September trailer orders beat expectations

FTR reports that September 2015 U.S. Trailer net orders were 34,700, significantly above expectations. The order total for the month was 48% above August and improved 8% from a year ago. Trailer orders have now totaled 338,000 for the past 12 months. Dry van orders were very healthy, 11% higher year-over-year; refrigerated van orders were

Class 8 orders flat, Classes 5-7 rise in September

Class 8 booked 19,400 net new orders in September, while Classes 5-7 posted 22,000 net orders. These results were published in the latest State of the Industry report, recently released by ACT Research Co. The report covers Classes 5 through 8 vehicles for the North American market. Kenny Vieth, ACT’s President and Senior Analyst, noted that

How will GHG Phase II affect truck orders?

The U.S. Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) announced a joint standard in June of this year for fuel economy and greenhouse gas—the Phase II Greenhouse Gas (GHG) standards. The incoming standards will cover trucks from model year 2019 to 2027 and will have far-reaching effects in all phases

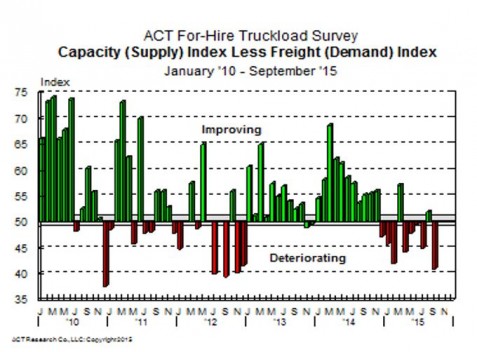

Class 8 truck supply rising faster than demand

The supply of Class 8 trucks continues to rise faster than demand for trucks according to the most recent ACT For-Hire Trucking Index from ACT Research Co., as seen in the graphic above. “The capacity index [supply] rose faster than the freight index [demand] for the 8th time in 10 months in September,” said Kenny

FTR: Class 8 order levels remain unchanged from August

FTR has released preliminary data showing September 2015 North American Class 8 truck net orders at 19,460 units, 0.4% below August. The September order activity met expectations albeit with a higher anticipated cancellation rate for the second month in a row. Base Class 8 order activity has been consistent for the past five months. September

Class 8 truck sales ticked up while Classes 5-7 take a hit

For the month of September, 40,700 Classes 5-8 vehicle orders were booked, up 7% from August but down 8% compared to September 2014, according to the latest numbers from ACT Research. “The year-over-year decline marked the sixth consecutive negative reading for Classes 5-8 orders,” said Kenny Vieth, ACT’s president and senior analyst. “While we continue to

FTR Shippers Conditions Index for July reflects benign conditions for shippers

FTR’s Shippers Conditions Index (SCI) for July, at a reading of -1.3, continues to reflect the short term stability of capacity utilization and steady fuel prices that are aiding shippers in containing costs. However, FTR expects the SCI to fall gradually during the balance of 2015 with a more severe negative downturn in 2016 due

FTR: August trailer orders were impressive

FTR reports that August 2015 U.S. Trailer net orders totaled 23,500 units, up 15% versus the previous month and up 1% from a year ago. Dry van and refrigerated van were the strongest segments, with very high totals for a typically slow summer month. U.S. trailer orders have now totaled 335,000 units over the past twelve

Fifth straight month of declining Class 5-8 net truck orders

For the month of August, 37,200 Classes 5-8 vehicle orders were booked, down 8% from July and down 14% compared to August 2014, according to ACT Research. (Note: these numbers are preliminary. Actual numbers will be published in mid-September). “The year-over-year decline marked the fifth consecutive negative reading for Classes 5-8 orders,” said Kenny Vieth,

Trailer orders decline month-over-month but rise year-over-year

Trailer net orders in July, at more than 20,300 units, declined 27% from the outlier 27,900-unit June pace, but still did rise 7% on a year-over-year basis, according to the most recent State of the Industry: U.S. Trailers published by ACT Research Co. “While total net orders were off 27% m/m, the majority of that decline

Class 8 used truck volumes flat in July

According to ACT Research’s latest State of the Industry report, used Class 8 truck metrics were generally in line from June to July, with average age and miles up an incremental 1% each. Compared to last year, average prices were up 2% in July and 6% year-to-date. “Used truck sales remain strong, but some downward

July trailer orders in line with expectations

FTR reports that July 2015 U.S. Trailer net orders were 20,400 units, 24% below the previous month but still a 13% improvement over a year ago. The month-over-month decline was particularly impacted by a drop in dry van orders following some large fleet orders placed in June. Although lower, dry van orders in July were