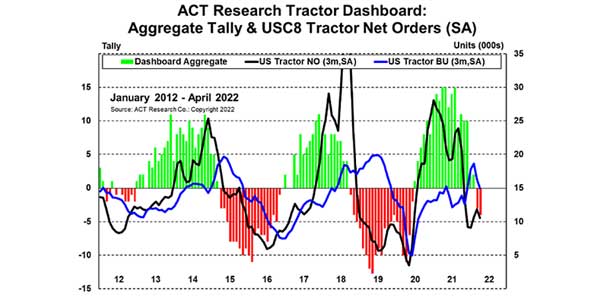

ACT Research Class 8 Tractor Dashboard drops again

According to ACT Research’s recently released Transportation Digest, the top line on the Class 8 Tractor Dashboard dropped again in April. “The Tractor Dashboard result affirms the steady and steep erosion in prospective business conditions for Class 8 tractors that has been the rule through calendar year 2022,” said Kenny Vieth, ACT’s President and Senior Analyst.

Seasonally adjusted June Class 8 truck orders in line with YTD average

Preliminary NA Class 8 net orders in June were 15,500 units, while NA Classes 5-7 net orders were 17,800 units. Complete industry data for June, including final order numbers, will be published by ACT Research in mid-July. “Seasonal adjustment lifts the Class 8 June total to 18,300, representing the strongest seasonally adjusted total since March

U.S. used truck sales cycle at the ‘beginning of the end’

Preliminary used Class 8 retail volumes (same dealer sales) fell 10% month-over-month, and were 40% lower compared to May of 2021, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. “Unfortunately, long-awaited reports of loosening inventories come at exactly the wrong time in

Domestic demand for commercial vehicles in China softened in Q1 ’22

According to the recent release of ACT Research’s China Commercial Vehicle Outlook, the Chinese commercial vehicle market has been reacting to the domestic and global surges of COVID, long-term pressures of market restructuring and new emissions regulations. Domestic demand for heavy trucks fell more than 50% y/y, while the tractor market shrank almost 67% y/y and

Mild recession scenario considered in commercial vehicle market forecasting

According to ACT’s latest release of the North American Commercial Vehicle OUTLOOK, while ACT Research still believes a soft landing is the US economy’s most likely path, the potential for a mild recession is becoming an increasingly compelling alternative. “We find ourselves in a turbulent environment, where still significant positive and increasingly negative economic forces are crashing

May preliminary data show new truck order activity aligned with macro trend

Preliminary North American Class 8 net orders in May were 14,000 units, while Classes 5-7 net orders moderated to 17,000 units. Complete industry data for May, including final order numbers, will be published by ACT Research in mid-June. “We are coming to that time of year when orders tend to be seasonally weak, as OEMs

Phillips Connect’s new facilities support growth of commercial vehicle technology

Phillips Connect expanded its business facilities to accommodate explosive growth since 2020. The new capacities in manufacturing, R&D, warehousing, and a new headquarters complex reflect the increasing recognition of its intuitive and scalable telematics solutions by major transportation and logistics companies. In the last five years, Phillips Connect leveraged long-standing relationships from Phillips Industries with

Are EVs sticking around for the long-haul?

It seems there isn’t a shortage of things we can find to disagree on. Everyone has their own view (and a side that opposes them), and the trucking industry is no exception. But not being able to see eye to eye on hot topics isn’t necessarily a bad thing. In fact, it may just lead

Used truck retail sales close 2021 with 6% increase

Preliminary used Class 8 retail volumes (same dealer sales) grew 4% month-over-month and ended 2021 with a 6% ytd increase, despite dropping 30% y/y in December, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. Other data released in ACT’s preliminary report included

Torc Robotics expands to Austin location to drive toward commercialize self-driving trucks

Torc Robotics will open its third U.S. location in Austin, Texas, in early 2022. The approximately 21,000-square-foot office will complement the self-driving truck firm’s Blacksburg, Virginia, headquarters and its Albuquerque, New Mexico, test center. The expansion coincides with the recent two-year anniversary of Torc joining the Daimler Truck family as an independent subsidiary. In addition