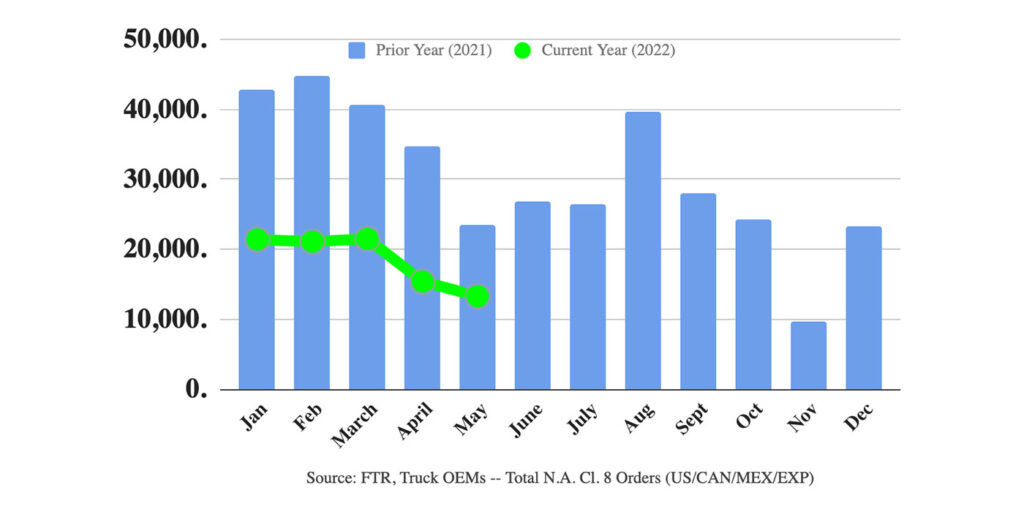

FTR reports preliminary North American Class 8 net orders dipped in May to the lowest total since November 2021 at 13,300 units. May order activity was down 13% m/m and down 43% y/y. Class 8 orders have totaled 270,000 units over the last twelve months.

OEMs are quickly running out of build slots for 2022 and with production still constrained by the supply chain, especially semiconductors, they cannot increase build rates this year. OEMs are not booking many orders for 2023 because the cost of commodities and other components are inflated and variable, making accurate quoting difficult.

“The supply chain was making slight improvements in the last few months, but some of that progress stalled due to disruptions in China and Russia,” said Don Ake, vice president of commercial vehicles, FTR. “The OEMs are not confident they can increase production in the second half of the year; therefore, they are not able to take more orders.

“Demand for new trucks remains healthy. Freight is growing and fleets need more trucks to keep up with customer demands and to trade in older vehicles. The supply of new trucks has been running way behind demand for over a year now and many fleets need to catch up to their replacement cycles.

“This is like ticket sales for a popular concert. At the beginning, sales are high because there are plenty of seats available. But at the end, fewer tickets are sold because there are fewer seats to sell. There just aren’t many build slots still open in 2022. Orders could even slide under 10,000 in the summer months before the cycle begins for next year.”

Final data for May will be available from FTR later in the month as part of its North American Commercial Truck and Trailer Outlook service.