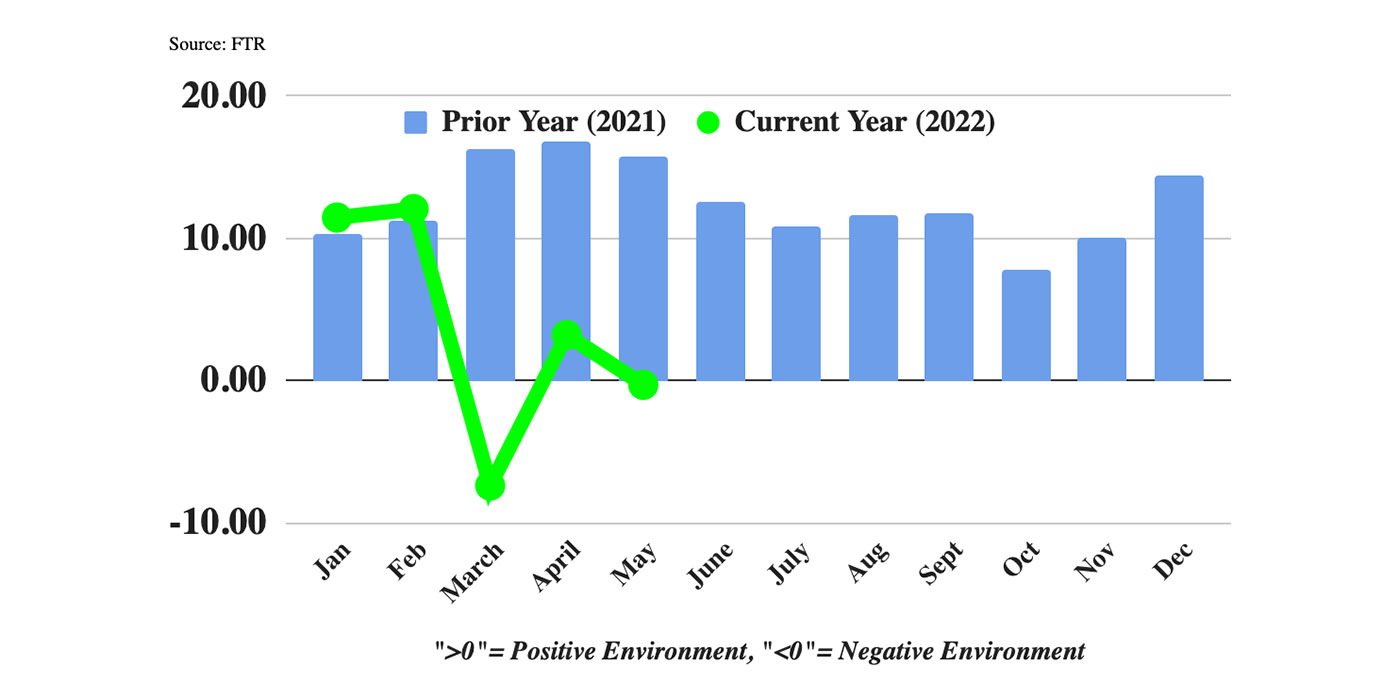

FTR’s Trucking Conditions Index remained in negative territory for third consecutive month

FTR’s Trucking Conditions Index (TCI) improved in July to a reading of -0.7 from the previous -3.36 principally because of falling diesel prices. Although the index was just below the index’s base of zero, it was the third consecutive month of negative readings–a situation that had not occurred since March-May 2020. FTR expects that trucking market

FTR’s Trucking Conditions Index fell due mostly to diesel price gains

FTR’s Trucking Conditions Index (TCI) for May fell back into negative territory with a -0.3 reading from 3.21 in April. Sharp increases in diesel prices during May offset slightly improved freight market conditions for carriers. Freight demand, capacity utilization, and freight rates were slightly stronger in May but together were unable to diminish the negative

