ACT Research to launch new expanded forecast report in 2024

The expanded forecast, NA CV Outlook Plus, will feature an annual decarbonization market update, longer-term production forecast and more.

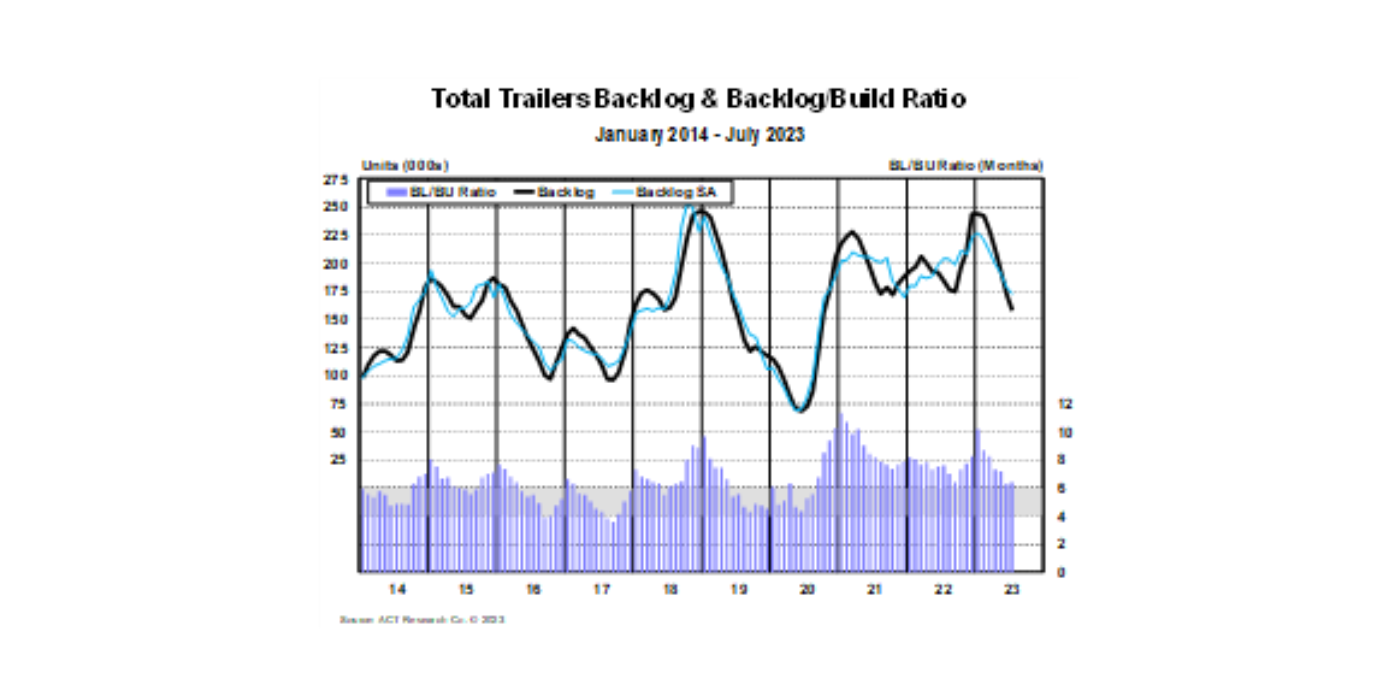

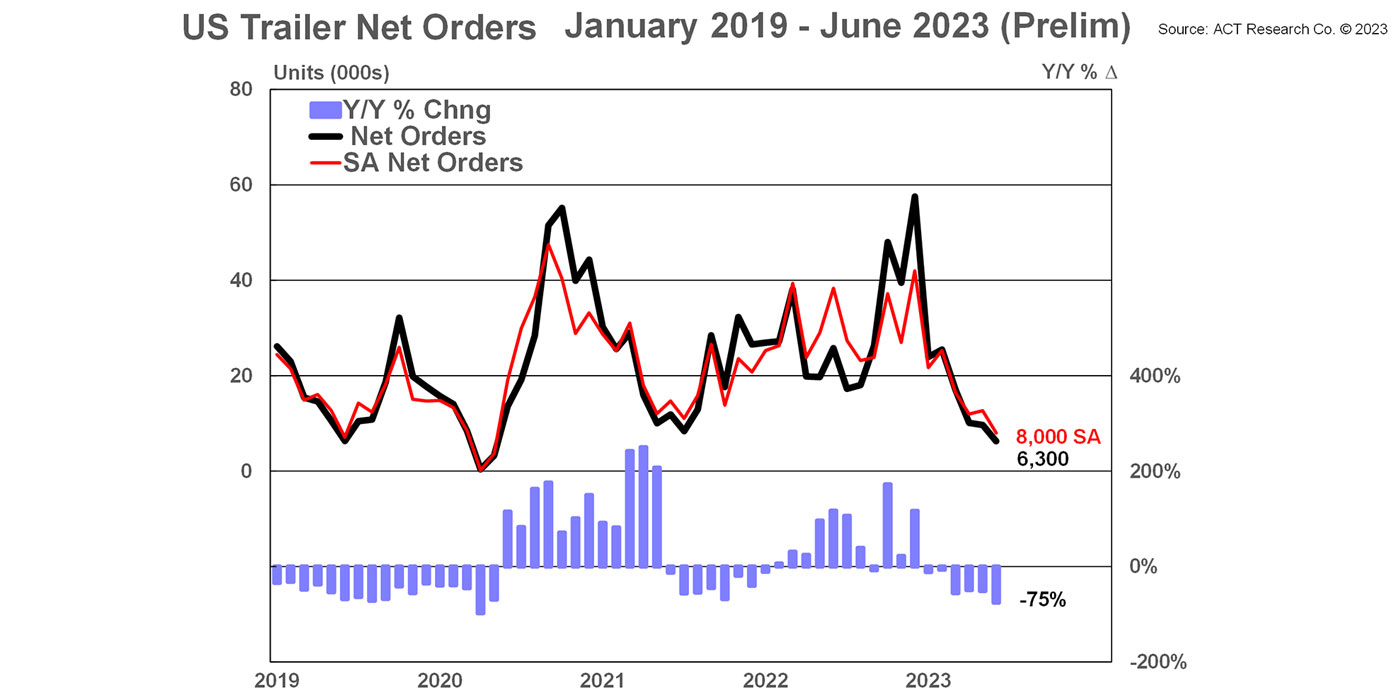

Current trailer backlog commits industry into 2024

“Fleet commitments improved in July but were still somewhat mixed. Total cancels dropped to 1.7% of backlog, following two months of elevated activity.”

