Trailer orders surge in November

According to the numbers from ACT Research Co., new and net trailer orders surged in November, climbing 71% month-over-month—a growth driven mostly by dry van sales. “Dry vans were nearly equivalent to year-ago levels,” said Frank Maly, ACT’s director of commercial vehicle transportation analysis and research at ACT. “Even with that surge, total trailer orders

Class 8 orders improve in November

Class 8 net truck orders moved upward in November, following the weak, cancellation-heavy numbers reported last month, according to ACT Research Co. November new orders totaled 21,108 units, with the net at 19,440 units. “In addition to rising 40% from October, November marked the first positive year-over-year net order report in 22 months,” said Jim

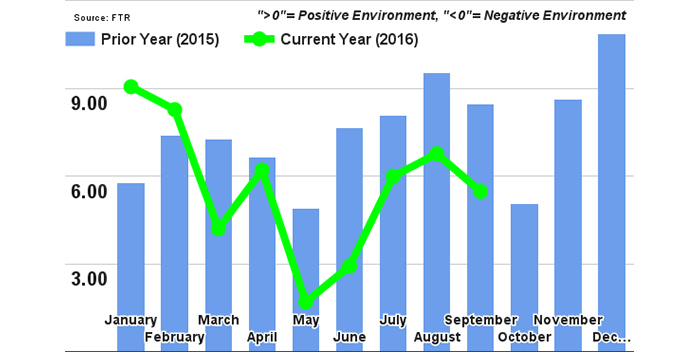

FTR’s Trucking Conditions Index dips ahead of expected market improvement

FTR’s Trucking Conditions Index (TCI) for October, at a reading of 2.84, continued the short-term pullback ahead of expected capacity tightening in 2017. While current readings are in low positive territory, the index remains on course to reflect improving conditions for carriers as capacity tightens from regulations being implemented. This will improve pricing and margins

Trailer orders beat expectations

FTR reports that final November net trailer orders came in at 35,800 units, beating FTR’s expectations by a wide margin. November orders were plus 78% month-over-month but 8% below last year; however, November 2015 trailer orders were exceedingly strong. Dry van orders lead the way in November, with particularly robust order intake. Trailer orders have

September FTR Shippers Conditions Index falls

FTR’s Shippers Conditions Index (SCI) moved back into negative territory, falling three points from August to a -2.4 reading in September. The August positive reading was not expected by FTR to last, and in September, the slow but steady build in regulatory drag moved the index back into negative territory that will not reach its

Heavy-duty orders up, medium-duty orders down in November

For the month of November, preliminary Classes 5-8 order data from ACT Research Co. shows that the industry booked 36,600 net orders. “Class 8 net orders rebounded to 19,500 units for the month,” said Kenny Vieth, ACT’s president and senior analyst. “This follows cancellation-impacted October net orders of 13,900 units. But for cancellations, Class 8

November preliminary truck orders rise

According to FTR’s preliminary Class 8 net order numbers for November, orders came in at 19,300 units, up 41% month-over-month. This was right in line with the FTR forecast, and represents the market making a return to tracking normal cycles. Class 8 backlogs are expected to increase for the first time in ten months. Including November, Class

FTR’s Trucking Conditions Index for September reflects modest market tightening

FTR’s Trucking Conditions Index (TCI) for September at a reading of 5.47 retreated somewhat from August. However, the overall positive trend in the index reflects the modest tightening in capacity as additional regulations take effect in 2017. This expected drag on capacity should improve pricing and margins for carriers through the end of next year.

October Class 8 orders weak, according to ACT Research

Class 8 net orders continued to move sideways for the third consecutive month in October at 13,907 units. Seasonally adjusted, October’s orders were weak at 12,060 units, according to the numbers from ACT Research Co. “The driving factor behind the weak net orders number was an unusually high level of cancellations booked in the month

October trailer orders up month-over-month, down year-over-year

According to FTR data, final October net trailer orders came in at 20,200 units, up 72% month-over-month but down 38% year-over-year—meeting FTR’s expectations. Although dry van orders in October were the highest in ten months, they were significantly below the robust numbers that came in during the same month in 2015. Backlogs dipped 3% and

Used truck sales fall in September

Used Class 8 truck same dealer truck sales fell 11% month-over-month in September. The drop reversed a growth trend that started in February, according to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research. The average price of used Class 8 trucks rose 1% month-over-month while

Retail sales of natural gas-fueled heavy-duty trucks down YTD

According to the numbers from ACT Research Co., U.S. and Canadian natural gas (NG) Class 8 truck retail sales declined in the June to August period. Year-to-date (YTD) sales through August continued to lose ground, falling 29% behind last year’s comparable level from a reading of 25% lower for year-to-date May, as reported last quarter.