It’s no secret that your trucks are streaming data from their on-board computers every second that they are on the road. Everything from the time spent in top gear to the time spent in cruise control is spilling off your truck, leaving a breadcrumb trail of insight that can lead your fleet to improved fuel economy.

Chances are you’re not using the data from your numerous trucks to lessen the number of diesel gallons guzzled. That’s not just editor’s intuition—a recent report from Fleet Advantage stated that while 70% of industry professionals regularly monitor OBC data for driver logs and dispatching only 6% utilize it to gain insight on fuel consumption. Six percent. That was out of a 2,000 fleet sample size.

To find out why so many fleets aren’t capitalizing on the power of OBC data, I caught up with Jim Griffin, chief technology officer and chief operations officer at Fleet Advantage.

“Use of OBCs is really about running the business every day, traditionally,” Griffin explained. “Fleets are worried about their service-level agreements for on-time deliveries. They are worried about logistics. They’re worried about their hours of service and driver management, routing and dispatching; all those sort of functions that run their business day-to-day. Those are a real challenge in today’s industry.”

In the Fleet Advantage survey, 100% of survey respondents said that their OBC data assists with managing overall fleet operating performance to lower costs. The focus, however, was clearly on freight logistics as opposed to equipment efficiency. From Griffin’s point of view, the challenge comes in how the data is viewed and quantified. The survey discovered that 33% of respondents cannot quantify operational savings using OBC reporting. Of the remaining respondents, 10% report annual savings of $4,000 per vehicle or greater; 10% reported savings of $2,000 to $3,000; 44% reported savings of $500 to $2,000; and 3% reported savings of $500 or less. Clearly there are significant savings to be had if a fleet can quantify what equipment data points will produce the most bang for the fuel efficiency buck when tracked and charted.

“The biggest impacting factor overall is lifecycle of the vehicle. After the three-year mark, our data analysis clearly shows that fuel economy begins to degrade,” Griffin said. “No matter how well you’re managing your drivers and how well the vehicle is driven, that’s just an effect of age and miles. And so the No. 1 factor is managing the lifecycle of the asset.”

