The North American Council for Freight Efficiency (NACFE) has released a new Guidance Report on the prospects of hydrogen electric power in the trucking industry.

Key findings from the report include:

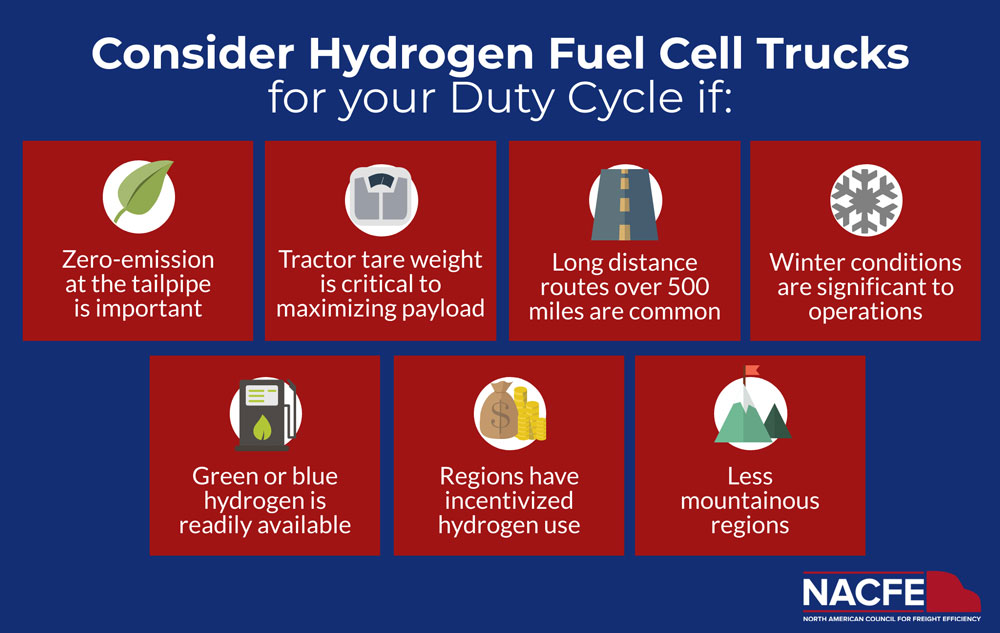

- Hydrogen fuel cells trucks are just starting to see real-world use and their adoption is being driven by regional or national considerations that are much bigger than what exists for trucking fleets.

- Battery electric trucks should be the baseline for hydrogen fuel cells electric vehicle (HFCEV) comparisons, rather than any internal combustion engine alternative.

- As for all alternatives, fleets should optimize the specifications of HFCEVs for the job they should perform while expecting that the trade cycles will lengthen.

- The future acceleration of HFCEVs is likely not about the vehicles and fueling but resides mostly on the creation and distribution of the hydrogen itself.

- Finally, the potential for autonomous fuel cell trucks to operate 24 hours a day adds significant opportunity for making sense of capital and operational investment in hydrogen.

“The opportunity with autonomy is 24-hour operations,” Rick Mihilec, director of emerging technologies and study team manager at NACFE, said in a conference call sharing the report’s findings. “The bulk of the research we did said that hydrogen refueling is generally going to be faster than battery recharging, so the edge is going to come from that speed.”

The report also offers fleets some recommendations on how to proceed with hydrogen fuel cell electric truck exploration:

- Fleet investment in new fuel cell electric and battery electric vehicles requires vehicles. The debate on infrastructure is irrelevant if there is no demand.

- Hydrogen is a regional solution, cheap hydrogen even more so. The ability to scale truck demand will be limited by the nature of truck production volumes and market forces.

- Purists pushing green hydrogen as a goal should accept that some compromise is needed to allow alternatives in the “how” of getting to net zero-emissions.

- Fill times are moving targets for both fuel cell and battery electric vehicles. In a zero-emission future world, as in California’s plans, diesel does not exist, so there is no value of a comparison on fill times.

- Incentives, grants, credits and tax breaks will be around for a while. Truck production volumes versus zero-emission target dates will require zero-emission transport financial help for some years.

“While hydrogen fuel cell technology is very promising, we know that widespread adoption will take time,” Amy Davis, president of new power business at Cummins, says in the report. “Many factors will influence this, including emissions regulations, infrastructure, hydrogen availability and total costs of ownership. Buses and trains will likely be some of the first applications to transition to hydrogen, with the Hydrogen Council predicting that heavy- duty trucks will fall further out on the curve with about 2.5% of hydrogen adoption in 2030.”

RELATED: Hear more from Amy Davis and Cummins on hydrogen power in FE’s recent podcast.

You can read the full report, including a video and several graphics helping make sense of the many types of hydrogen power, here.