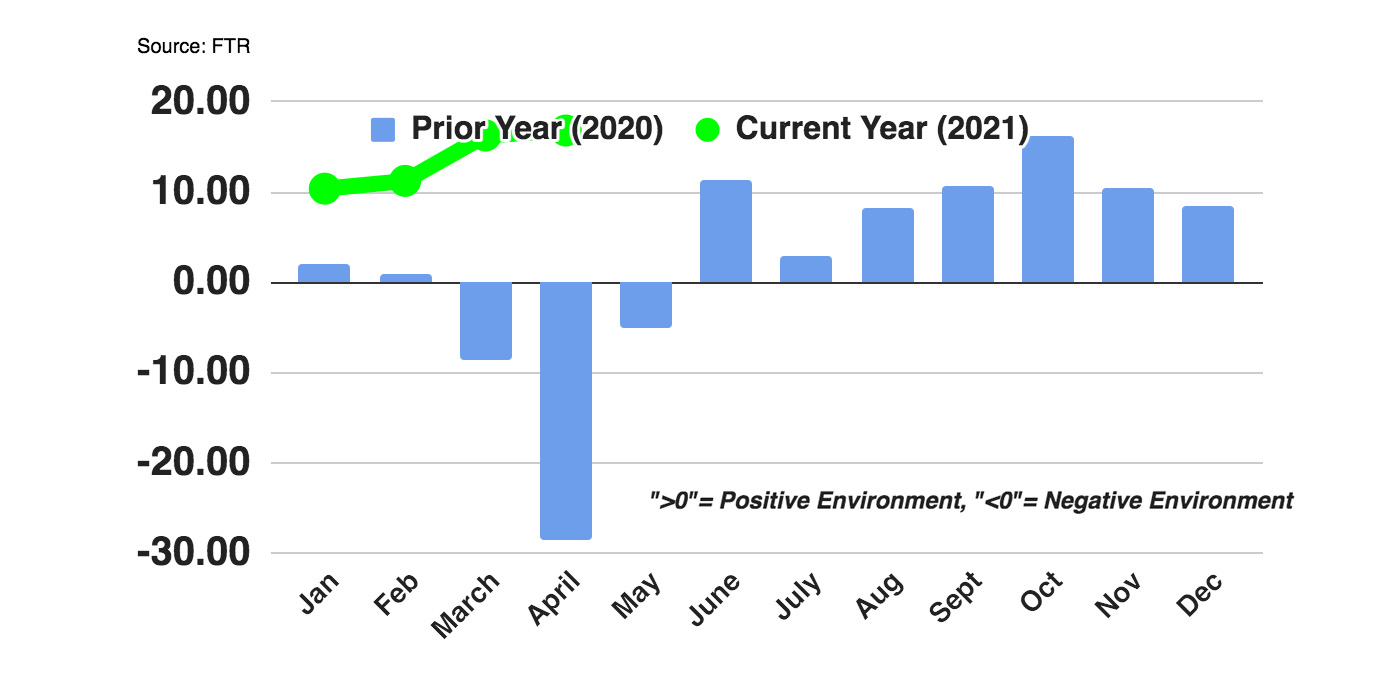

FTR’s Trucking Conditions Index for January still strong, but war raises risks

FTR’s Trucking Conditions Index (TCI) for January fell to 11.46 from 14.45 in December amid rising diesel prices. Although more robust freight rates more than offset the effects of higher fuel costs, freight volume was a significantly weaker positive factor than it had been in December. A record surge in fuel costs in the wake

