OEMs should expect good Class 8 visibility in 2023

Class 8 orders surge along with year-end demand

Strong November Class 8 orders likely pushed backlog higher

Preliminary NA Class 8 net orders in November were 33,000 units, while NA Classes 5-7 net orders were 21,400 units. Complete industry data for November, including final order numbers, will be published by ACT Research in mid-December. Regarding the strength in Class 8 orders, Eric Crawford, vice president and senior analyst, ACT, shared, “OEMs having

CV Powertrain initiatives keep rolling against economic slump

According to the recently released N.A. Commercial Vehicle On-Highway Engine OUTLOOK, published by ACT Research and Rhein Associates, the commercial vehicle (CV) industry continues to invest in new powertrain initiatives and lower carbon emissions from CV fleets despite an unfavorable economic outlook. When asked about the US economic outlook, Kenny Vieth, president and senior analyst,

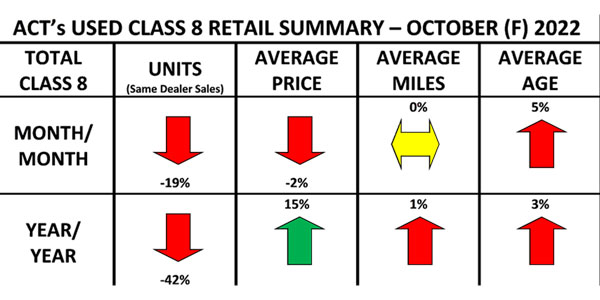

Used Class 8 retail sales fell in October

According to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research, used Class 8 retail volumes (same dealer sales) were down 19% m/m. Average mileage was flat, with average price down 2% and age up 5%, m/m. Longer term, average price and miles were higher y/y, with

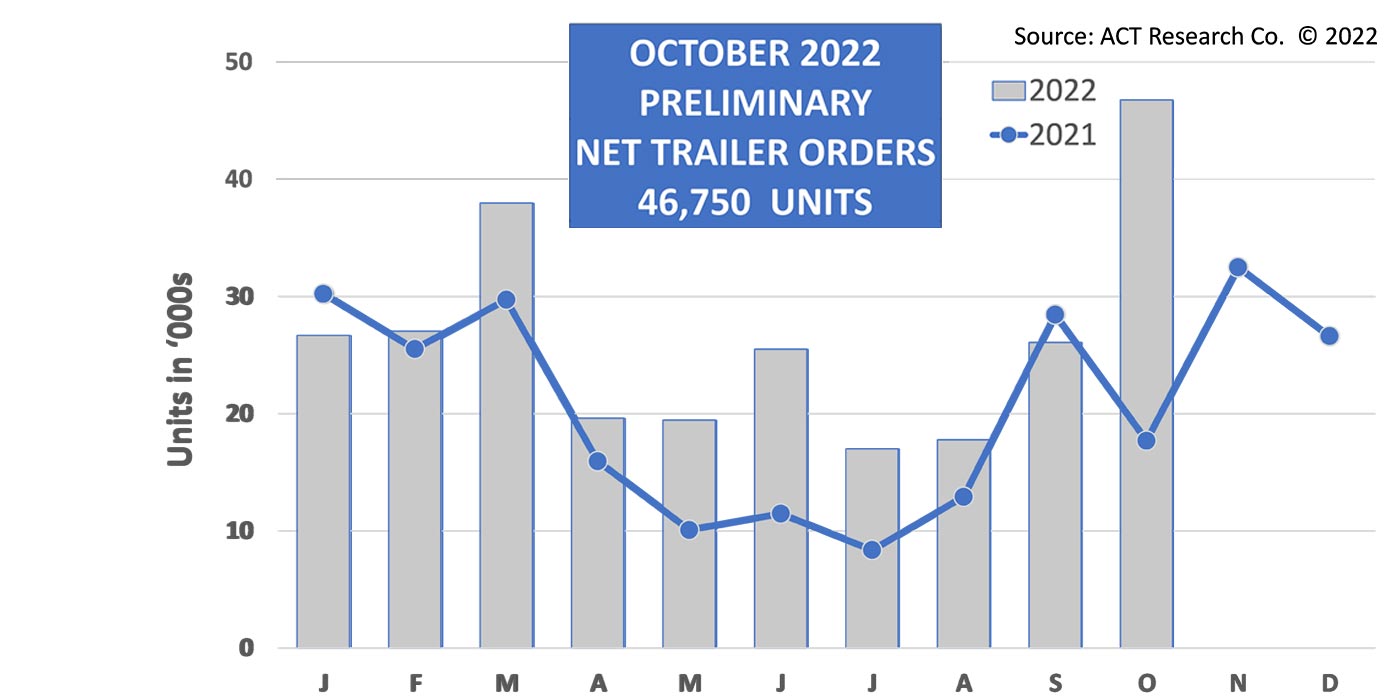

October data show US trailer orders continue to rush in

October net US trailer orders of 47,860 units were 83% higher compared to last month, +57% on a seasonally-adjusted basis, and 171% above the year-ago October level, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report. “Discussions across the past month indicate trailer OEM business conditions, including 2023 demand, material/component supply

Despite current economic activity, 2023 trucking decline yet to come

In the release of its Commercial Vehicle Dealer Digest, ACT Research reported a slightly raised 2022 GDP forecast despite current economic activity, but analysts continue to expect a decline in 2023. According to Kenny Vieth, president and senior analyst, ACT, the Federal Reserve will continue to aggressively raise interest rates so long as inflation remains

