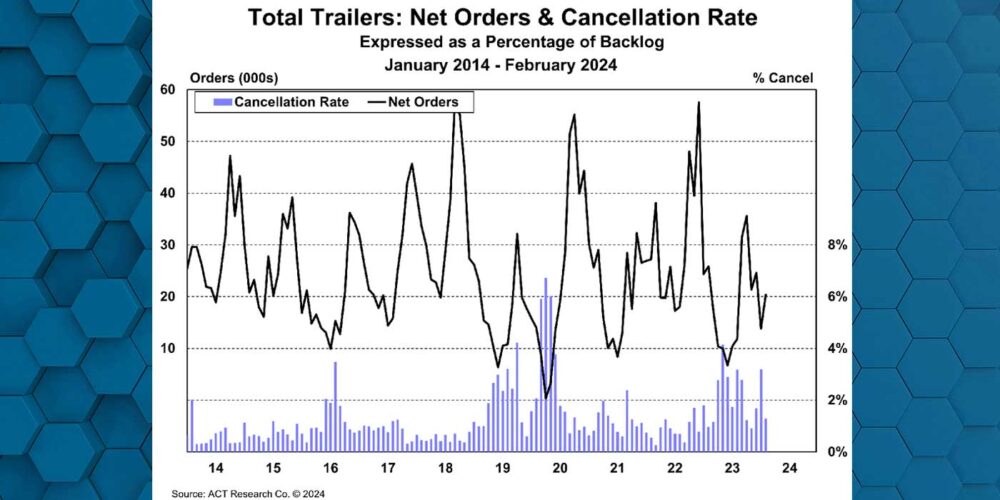

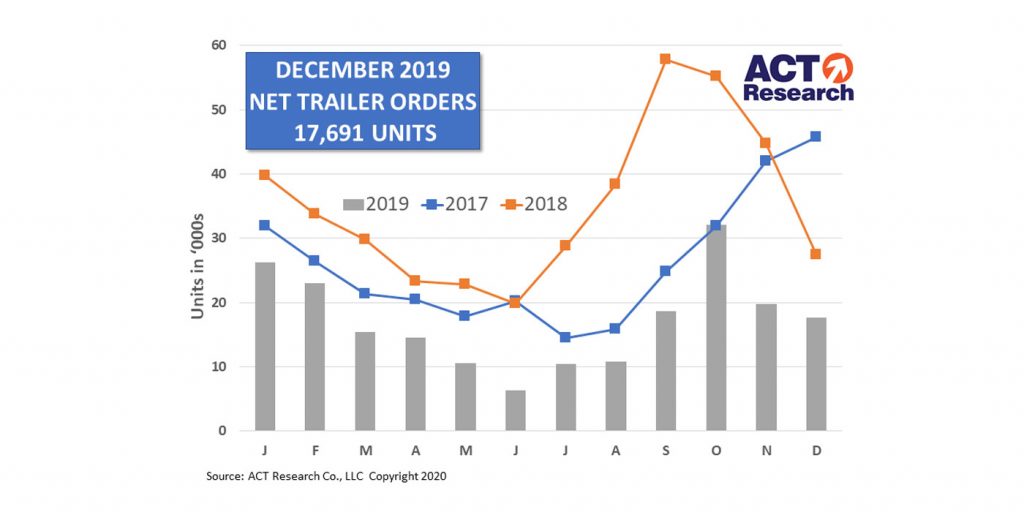

New U.S. trailer orders of 18,400 were down 13% month-over-month in December, and after accounting for cancellations, net orders of 17.7k dropped 11%, according to the latest numbers from ACT Research.

Longer-term comparisons show net orders down 35% year-over-year and 51% lower compared to full-year 2018, ACT found.

“While seven of the ten major trailer categories posted month-over-month gains, the sequential 32% drop in dry van orders was significant enough to pull the total industry results into the red,” said Frank Maly, director of CV transportation analysis and research at ACT Research. “Continued softness in both freight volumes and rates are generating financial headwinds for fleets, and as a result, their investment plans continue to be extremely cautious.”

Maly continued, “Fleets are aware that, as a result of weaker OEM orderboards, lead times are dramatically shorter than this time last year, so any orders placed now are likely to be delivered in a much more acceptable timeframe. It is also likely that pricing will be more advantageous.”