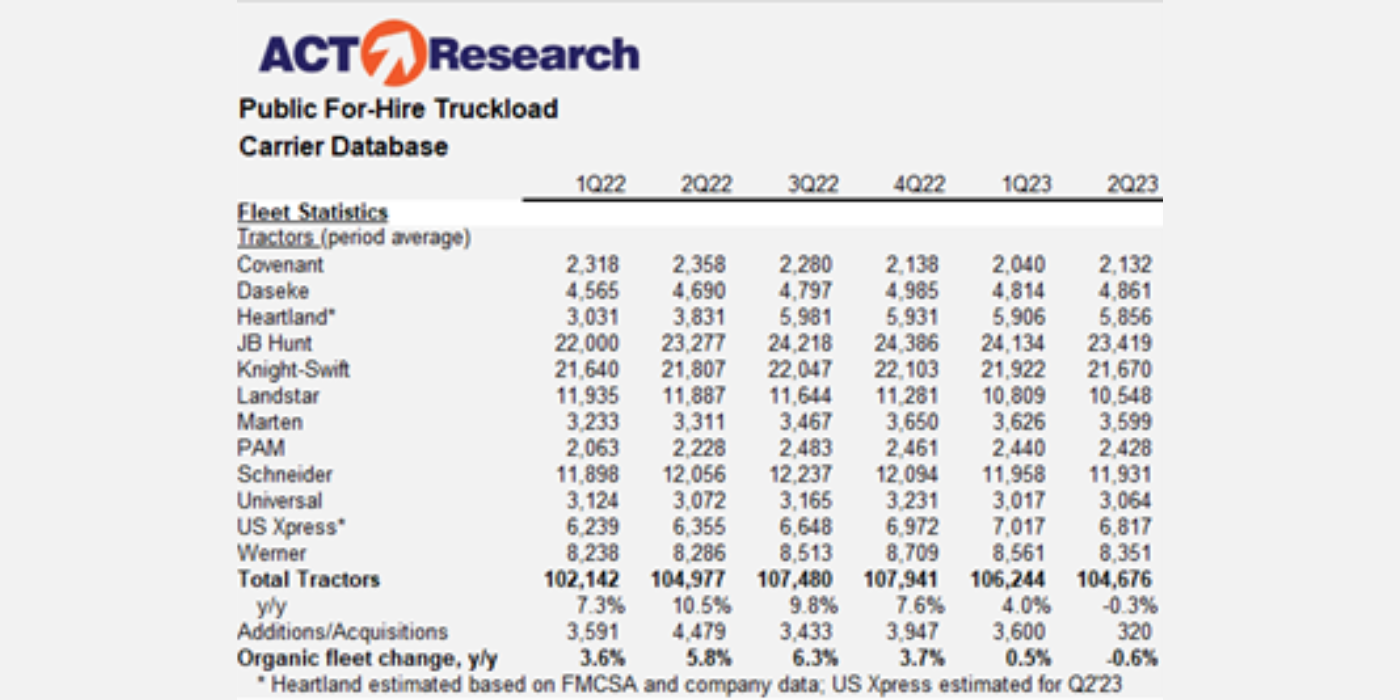

ACT Research findings indicate slow industry rebalancing

Private fleets are still growing and pulling freight from the for-hire market.

ACT Research recommends fleets plan 18 to 24 months ahead for behind-the-fence EV charging infrastructure

“Early adopters of battery-electric commercial vehicles experienced rather lengthy timelines to install EV charging infrastructure.”

