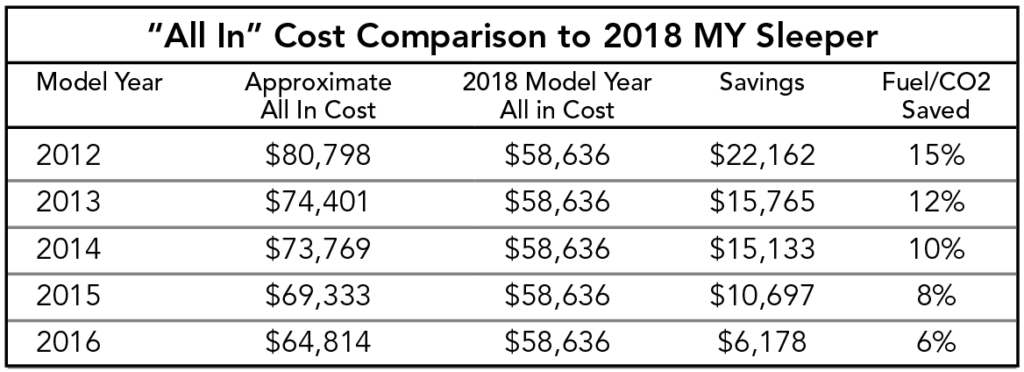

Fleet Advantage, a truck fleet business analytics, equipment financing and lifecycle cost management company, released its 2017 Truck Lifecycle Data Index (TLDI) comparing all-in operating costs of early-model Class 8 trucks to 2018 model year (MY) replacements. The TLDI shows significant cost savings when replacing older-model vehicles with 2018 MY trucks.

Working from Fleet Advantage’s Advanced Truck Lifecycle Administrative Analytics Software (ATLAAS), the TLDI shows that fleet operators can realize a first-year per-truck savings of $22,162 when upgrading from a 2012 sleeper MY truck to a 2018 MY, a 17% increase in savings compared with year-ago figures ($19,023) for 2017 model-year upgrades.

A significant portion of these savings can be found in the maintenance costs, Fleet Advantage reported, in addition to the 15% fuel economy improvement—especially considering that the U.S. average retail price of diesel currently sits at $2.915 per gallon, the highest mark in more than two years and 35 cents higher than a year ago.

“Maintenance and repair [M&R] costs increase drastically in years five to eight-—about three and a half times higher than years one through four,” said Michael Spence, senior vice president of fleet services at Fleet Advantage. “When analyzing M&R in the Fleet Advantage Truck Lifecycle Data Index, the M&R cost of a 2012 MY sleeper is $17,315. When comparing this to M&R cost of $1,820 for 2018 MY, that’s more than a $15,000 difference.”

Big ticket maintenance items, according to Spence, include:

- Equipment issues combined with warranty expiration—emissions issues such as DPF cleaning or replacement; failing engine components; and brake issues in which costs jump significantly at 250,000 miles.

- Unforeseen breakdowns.

- Lack of follow-up repairs.

- Tire wear.

“The age of the asset also impacts the spare factor significantly,” Spence said. “The older the truck, the repairs become more complex and require more time to fix. Therefore, more spares per vehicle are required to sustain operation. The big savings are in changing your asset lifecycle model and moving away from older vehicles, which are quite expensive to run, to new models, which essentially reset your maintenance costs per mile.”

A longer-term lifecycle of a vehicle means organizations have more unpredictable costs—maintenance, fuel expenditure, repair, etc.—whereas a shorter lifecycle of two trucks equaling the same time frame may result in a slight increase in the initial fixed cost (interest rate, lease payment, etc.) due to the market price of the second asset, but is less expensive over time.

“I think you’re beginning to see greater buy-in on the benefit data and analytics can have not only in operating a fleet of trucks, but in the analysis of this data in order to make better, more profitable decisions for the greater fleet,” Spence said. “Even though data is more readily available to the fleet executive through the use of onboard computers and now ELDs, our feedback from fleets has been that they wish to remain focused on their core competency, which is customer satisfaction, logistics, routing, supply chain, etc.

“These organizations may be in position to obtain more data from their trucks, but they rely on third parties such as Fleet Advantage to be able to run their data against historical patterns in an effort to make better decisions.”