Trailer production rises in May

Facilitated by the additional build days, total trailer production was up 12% sequentially in May, and was 2% better than last year, according to ACT Research Co. “The majority of the May increase resulted from two more days in the schedule, although an increase in daily build rates also contributed,” said Frank Maly, director of

Trailer orders begin seasonal decline but outperform last year

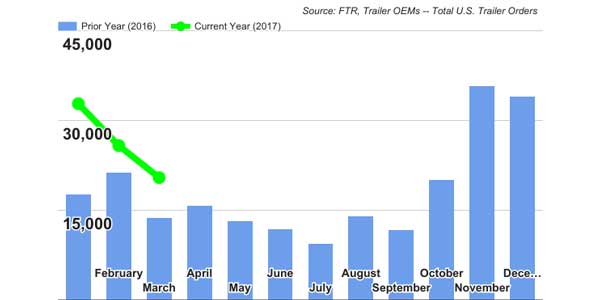

According to the numbers from FTR, net trailer orders in May came in at 16,600 units, down 17% month-over-month but up 26% versus a year ago. May trailer orders started the typical seasonal decline after two months of stronger than expected activity, FTR says. Most segments experienced m/m reductions, except for liquid tanks and lowbeds, each

ACT Research: New truck equipment purchase intentions at their highest

The latest release of ACT Research Co.’s For-Hire Trucking Index indicated that May’s purchase intentions for new truck equipment remained elevated, with 61% of responding fleets planning equipment investments in the next three months. This marked the strongest three-month reading since the third quarter of 2014. Following April’s slowing growth, the volume reading advanced for

Used Class 8 truck sales decline in April, up 1% year-over-year

Class 8 same dealer used truck sales volumes dropped in April, breaking a three-month run of double-digit gains, according to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks by ACT Research. Total volumes for the dealers in ACT’s sample continue to show modest improvement for long-term comparisons. “All three

Preliminary truck order numbers decline in May

According to both FTR and ACT Research Co., preliminary numbers show a decline in Class 8 truck orders in May. FTR’s numbers show Class 8 net orders for May at 16,300 units, retreating after a long, steady streak that had begun in October 2016. May order activity was below expectations, falling 31% under April. In

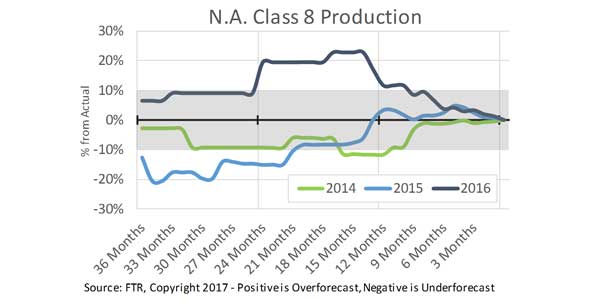

FTR releases Commercial Vehicle Forecast Accuracy Report

FTR has finalized truck and trailer builds for 2016 and completed its annual CV Forecast Accuracy Report. The report details the accuracy of FTR’s 2016 commercial vehicle forecasts from January 2014 through December 2016 and covers Class 8 trucks, commercial trailers and Class 4-7 (medium-duty) trucks. The analysis also shows the accuracy results of the

Trailer orders up year-over-year, down month-over-month

According to the numbers from FTR, final April net trailer orders came in at 20,000 units, down 4% month-over-month but up 26% versus a year ago. April trailer order activity continued the strong year-over-year comparisons, with orders holding steady from March. Fleets are continuing to place orders for second-half 2017 delivery with dealer orders also brisk for

Preliminary heavy-duty orders steady, medium-duty orders down

According to data from FTR, preliminary Class 8 truck net orders for April measured at 23,600 units, maintaining the steady track that started seven months ago. While OEM activity was modestly better for some and down marginally for others month over month, April orders met expectations with a 4% increase over March and up 77%

Trailer orders for March up 50% over last year

According to FTR’s data, final March net trailer orders came in at 20,500 units, down 20% month-over-month but up 50% versus a year ago. The drop-off from February for both dry and refrigerated vans is simply due to the start of a typical seasonal decline for trailer orders, and the strong year-over-year comparison reflecting a positive

Preliminary numbers show Class 8 orders up year-over-year

According to preliminary numbers from FTR, Class 8 net orders for March came in at 22,800 units, slightly above FTR’s expectations and much higher than a year ago for the third consecutive month. March orders were basically flat month-over-month and up 41% year-over-year. Backlogs are now close to where they were a year ago, and production

Preliminary numbers have medium-duty orders up, heavy-duty orders flat in March

According to preliminary Classes 5-8 data for March from ACT Research Co., trucking industry net orders rose to a sixteen-month high, 47,300 units. That aggregate volume represents a 19% improvement compared to last March. North American Class 8 net orders fell 100 units from February to 23,100 units. With a nominal, but positive, seasonal factor,

Used truck sales improve in February

Used Class 8 truck same dealer sales volumes improved for a second consecutive month in February, according to ACT Research. The average price of used Class 8 trucks fell month-over-month in February and year-over-year. Year-to-date, values are down compared to the same period in 2016, ACT found. “Total volumes were also higher year-over-year compared to