According to the numbers from both ACT Research and FTR, medium- and heavy-duty truck orders saw a rebound in June.

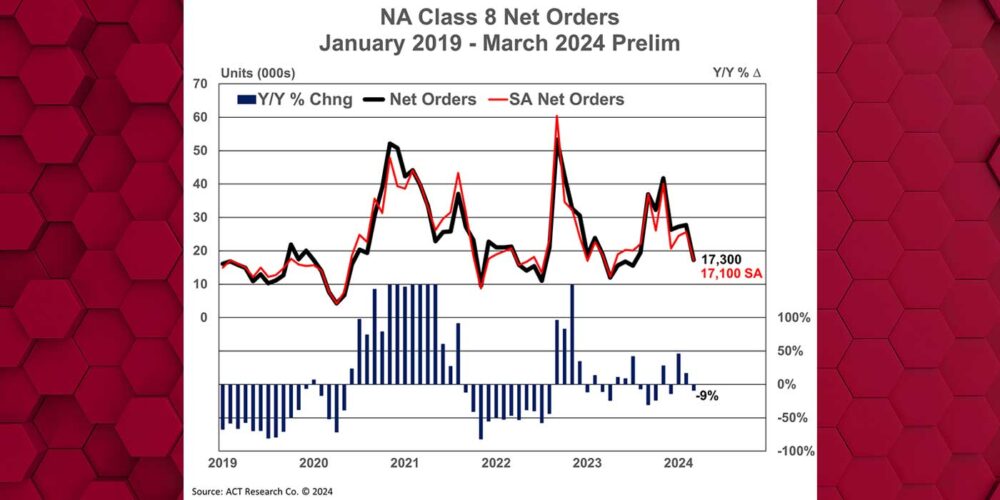

ACT Research reports that preliminary North American Class 8 net orders in June were 16,000 units, rising 139% from May, and up 23% from a year-ago comparison. FTR reported preliminary numbers at 15,500 units.

The NA Classes 5-7 market saw orders improve 77% month-over-month, ACT says, despite being down 20% from the year-ago June volume.

“Preliminary data show that June orders for medium and heavy-duty vehicles jumped to a four-month high, rising above the combined April and May order tally,” said Kenny Vieth, ACT’s president and senior analyst. “On the back of a rapid improvement in freight rates over the course of May and June, North American Class 8 net orders spiked in June and were up against an easy year-ago comparison, when orders were under pressure from still large backlogs and rising equipment overcapacity. June is typically a slower order month, so seasonal adjustment augments the rebound.”

Regarding the medium-duty market, Vieth said, “Preliminary data here also show a four-month high and seasonal adjustment provides a lift to June’s Classes 5-7 orders.”

FTR says fleets’ confidence is improving gradually as the economy and freight markets recover from the pandemic-related restrictions. The June order volume may not be sustainable in July, FTR notes, because some of the larger fleet orders may be difficult to replicate in the short term. Order volume should exceed the 10,000-unit mark throughout the summer as freight volumes continue to improve.

“June’s order activity is good news, after last month’s disappointing number,” Don Ake, FTR’s vice president commercial vehicles, said. “We expected orders to average around 10,000 units for a few months, and now they have averaged 11,000 for the past two months. The Class 8 market is on the slow, steady recovery that matches our forecast. It is also encouraging that fleets are showing enough confidence in the economy to begin placing some viable orders. The trend should continue, but a significant increase is not expected until October when the big fleets begin placing orders for 2021 delivery.

“The great thing about the order improvement in June is that it should permit OEMs to continue to produce at a steady, but still reduced rate, for a couple of months. However, some of the OEMs need higher order volumes in July to keep the industry moving out of the mire caused by the virus.”