With industry challenges such as driver shortages and high levels of equipment utilization, efficiently managing trailers is more critical than ever. Real-time visibility into the location and status of assets has a direct impact on improving productivity and efficiency, and in lowering costs.

Recently, Fleet Equipment asked a panel of experts to weigh in on several considerations about trailer tracking technology. The companies and panelists included:

- Omnitracs: Andrew Hicks, lead product manager for asset management

- Orbcomm: Sue Rutherford, global vice president of marketing

- Peterson Mfg. Co.: Allyn Leake, corporate director of heavy-duty sales

- Phillips Connect Technologies: Gerry Mead, executive director of innovation

- Sierra Wireless: Benoit Tournier, director of marketing for transportation

- SkyBitz: Henry Popplewell, president

- Spireon: Reza Hemmati, vice president of product management

- Truck-Lite: Andrew Liuzzo, marketing communications specialist

What are the major considerations fleets should have when choosing a trailer tracking solution?

Liuzzo: Fleet managers should fully assess their areas of need and consider which option can best optimize their fleet’s performance. The best solution will be able to seamlessly adapt to a fleet’s operation while offering ease of both installation and use.

Leake: Look for systems that leverage existing equipment and industry protocols and use readily available, accepted and reliable communication technology. This not only ensures long-term systems compatibility and component availability but also increases the likelihood of getting a system that is robust and ready to go from the start.

Mead: Data from the system should support business process improvements. The technology also needs to have maintenance and safety benefits such as the ability to send condition reports and prescriptive conditional alerts. A trailer tracking system must improve overall fleet efficiencies and aid drivers in making better use of their available hours of service. Finally, any system must integrate into current back office systems to exchange data that will produce better results for the operation.

Popplewell: There are many considerations for choosing a trailer tracking solution, such as power sources and reliability of hardware, installation of the device and actionable data. It’s equally important to make sure the company you’re partnering with understands your business goals and is committed to your success while using their product.

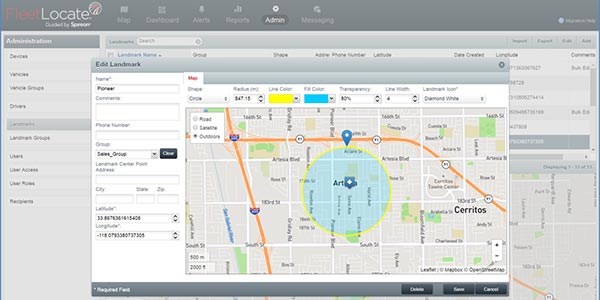

Rutherford: Fleets need to look at a solution that will grow and easily adapt as their requirements change and trailer tracking solutions should be able to easily deliver data directly to an existing application without having to use another platform. It’s all about making data readily available to fleets when and where they need it.

Tournier: When choosing a trailer tracking solution, fleet operators should ensure that their solution can evolve to monitor more things in the trailer or track different types of trailers in the future. A scalable solution should be able to orchestrate data from sensors and define rules to trigger alerts depending on sensors and trailer use cases. Fleet operators should consider all the possible applications for their solution today and the level of flexibility they could require for the future.

Hemmati: The solution should provide more than just the location of the fleet, but also insight into the fleet’s operation to increase efficiency and profitability. For example, the ability to monitor trailer location, duration within landmarks, and cargo status can reduce driver idle time and correctly assess detention billing.

Hicks: Fleets should ensure that the features provided by the system—not just the devices themselves but also the data points captured—can be integrated into meaningful insights about how the fleet operates. Make sure there is a plan on how to use trailer tracking across the organization, and make sure your trailer tracking provider is capable of delivering information to end users when and where they need it in a form that is actionable.

What industry, equipment and operational needs are leading to new trailer tracking system designs and features?

Hicks: New technology for detecting loaded percentages in less-than-truckload trailers is making tracking more viable for those assets. Using connectivity between tractors, trailers and back office systems we can expand on the utility of trailer data for drivers, dock personnel, equipment managers, and other stakeholders.

Hemmati: Customers have been looking for more accurate trailer cargo status data to support their detention billing invoices and minimize trailer idle time. However, previous cargo sensors typically leveraged ultrasonic technology, which has been proven undependable in common transportation use cases and especially for certain cargo types. New cargo sensors that employ a combination of time-of-flight sensor and optical imaging data, along with machine learning algorithms, can provide unprecedented cargo status accuracy, regardless of environmental conditions and cargo types.

