According to ACT Research’s recently released Transportation Digest, North America’s commercial vehicle industry is experiencing material capacity constraints that are dictating the speed at which the industry can produce for the rest of this year and next. The report, which combines proprietary ACT data and analysis from a wide variety of sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets. This monthly report is designed as a quick look at transportation insights for use by fleet and trucking executives, reviewing top-level considerations such as for-hire indices, freight, heavy and medium duty segments, the US trailer market, used truck sales information, and an overview of the US macro economy.

“Panic is not much of an overstatement for everyone involved in the motor vehicle supply chain these days. From early-stage fabrication of components to the buyers of new trucks, the universal sentiment is ‘it’s just crazy out there’,” said Kenny Vieth, ACT’s president and senior analyst. “For heavy trucks, no less than for medium and light vehicles, procuring supplies to manufacture products has become the top management priority. As capacity constraints became increasingly severe during the middle months of 2021, COVID unfortunately roared back with its Delta variant adding another challenge in this already challenging environment.”

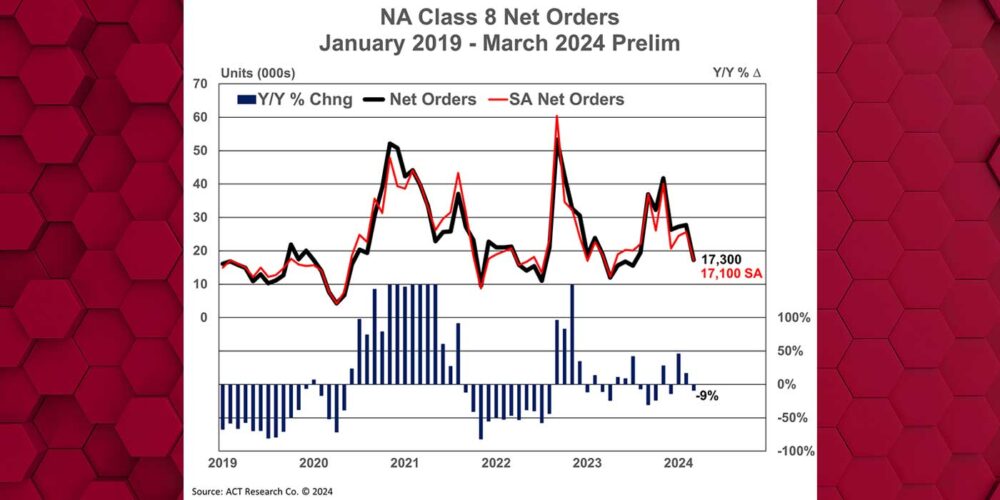

“For North America heavy truck, the result has been sizable gaps between build plans and actual production, especially in June and July, and prospectively in the months ahead,” Vieth added, “and if the factory can’t build, then the dealers can’t sell.

“ACT has certainly rolled back heavy-duty truck forecasts in the past, but that was when the economy weakened and freight declined. The supply-chain crisis has created a unique situation, a major forecast haircut in a period of ripping demand. The sizeable forecast reductions of the past two months are unprecedented–especially considering that 2021 is more than half in the books. In a period of a recovering economy, government stimulus, strong freight and record freight rates, rising vehicle backlogs and falling inventories, the usual bearings and landmarks we use to guide a forecast don’t work. At least for 2021 and certainly into early 2022, the forecast is determined by supply considerations, rather than by what demand dictates.”