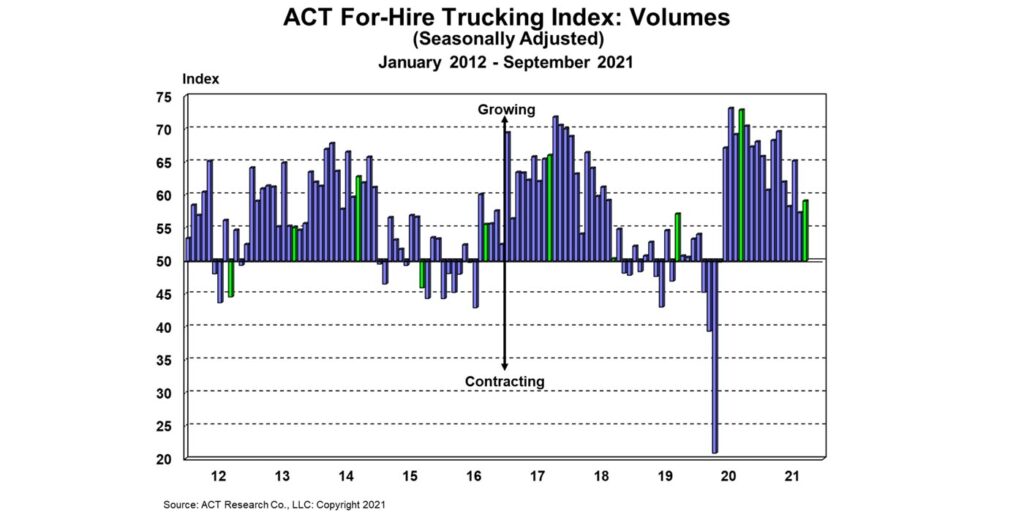

The latest data from ACT Research shows a stronger trucking market in September. The release of ACT’s For-Hire Trucking Index showed an increase in volumes, pricing, and capacity, with a lower but still-strong supply-demand balance. The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers.

“Although it increased in September, the Volume Index is still considerably below the 65.5 average of the past 12 months, due in large part to supply bottlenecks. In particular, chip and part shortages are hindering vehicle production, though peak holiday shipping is continuing to provide demand support,” said Tim Denoyer, vice president and senior analyst at ACT Research.

“Trucking markets remain very tight. Equipment supply-chain constraints also continue to limit capacity growth, and hiring and retention of new drivers will be key to the rate trajectory,” he continued. “While down from this year’s peak of 69.2 in April, the current reading still reflects a tight supply-demand environment. Class 8 retail sales are constrained by tight inventories and unmet production demand due to parts shortages, slowing the recovery in equipment capacity. With some structural driver issues likely to outlast the pandemic and a generally positive freight outlook, we do not expect the market to loosen quickly.”