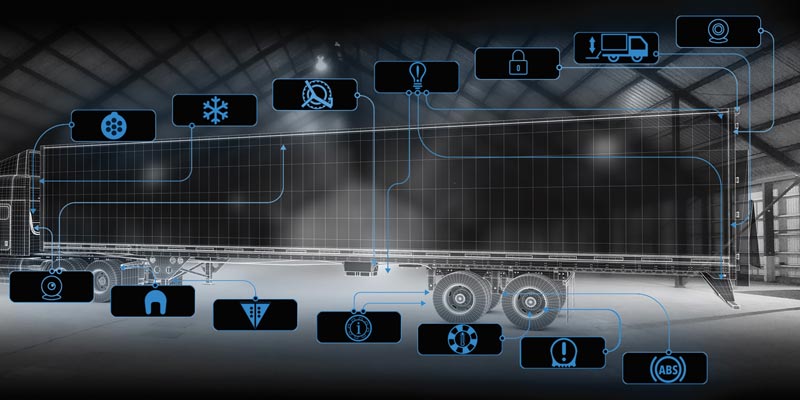

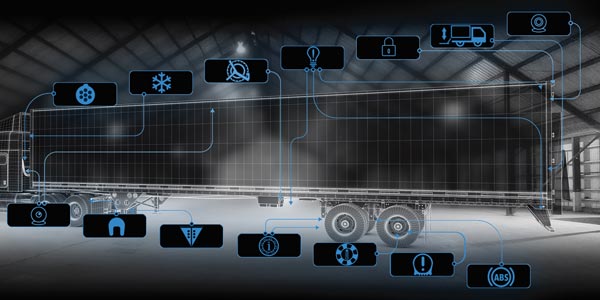

Rutherford: With the evolution of sensor and wireless technologies and the desire among fleets to get more from their providers, solutions now expand well beyond GPS location reporting and incorporate sophisticated wired and wireless sensors capable of collecting data on trailer load and door status, tractor-trailer pairings, and more. These new solutions seamlessly integrate with the truck and driver to enable management of driving hours, compliance with driving-time regulations, and to improve safety.

Tournier: New scalable solutions should be able to orchestrate data from sensors, configure different types of devices, attach to the most appropriate mobile networks and distribute processing to optimize operating costs and power consumption.

Popplewell: Solar-powered solutions are the gateway to the next generation of trailer intelligence. The operational and vehicle maintenance benefits that are realized through sensor deployment will also cut costs.

Liuzzo: More sophisticated smart devices are constantly added to provide data to help users better monitor and maintain their assets. In order to use this data to improve their operation, fleets will depend on agnostic networks that can consolidate and display diagnostic data from smart devices. A system’s hardware itself must also adapt to a variety of trailer types.

Leake: Trailer tracking is all about reducing the time that vital information takes to reach the people who need to know it, whether it’s the driver or the fleet manager.

Mead: As smarter products and services hit the market, they are using a multitude of data points being sent from the trailer. Look for solutions to pain points such as driver satisfaction and retention, rising costs, violations and safety.

What future trailer tracking benefits can fleets expect to see?

Mead: Today’s information will be surpassed by a sensor-equipped, artificially intelligent, self-reporting trailer. If it can be sensed, it can be tracked, so smart enabled components will bring benefits to solve the industry’s issues and meet the demands of today and tomorrow.

Liuzzo: Fleets can expect to see an increase in connectivity among their trailers and trailer equipment.

Leake: Raw data from a tracking infrastructure will be leveraged to develop other capabilities we haven’t even considered yet, such as enhanced artificial intelligence methods of optimizing scheduling and payload distribution.

Popplewell: In the future, significant financial benefits will be delivered through sensors offering trailer intelligence that will allow operators to lower maintenance costs and predict over the road failures.

Tournier: In the near future, we expect to see advances like low power wide area (LPWA) networking technologies and distributed data orchestration solutions. LPWA technologies deliver cost, power and data consumption savings, and improved coverage in rural areas, giving fleets better visibility into assets. Distributed data orchestration solutions will allow fleets to remotely update, dynamically configure and easily change a device’s capabilities.

Hicks: Tighter integration of tractor and trailer systems will allow fleets to identify the optimal trailer for a driver’s next load, push navigation instructions to their mobile device, provide immediate notification of incorrect trailer hooks or maintenance issues, and automate inspection report entries to provide significant reductions in the amount of time spent on trailer-related tasks.

Hemmati: Fleets will be able to gather more advanced data points from trailer devices and integrated component sensors. These data points can be interpreted and processed with new machine learning and artificial intelligence technologies and presented using various tools that make the right insights available around business operations. Customers will be enabled with prescriptive and predictive insights that help them improve their fleet’s performance.

Rutherford: The growing appetite for more actionable data is driving the adoption of analytics and technologies such as AI and machine learning, which will make it possible for fleets to make accurate predictions and assumptions based on current and historical data patterns. This will be key in optimal business planning, anticipating and preparing for issues before they occur and making operational changes to optimize output and service delivery. We expect to see more open ecosystems and platforms, and providers becoming more hardware agnostic.

Check out the rest of the June digital edition of Fleet Equipment here.