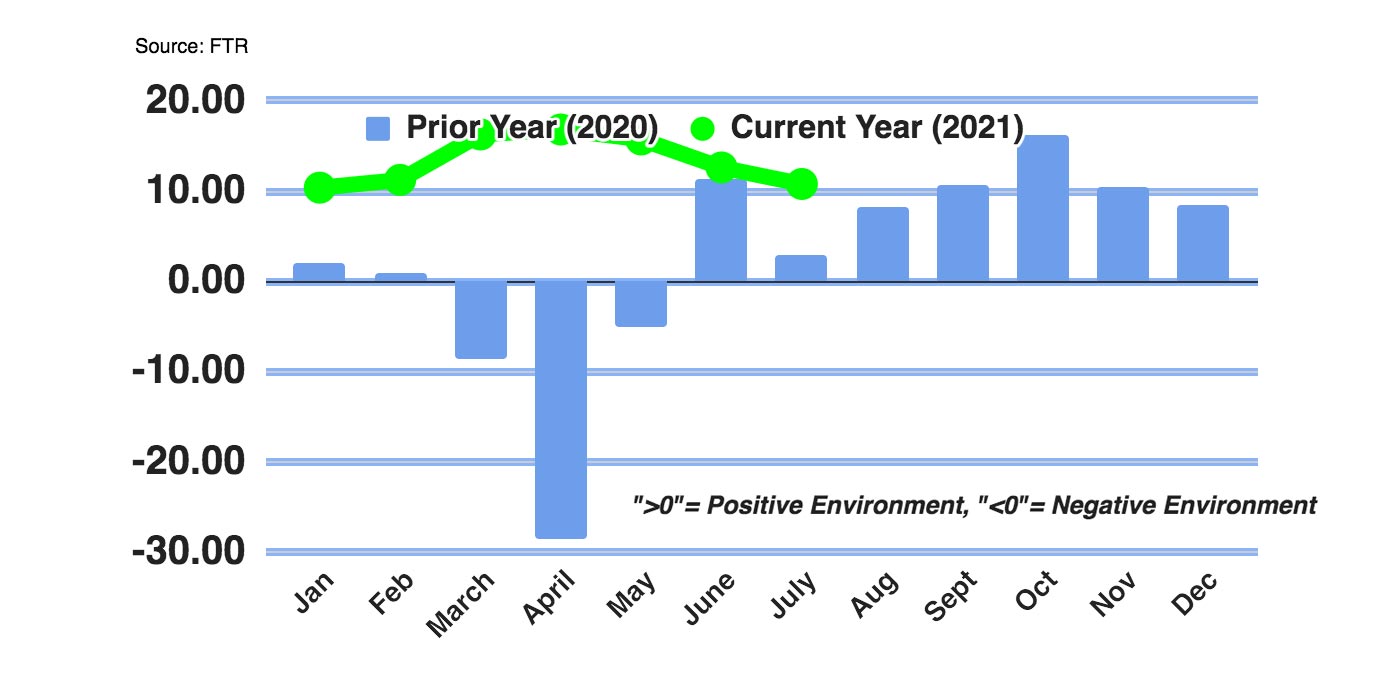

FTR’s Trucking Conditions Index in double digits as freight rates strengthen

FTR’s Trucking Conditions Index (TCI) reading for September increased marginally to 11.79 from 11.63 in August. Freight rates continued to strengthen in September, but freight volume and capacity utilization were not as beneficial to carriers as they were in July and August. FTR’s forecast remains for strong positive TCI readings well into 2022. “The market

FTR’s Trucking Conditions Index eased in July, remain robust for carriers

FTR’s Trucking Conditions Index (TCI) for July declined to 10.78 from 12.61 in June. Market conditions are still robust for carriers despite some modest easing over the past three months from the record TCI posted in April. In July, a softer rate and utilization environment along with a slightly higher cost of capital was offset

FTR’s Trucking Conditions Index sets another record

FTR’s Trucking Conditions Index (TCI) for April, as reported in the June Trucking Update, achieved a record-high reading of 16.82, surpassing what had been an all-time high in March. Although most market factors were not quite as strong in April as they were in March, a reversal of March’s higher diesel prices improved overall trucking

