As we are all aware, this has been a very bumpy, uneven year for the truck market, full of unexpected twists and turns. How your fleet has done largely depends on what kind of applications you run, and how much they were, or continue to be, affected by the pandemic and the related shutdowns.

So what’s next? As with most of 2020, we don’t really know, as there are a large number of factors at play. In a recent webinar, Paul Kroes, Thermo King‘s market insights leader for North America, broke down those factors and how they might play out.

The holiday season

From a trucking industry standpoint, one of the biggest trends of the year has been issues with the supply chain––issues that have not been resolved, and may in fact become more pronounced during the upcoming holiday season.

“If you thought the hoarding and shortages were bad in Q1 and Q2, they’re going to be way worse in the holiday season,” Kroes said.

“Retail inventories are still low, so we’re starting from a bad spot, but the general population is now much more aware of how bad it can be,” he elaborated. “The holiday surge in demand is just going to hurt things. The amount of hauling capacity is no better, so not only do fleets have to haul all of the toys and electronics and everything else that gets consumed during the holidays, they are still being asked to haul everything else.”

Low inventory levels coming into the season supports the idea that freight volumes will remain strong over the next couple of months, Kroes added.

Supply vs. demand

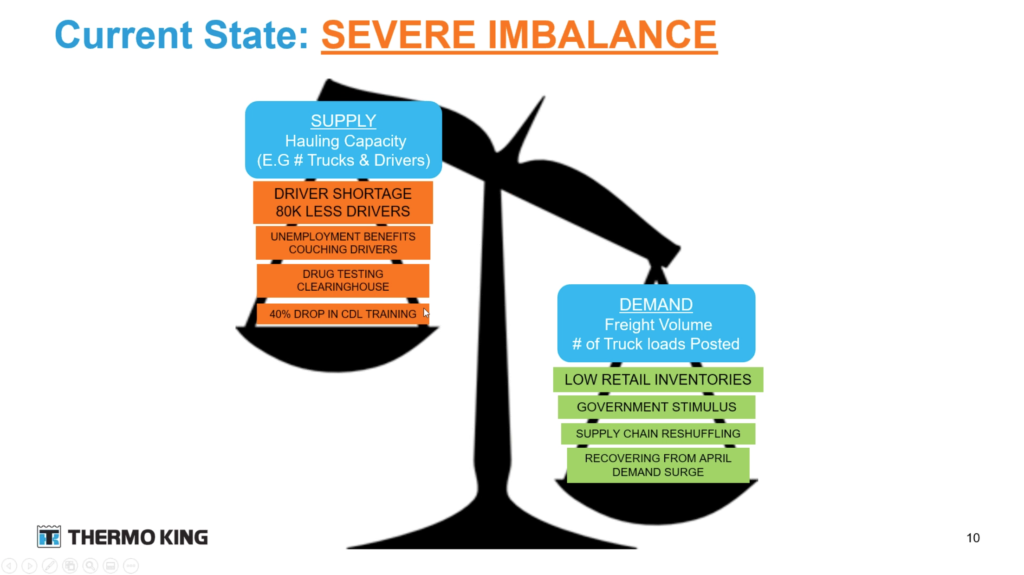

Kroes calls the current supply vs. demand conditions a “perfect storm,” causing a severe imbalance between the two.

“On the supply side we are very light,” he said. “And it’s not because of equipment—because of the pandemic and other factors, it’s actually a driver shortage that’s causing this.”

Kroes noted that by several measures, there are about 80,000 fewer drivers available now than there were a year ago. Among the causes of this include the Drug Testing Clearinghouse, which brought with it much more stringent drug testing processes and tracking; and a 40% drop in CDL training, as many training schools were shut down during the pandemic.

On the demand side for consumer goods, low retail inventories, supply chain reshuffling and recovery from the March/April demand surge cause a demand that heavily outweighs the supply at the moment.