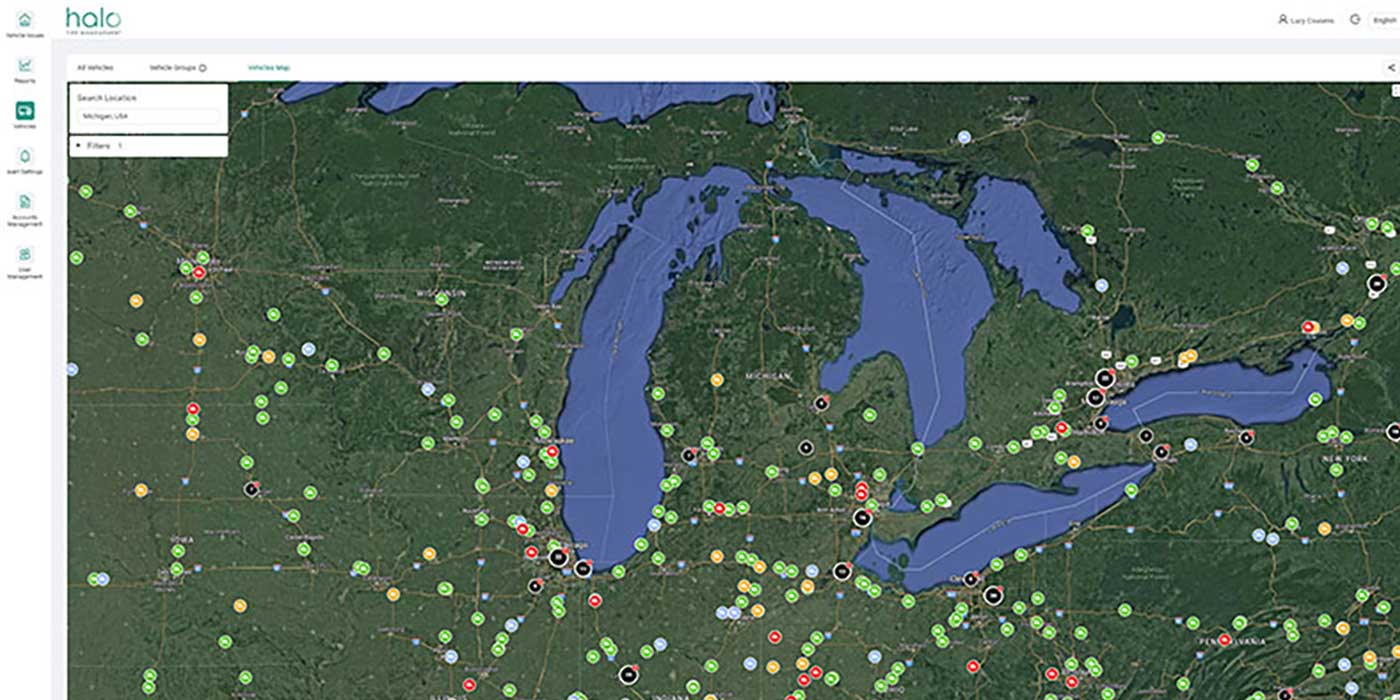

The importance of grouping your trucks is to ensure that you’re comparing data apples to data apples—a 2017 model year truck will benefit more from improved efficiency (when looking at operational performance) than a 2013 model year truck. Once you have your trucks properly categorized within the data, you can start focusing on operational data points. Griffin recommended starting with the following: Rapid accelerations; idle time; time spent in top gear; and percentage of time in cruise control.

“We have clients that build driver reward programs for achieving certain metrics with regards to those underlying factors,” Griffin said. “In the past, drivers weren’t hitting certain miles per gallon threshold. That’s a top-level number, which doesn’t tell you much. Today, with the data and with the business intelligence, we’re able to understand why drivers are not achieving it and are able to coach drivers and work with clients to achieve specific metric goals.”

Granted, proper driver training isn’t necessarily a fleet manager’s focus. On the other hand, you can spec the latest and greatest powertrains with fuel-saving features like adaptive cruise and neutral coast, and they won’t save your fleet a dime if drivers aren’t properly instructed as to how to operate the latest technologies. Additionally, by not tracking the operational data, you won’t have a specific example to point to when you’re asked why your new trucks aren’t achieving the expected MPGs.

So where do you start?

“What do you have control over?” Griffin countered. “If you’re a for-hire, over-the-road fleet, for example, then you’re going to expect a higher percentage time in cruise control. If you’re a local delivery, then the metrics are going to be a little bit different—your time in cruise control may not be that relevant because you may never actually be able to be in cruise control. You have to look at your business—look at your routes, the characteristics of your driving or of your deliveries—and decide what’s important and what’s manageable.”

“Manageable” is the key word. It’s easy to tumble down the data analytics hole and lose sight of the big picture. Start with one of the key metrics listed above and devise goals that help increase time spent in cruise.

Keep in mind that, once you start tracking specific data points, it will take time for your fleet to establish baseline trends by which you can compare the performance of your equipment. You can drill down as far as you like within the data, but Griffin recommends keeping it digestible: Take a look at the data every 30 days. Perhaps start on the first of the month to see how your trucks performed in the past 30 days and how that compares to the month before that. Before long, you’ll start to see how your equipment truly behaves on the road and can take the proper steps to improve its operational efficiency.

“One of the first things a fleet manager would look at is the average MPG per truck,” Griffin said. “A half of a mile per gallon savings on a truck that’s traveling 100,000 miles a year is going to save you between $3,000 and $5,000. That’s significant, when you apply that across the larger fleet of 50 or even 100-plus trucks. That becomes a significant savings, and that’s just looking at fuel economy alone.”

Those potential savings exist within your fleet right now. You just have to know what data to look at and what operational behaviors will help you lessen your equipment’s fuel consumption.