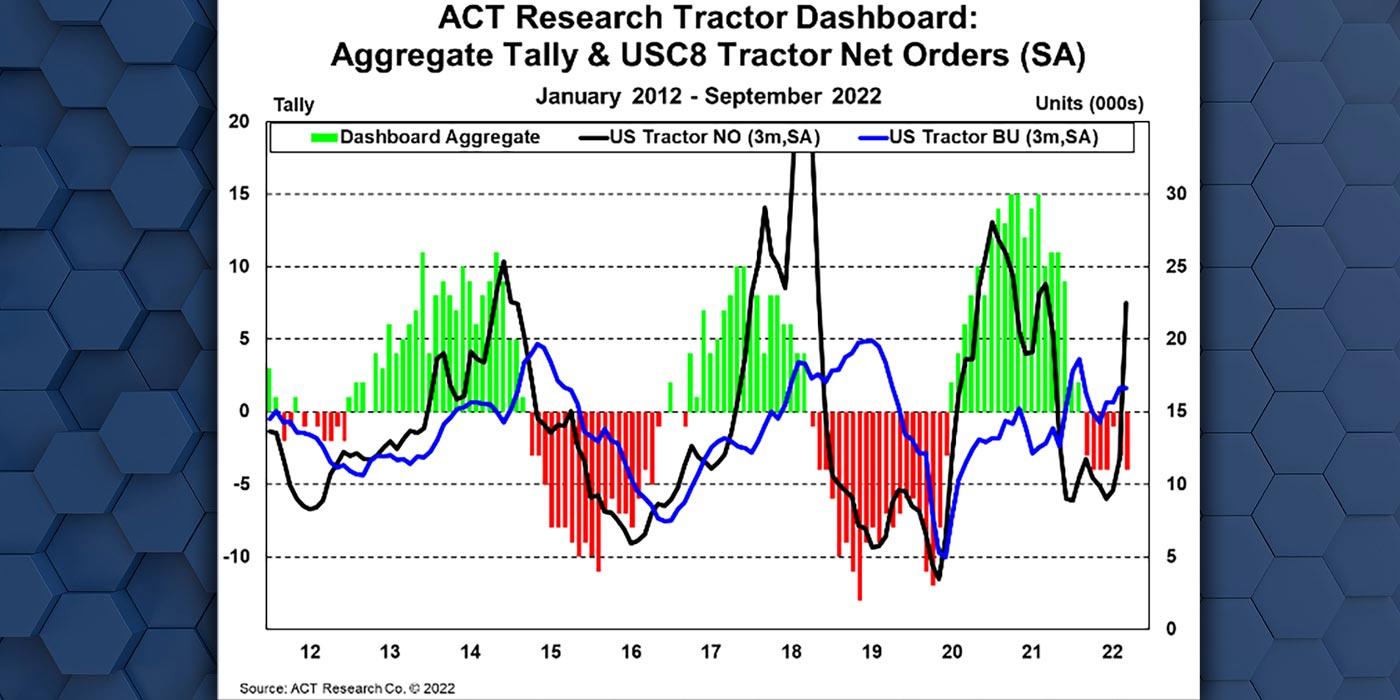

Class 8 Tractor Dashboard drops sixth time in seven-month period

According to ACT Research’s recently released Transportation Digest, the top line on the Class 8 Tractor Dashboard slipped in September to a -4 reading, the sixth moderately downbeat reading in seven months. “We think the Dashboard readings suggest a better outcome for Class 8 than was the case in the last two downturns (COVID 2020 and

What’s ahead for trucking market in 2023

Christmas came early everyone! It’s our annual conversation with ACT Research President and Senior Analyst Kenny Vieth in which we unpack what happened in the trucking market this year, take stock of how close the market predictions were last year and take a look ahead at what’s coming down the road in Q1 of 2023

Spot rates further below costs than ever before

ACT Research released the latest installment of the ACT Freight Forecast, U.S. Rate and Volume OUTLOOK report. The monthly 56-page ACT Freight Forecast report provides forecasts through 2024 for volumes and contract rates for the truckload, less-than-truckload, and intermodal sectors of the transportation industry, including the Cass Shipments Index and Cass Truckload Linehaul Index. For the truckload spot market,

October trailer orders jump as 2023 orderboards open more fully

Preliminary reports show net trailer orders in October were 46,750 units, up 82% from September, and 168% higher than the same month last year. Final October results will be available later this month. This preliminary market estimate should be within +/-5% of the final order tally, according to ACT Research. “With more 2023 orderboards opening,

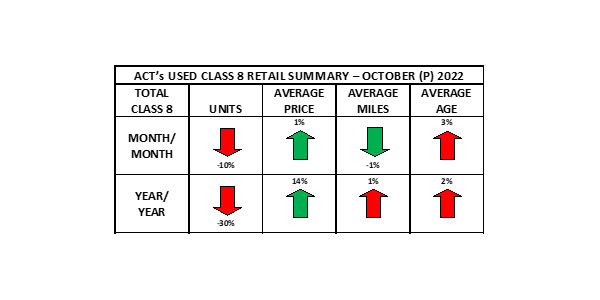

October US used truck average retail sales price defied expectations

Preliminary used Class 8 retail volumes (same dealer sales) decreased 10% month-over-month, and were 30% lower compared to October of 2021, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research. Other data released in ACT’s preliminary report included month-over-month comparisons for October 2022, which showed

October Class 8 orders continue at robust levels

Preliminary NA Class 8 net orders in October were 42,500 units, while NA Classes 5-7 net orders were 23,400 units. Complete industry data for October, including final order numbers, will be published by ACT Research in mid-November. “The strength in orders reflects, one, OEMs having opened their orderboards for 2023 more broadly, and, two, ongoing