD order month on an actual basis, we only have to go back three months when looking at seasonally adjusted data.”