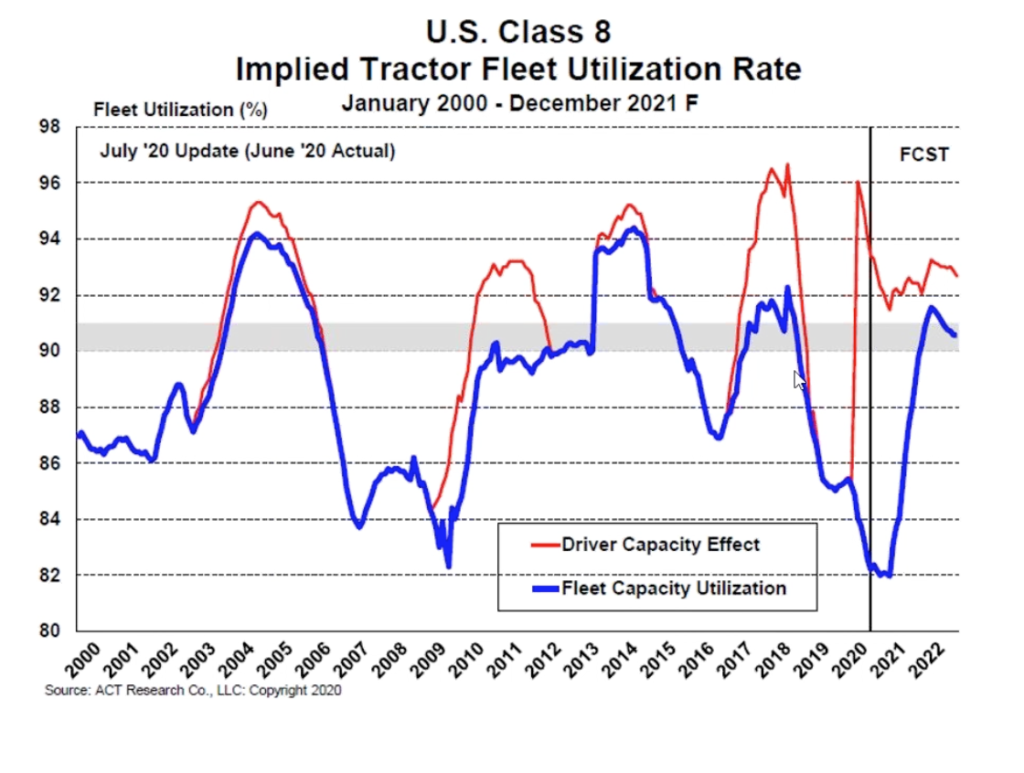

This is borne out, as Kroes noted, by ACT Research Co.’s tractor utilization metric (seen above), which sees the driver shortage heavily outpacing the amount of equipment fleets have.

“For nearly every driver that fleets have, they are putting them to work constantly,” he said. “That means there’s no more flex capacity, they have very little ability to react to changes in supply chain or new business.

“The driver shortage is now the determining factor and it will be for the foreseeable future until all of that gets resolved.”

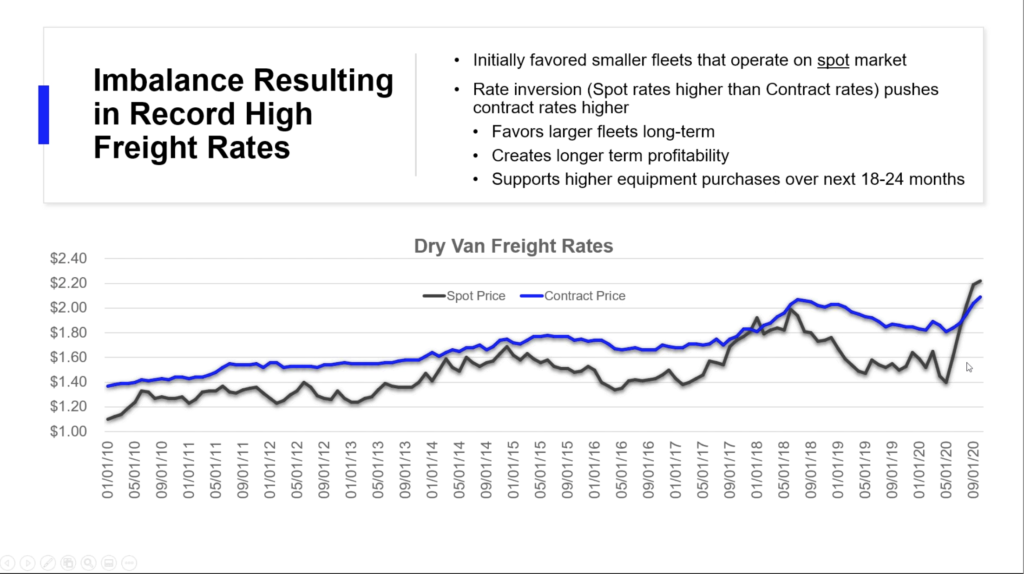

Freight rates

Kroes went on to note that while 2020’s trucking conditions initially favored smaller fleets that operate on the spot market, the rate inversion favors larger fleets in the long term, and supports higher equipment purchases by those fleets over the next 18 to 24 months.

“That’s why we have a very favorable outlook over the next two years because over the next year as those contract rates get rewritten, it then puts out another 12-month time period in which fleets have very good profitability and revenues to support higher equipment purchases,” he said.

With conditions favoring larger fleets, Kroes noted that we may continue to see the big fleets getting bigger through mergers and acquisitions in 2021.

The medium-duty market

Kroes noted that the medium-duty market as a whole has been recovering well, mostly driven by e-commerce.

That said, recovery varies wildly among medium-duty fleets depending on their segment and application. Much of the refrigerated segment, for example, has been hit hard in 2020, with food delivery fleets not meeting their usual rates of delivery to restaurants, bars, music venues, etc.

Additionally, Kroes noted that the medium-duty market is trending towards renting trucks rather than leasing, due to the variables in the market. Another factor is the continued shift towards smaller GVWR trucks to avoid CDL requirements, something that has only continued thanks to the current driver shortage.

2021 outlook

As with the rest of 2020 up to this point, what happens next depends on a variety of factors that have yet to play out.

We could see rolling shutdowns across the country as COVID-19 numbers spike, and may continue to do so throughout the holiday season as people travel and gather in groups.

“What we really need is government stimulus, especially if we start to see shutdowns,” Kroes said. “I believe that we do need something to continue to put money into consumer spending, keep things from getting worse, especially with the shutdowns that might come.”

According to Kroes, vaccine distribution is the single biggest driver for broader economic recovery. And while there has been some positive news on that front lately, there is still a long way to go, and a lot that can happen along the way.