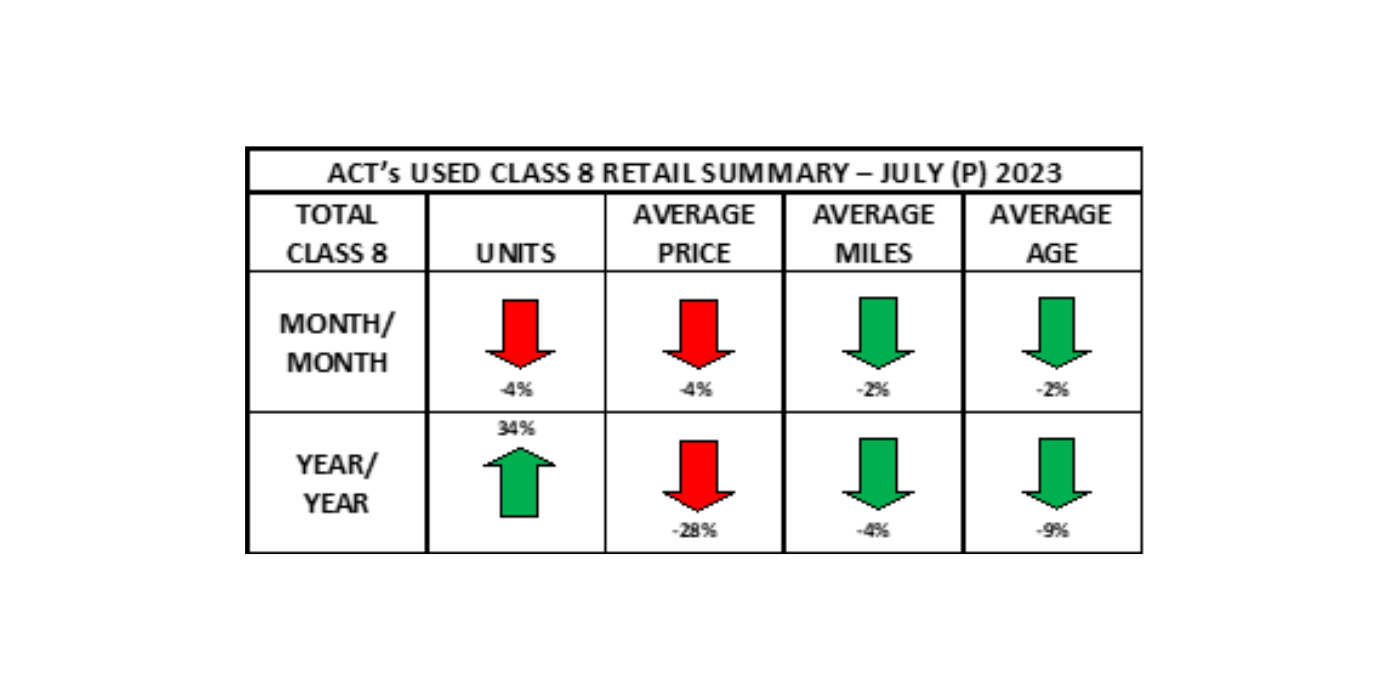

Used truck market declined in July

Compared to June 2023, average retail price declined 4%, while miles and age both declined 2%.

July Class 8 truck orders see significant jump

Complete industry data for July, including final order numbers, will be published by ACT Research in mid-August.

