During a press conference that touted the launch of Mack Trucks Command Steer, Jonathan Randall, senior vice president of North American sales and commercial operations, Mack Trucks, provided a trucking market update and gazed into his crystal ball to look at what 2023 might hold.

Here are his top takes.

We’re heading toward a recession, but…

Randall noted that next year’s GDP would be at 2% or less, indicating a slow down compared to this year. However, the counterpoint is that “We find ourselves in an unprecedented level of demand for commercial trucks,” he noted. “And this is the dichotomy that we’re playing with when we talk about what’s happening with the industry.”

Randall rattled off a few quick-hit economic stats from the Bureau of Economic Analysis and Census:

- Trucking economic activity is “cooling from very high levels.”

- Spending is slowing down.

- Interest rates are rising.

“However, manufacturing orders are climbing and unemployment rate remains low, and when we say the labor market’s still very strong. Read that as the labor market is extremely tight, and labor continues to be one of the main challenges the industry faces … Labor, more and more, impacts on our ability to meet the demand.”

That said:

‘No one is calling to cancel trucks’

“The numerous calls I get today from our dealers and from our customers–no one’s calling to cancel trucks,” Randall noted. “No one is saying: ‘Hey, I know I told you I was going to take 75, but really I’m only going to take 50.’ The call is, ‘I’m going to take 75. Is there another 50 you can get me please? I need them desperately.’ You can see freight loads are starting to come down. You see freight rates are starting to come down. Yet, you still see truckload carrier profitability at good levels.”

Demand next year will be stronger

Randall reported that Mack Trucks forecasted U.S., Canada, and Mexico, truck manufacturing to be at about 300,000 units. Though Mack Trucks hasn’t officially put a number forecast out for 2023, Randall said:

“The demand next year will be stronger than this year.”

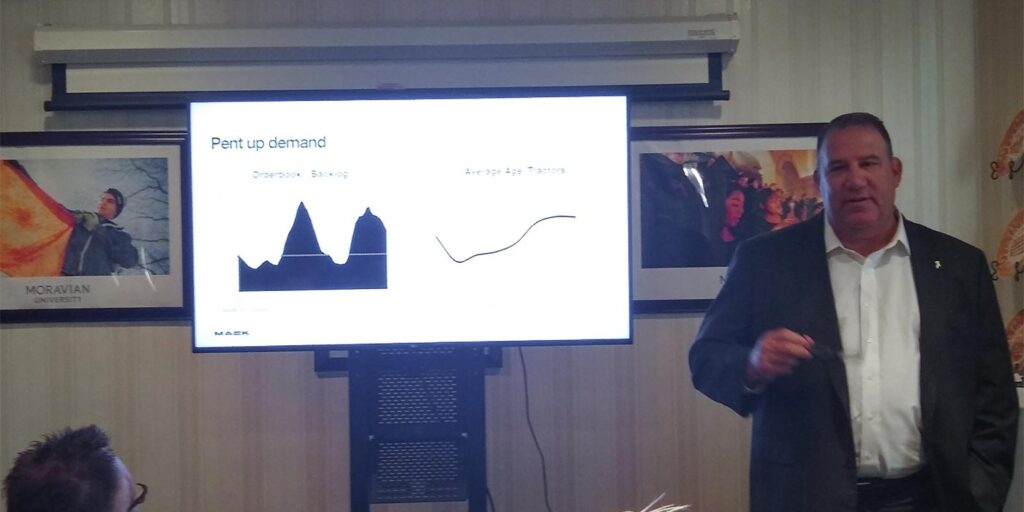

What makes Mack Trucks so confident?

“The order backlog and the average age of the trucks,” Randall answered. “What’s happened over the last several years, quite honestly, is the production has not been able to meet the demand. Tractor fleets are aging. Maintenance costs are going up and the replacement cycles are longer because we haven’t able to just meet even just the replacement demand.

“We’re going to maintain a very strong demand for the foreseeable future in the commercial truck industry.”

So whatever happens with the general economic conditions, and there will be a pullback, and we expect that there will be a pullback… Whatever the general economic pullback is, we believe that the commercial truck pullback, will not be a one for one relationship. If you look at it as a factor of 10, if the economy pulls back to a 10, maybe commercial trucks pulls back to a four or a five. Right, so there might be a softening, but it’s not going to be a one for one relationship with the general economy, mainly because we need to be able to meet just the replacement demand of what’s coming. And so that we forecast strong markets going forward. So there’s the economy.

Economic pull back will not equal a commercial truck pull back

But still: The ECONOMY!

“Whatever happens with the general economic conditions, and there will be a pullback, but whatever the general economic pullback is, we believe that the commercial truck pullback will not be a one for one relationship,” Randall said. “If you look at it as a factor of 10, if the economy pulls back to a 10, maybe commercial trucks pulls back to a four or a five. There might be a softening, but it’s not going to be a one for one relationship with the general economy mainly because we need to be able to meet just the replacement demand of what’s coming.”

Mack Truck market performance

Speaking of what’s coming, Randall started out with the Mack Trucks production update saying, “Our order boards are filling up for Q1 and Q2.

“We’re performing well in our core segments,” he continued. “What we’re finding as with any growth market, long haul is the engine that drives that growth.”

He did a quick, and helpful, rundown of commercial truck registrations this year vs. last.

- Long haul made up 47% of total registrations in 2021. This year it’s up to 52.1%

- Regional haul, which Randall noted is typically flat between 25% and 26%, is at 26.1% this year.

- One other segment Mack tracks is “straight truck greater than a 10-liter engine.” Last year, that segment made up 14.8% of the total registrations, and this year it’s just over 12%.

“The growth is in long haul; it’s not that there’s less numbers of straight trucks being bought. It’s just a smaller percentage of a high that’s being driven growth by the long haul segment,” Randall clarified. “And we see that growth for the foreseeable future, which makes the Mack Anthem that much more important from the standpoint of growth.”

Mack production lines are churning out trucks to keep up with demand. Randall noted that Mack typically sells a bulk of its trucks from dealer inventory–up to 30% of trucks at the Mack dealership don’t have customer names attached to them, in a typical year. But the past several years have been anything but typical.

“Right now dealer inventory is at about 5% to 6% of what’s sitting on dealer lots.”

Medium-duty market holds heavy-duty potential

Mack Trucks marked its re-entry into the medium-duty market in 2020. Despite the pandemic headwinds, Randall was bull(dog)-ish on the market potential.

“We’ve gone from zero to a hundred miles an hour, pretty darn quick on the medium-duty trucks, and we’re really happy and proud of that project,” he said. “We’re in our second full year and year to date this year, we’re at 4.7% market share.”