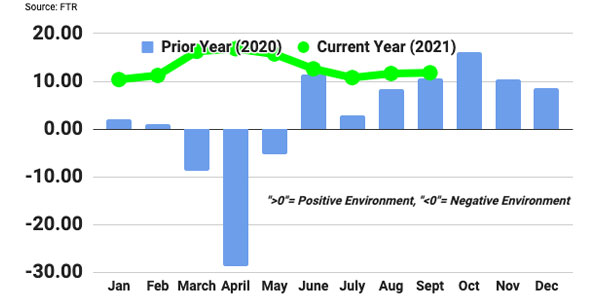

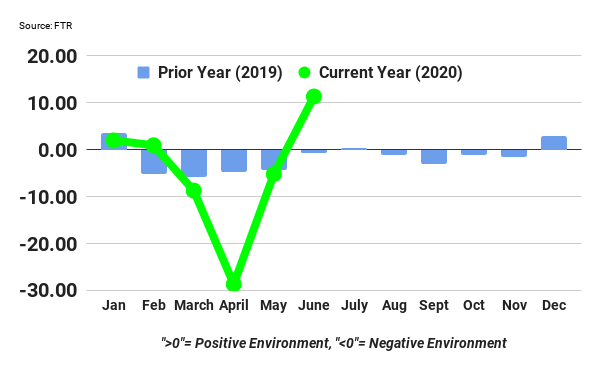

FTR June Trucking Conditions Index reflects freight rebound

FTR’s Trucking Conditions Index reading of 11.35 for June is the highest in a decade and comes just two months after a record-low April reading of -28.66. However, FTR says it is unclear how long the positive factors affecting the June reading—a combination of higher utilization and strong growth in freight demand and rates—will remain

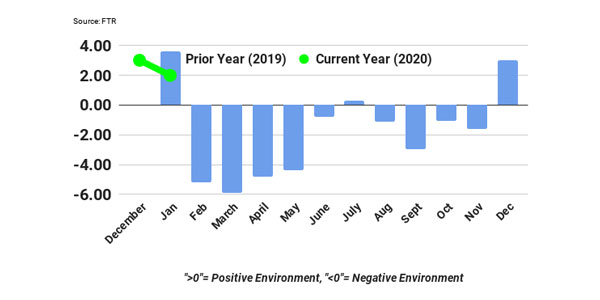

FTR: February likely last positive month this year for Trucking Conditions Index

Sharp declines in freight volumes, utilization and rates due to the COVID-19 pandemic could lead to the worst overall trucking conditions on record during the second quarter of this year, according to FTR’s projections for the Trucking Conditions Index (TCI). FTR forecasts that the TCI will hit its lowest points in April and May, but

FTR September Trucking Conditions Index reflects broadly weaker environment

FTR’s Trucking Conditions Index for September, at -2.94, was the lowest reading since May, reflecting a relatively weak environment for carriers.

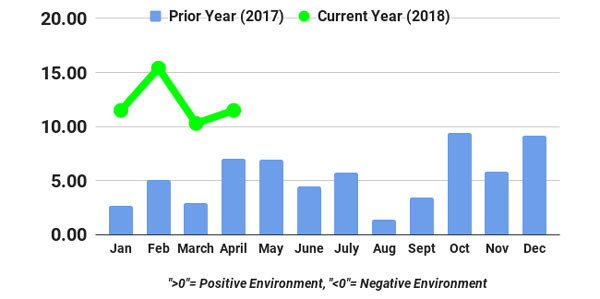

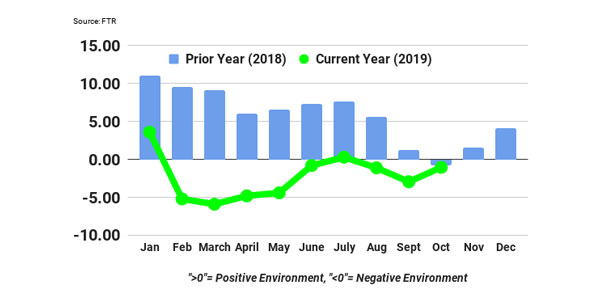

FTR’s Trucking Conditions Index reflects favorable environment for carriers

FTR’s most recent Trucking Conditions Index (TCI) came in at a reading of 11.5 for April, which reflects strong freight demand and continued tightness in capacity. According to FTR, carriers can expect the favorable conditions to improve further into Q3 and stay elevated well into 2019. The tight labor market, including a shortage of drivers,