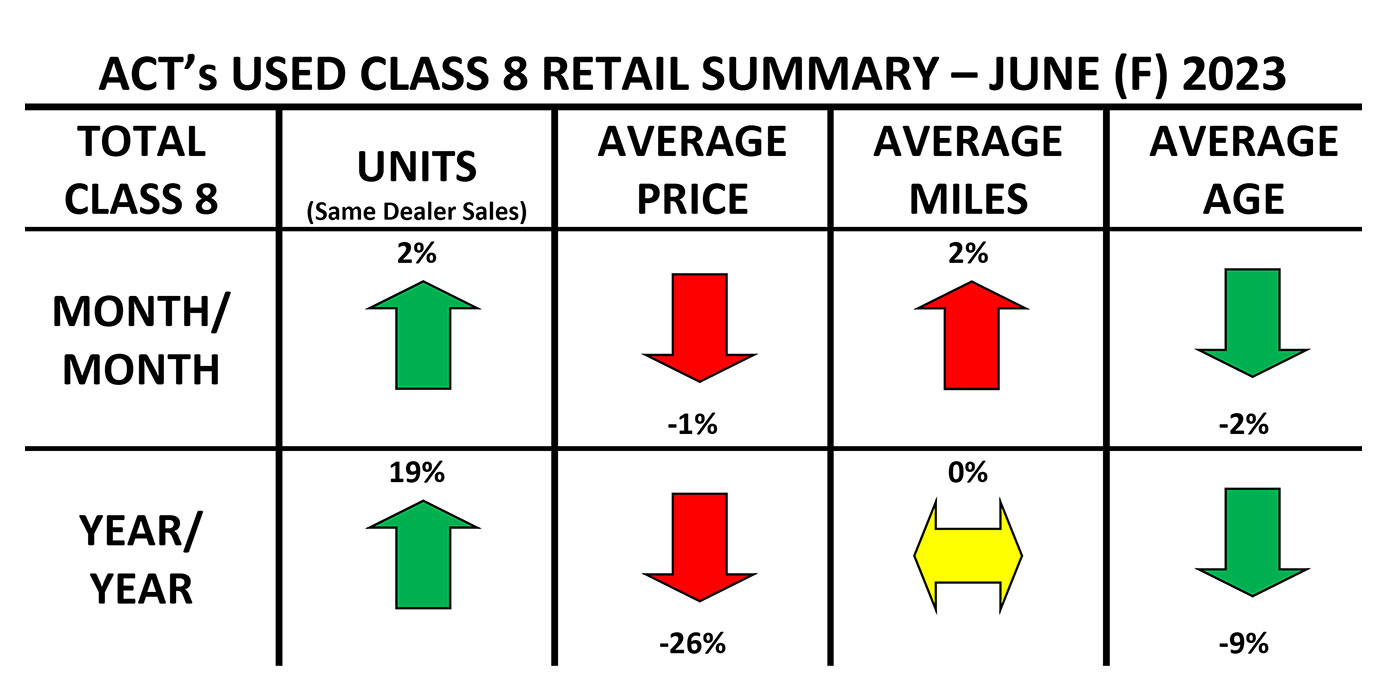

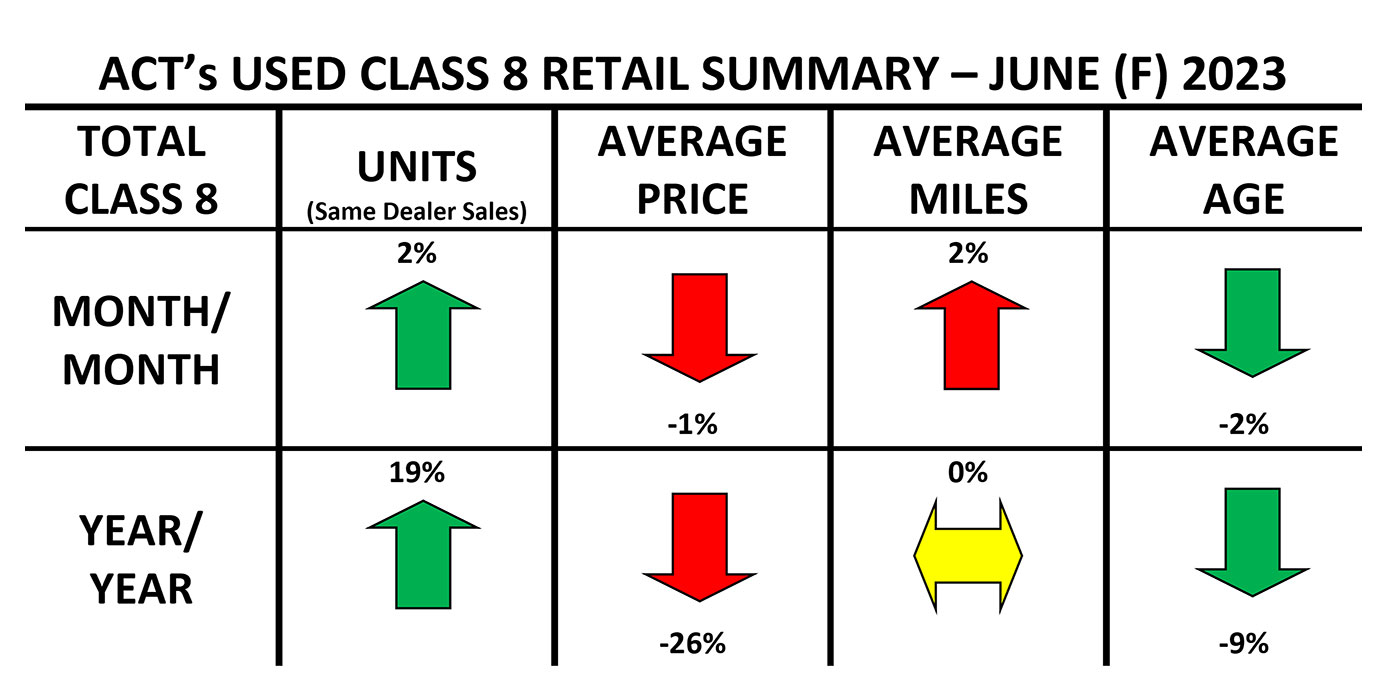

Used Class 8 sales ‘better than expected’ in June

These findings suggest that the dealers involved in their database have likely improved their market share penetration.

U.S. freight market bouncing along the cycle bottom

Driver capacity models suggest the record declines in freight rates should be pushing out more jobs.

June used truck market sees historically expected sales gains

Compared to June of 2022, volumes and miles increased 24% and 1%, respectively, but price and age declined 27% and 9%.

ACT: Net trailer orders fall, cancellations elevated but 2024 books opening

“It is no surprise that net orders in June were the lowest they’ve been so far this year. That is simply part of the cycle.”

Truck orders rise slightly in June

Complete industry data for May, including final order numbers, will be published by ACT Research in mid-July.

Class 8 truck sales, production forecasts follow economic expectations

The previously forecasted drop-off in Q4 sales and build activity no longer looks likely.