FTR, Truckstop.com share truck pricing insight

As FTR and Truckstop.com continue their analysis of spot market pricing, their research has unearthed a steady stream of new insights about truck pricing. Here are three quick observations from Noel Perry, transportation economist at FTR, which are now much clearer because of big data. “Spot prices have been rising more than contract prices. The

FTR’s Shippers Conditions Index falls after four improved months

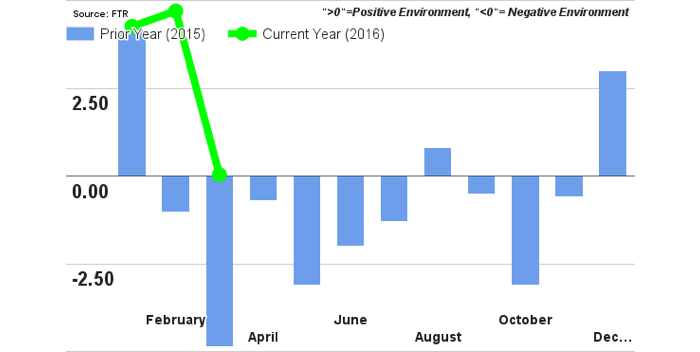

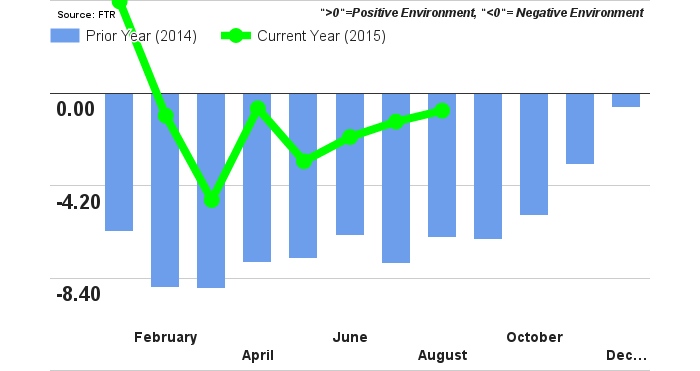

FTR’s Shippers Conditions Index (SCI) fell to a near neutral reading of 0.4 in March after improving for each of the four previous months. The risk of diesel prices rising has put pressure on the fuel cost component of the index, reflected in the current month’s decline. However, FTR expects the SCI to remain in

FTR forecasts placid conditions for trucking companies

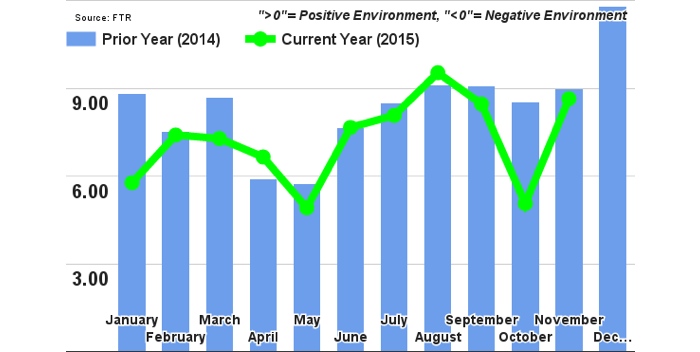

FTR’s Trucking Conditions Index (TCI) measure for December rose more than two points to a reading of 10.88. FTR’s forecast is that 2016 will be a year of placid conditions for trucking companies, with little or no change in the current trend of tight, but adequate, capacity. Two events could impact capacity utilization and possibly,

FTR’s Shippers Conditions Index reflects benign conditions for shippers

FTR’s Shippers Conditions Index (SCI) for September, at a near neutral reading of -0.5, reflects benign conditions for shippers. The index will start a steady downward trajectory during 2015 Q4 through 2016, reflecting the current expectations for freight haulers to institute increased pricing toward the end of next year. A portion of the index is

FTR Shippers Conditions Index remains moderate, likely to decrease for foreseeable future

FTR’s Shippers Conditions Index (SCI) for August, at a reading of -0.8, continues to reflect the moratorium in TL rate growth over the summer. However, the current soft level in the SCI is still below equilibrium, with the slightly negative reading. Shippers should expect a more challenging environment in 2016 in anticipation of the increasing

FTR Shippers Conditions Index for July reflects benign conditions for shippers

FTR’s Shippers Conditions Index (SCI) for July, at a reading of -1.3, continues to reflect the short term stability of capacity utilization and steady fuel prices that are aiding shippers in containing costs. However, FTR expects the SCI to fall gradually during the balance of 2015 with a more severe negative downturn in 2016 due

FTR: August trailer orders were impressive

FTR reports that August 2015 U.S. Trailer net orders totaled 23,500 units, up 15% versus the previous month and up 1% from a year ago. Dry van and refrigerated van were the strongest segments, with very high totals for a typically slow summer month. U.S. trailer orders have now totaled 335,000 units over the past twelve

Shippers Conditions Index reflects soft market conditions

FTR’s Shippers Conditions Index (SCI) for June, at -2.0, reflects soft market conditions which have slowed, for the time being, rate increases that negatively impact shipper costs. Slowing GDP growth and a change in growth towards services has dramatically softened freight markets for both truckload and rail. With freight growth slowing and fuel prices staying

FTR expects shippers to avoid rate increases in 2015

FTR’s Shippers Conditions Index (SCI) for May, at -3.1, reflects the current manageable capacity utilization, which is expected to remain in place through 2015. As a result of improved capacity and low fuel prices, shippers are getting a respite from rate increases, an environment which should be maintained throughout the year. However, conditions affecting shippers will

Truck orders have peaked, now what? FTR forecasts growth for trucking industry

New truck orders and backlogs have peaked; what now? That’s precisely the question FTR is trying to answer. FTR, a company that uses analytics and history to project the future of the transportation market, held a recent seminar to discuss the future of the truck and trailer industry. Taking a look at the market trends, FTR believes