Class 8 demand down year-over-year; medium-duty sales slow but steady

For February, 39,500 Classes 5-8 vehicle orders were booked: Class 8 garnered 17,900 orders and Classes 5-7 totaled 21,600 orders booked, according to preliminary numbers from ACT Research Co. “Orders for commercial vehicles in February largely mirrored the ongoing U.S. economic narrative,” said Kenny Vieth, ACT’s president and senior analyst. “Healthy consumer-related indicators, such as disposable

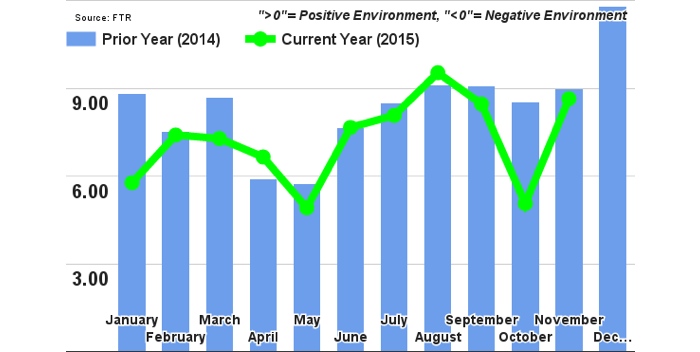

FTR forecasts placid conditions for trucking companies

FTR’s Trucking Conditions Index (TCI) measure for December rose more than two points to a reading of 10.88. FTR’s forecast is that 2016 will be a year of placid conditions for trucking companies, with little or no change in the current trend of tight, but adequate, capacity. Two events could impact capacity utilization and possibly,

FTR reports year-over-year decline in January trailer orders

FTR reports U.S. Trailer net orders for January at 17,900 units, a 30% decline from December and 37% below a year ago. Despite this, orders met FTR expectations for a fall off in activity after four consecutive months of strong trailer orders. Much of the decline was due to a lack of dry van orders, which

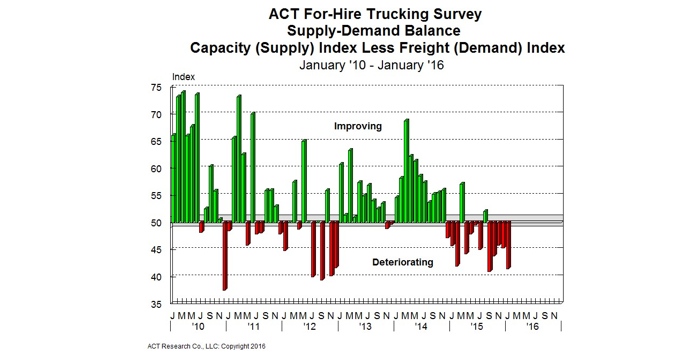

Class 8 supply rises faster than demand for fifth straight month

The supply of Class 8 trucks continues to rise faster than demand for trucks according to ACT Research’s For-Hire Trucking Index from ACT Research Co. “The capacity index [supply] rose faster than the freight index [demand] for the class 8 supply and the eleventh time in the past thirteen months in January,” said Steve Tam,

FTR says 2016 ‘not looking to be a strong year’ as Class 8 orders fall

FTR has released preliminary data showing that January 2016 North American Class 8 truck net orders slipping back to 18,062 units, down 35% month-over-month and 48% year-over-year. Net Class 8 orders for five of the last eight months were below 20,000 with a monthly average for the period of 21,200 units. Since September order activity has

Commercial vehicle demand weakens as Jan. orders stumble out of the gate

ACT Research Co. sounded off on January order numbers, noting that Class 5-8 booked a total of 36,400 vehicles. At 18,200 units in January, NA Class 8 net orders were down 48% against a tough January 2015 comparison. January volume was off 35% versus a better than expected December, making January’s orders the second lowest intake

FTR Shippers Conditions Index remains neutral

FTR’s Shippers Conditions Index (SCI) for November continued in near-neutral territory at -0.6, reflecting mild market conditions. The index will head into a moderately negative range later in 2016 as expectations for a tight capacity environment in 2017 begin to take hold. Shipping costs are currently being positively impacted by lower fuel costs that are

Truck orders end 2015 on a high note

Class 8 booked 28,150 net new orders in December, while Classes 5-7 posted 22,450 net orders, according to the numbers from ACT Research Co.’s latest State of the Industry report. “The U.S. Class 8 sleeper tractor segment had its best production and sales year in history,” noted Steve Tam, ACT’s vice president for the commercial vehicle sector.

Sales of natural gas fueled heavy-duty trucks down in 2015

U.S. and Canadian natural gas (NG) Class 8 truck retail sales started 2015 with slow growth and are ending the year in the same fashion, according to a recent report from ACT Research. The “Natural Gas Quarterly” attributes this to the continuing decline of diesel prices, making the return on investment for adopting of natural

2015 was the best shipment year in history for the U.S. trailer industry

According to the latest numbers from ACT Research Co., 2015 was the trailer industry’s best shipment year in history, edging out the previous record set in 1999. “Despite trailer net orders in December falling 31% month-over-month and 38% year-over-year, the solid order season continues for this segment of the commercial vehicle industry,” said Frank Maly,

Trailer orders fall in December

FTR reports that U.S. Trailer net orders for December were 25,500, with full year 2015 totaling 313,000 units. December trailer orders, even with -35% month-over-month and -43% year-over-year comparisons, met FTR’s expectations that orders would fall back into a more reasonable range after the robust activity in November 2015. FTR’s numbers also found that dry van orders

FTR Shippers Conditions Index on the decline

FTR’s Shippers Conditions Index (SCI) for October declined from the previous month to a reading of -3.1. According to FTR, the SCI will fall further in 2016 with truck freight forecasted to grow at a robust 3.6%. Shippers will ultimately be negatively affected by tight capacity in the second half of 2016. The Shippers Conditions