ACT Research predicts ‘year of transition’ as trailer orders fall in March

ACT says while softer order activity still meets expectations, net orders remain challenged by weak profitability for for-hire truckers.

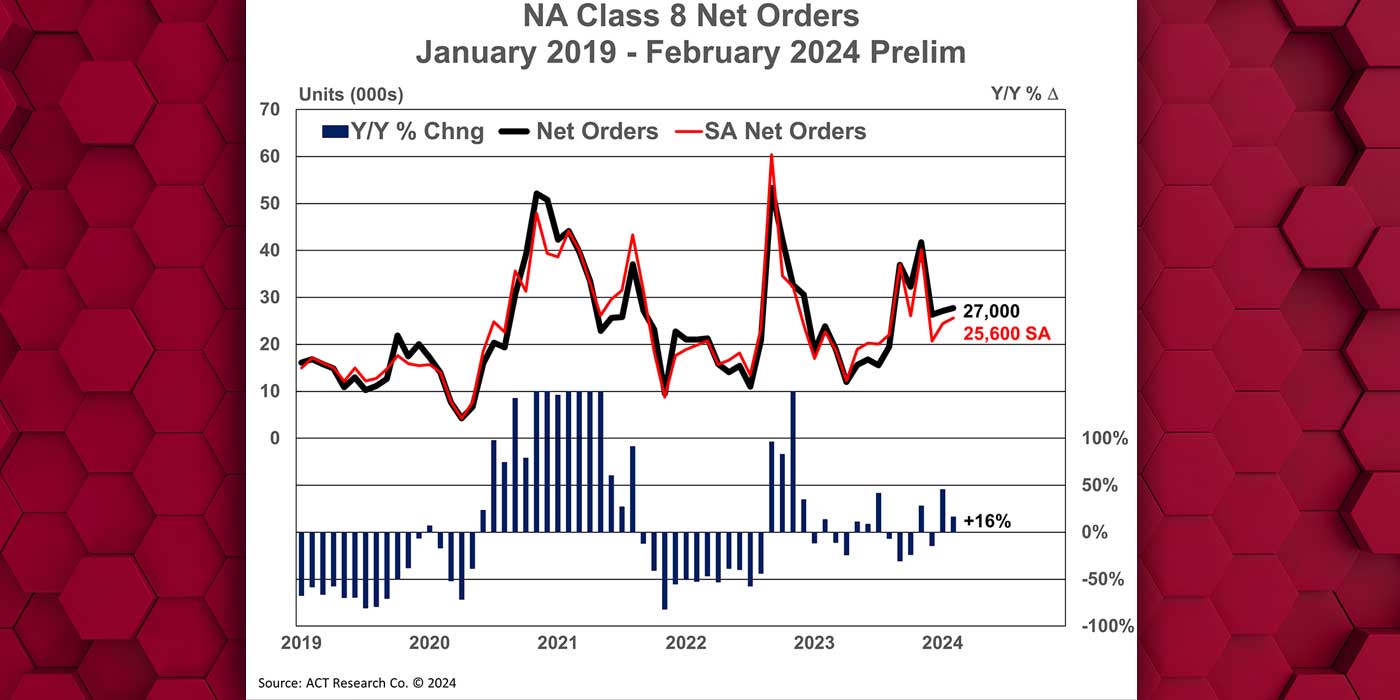

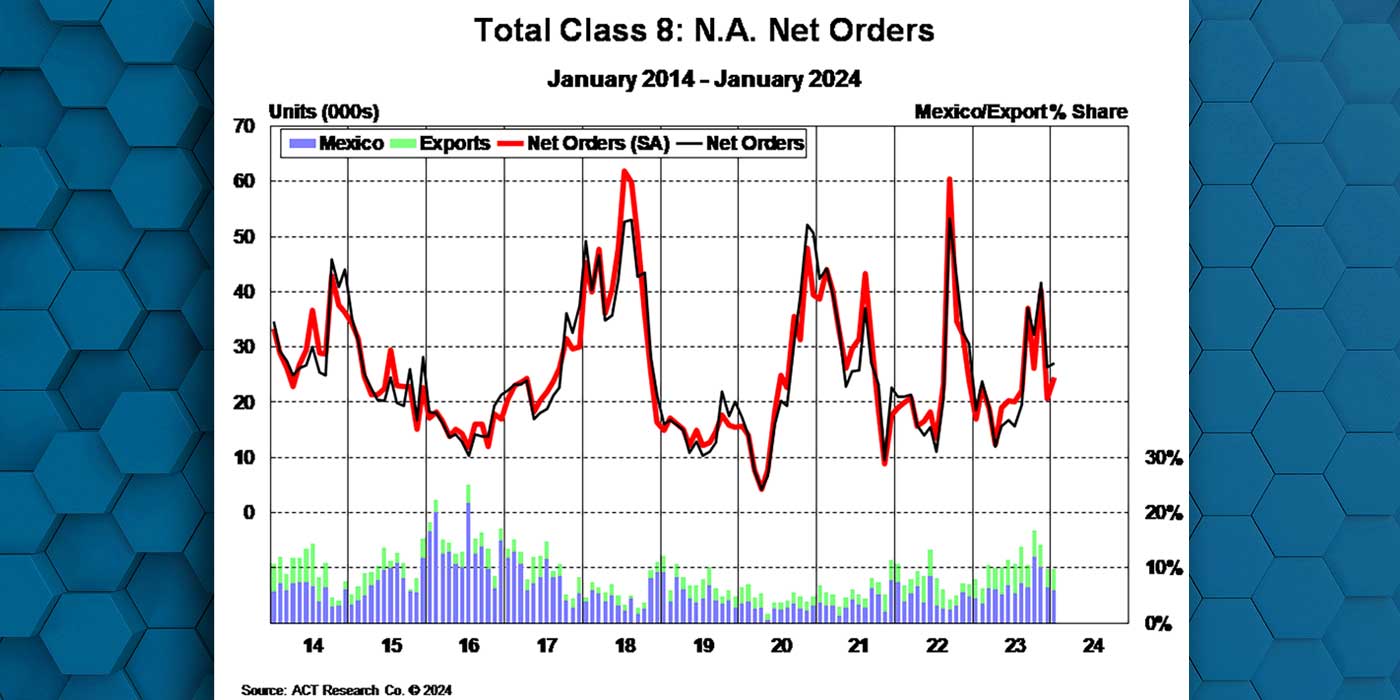

ACT Research data shows Class 8 order surge paused

At a seasonally adjusted 17,100 units, March marks the first month since May 2023 for seasonally adjusted activity below 20,000 units.

ACT Research trailer report finds carriers with ‘reduced willingness to invest in equipment’

ACT Research says limited capex and companies saving money to meet EPA regulations are currently weighing on trailer demand.

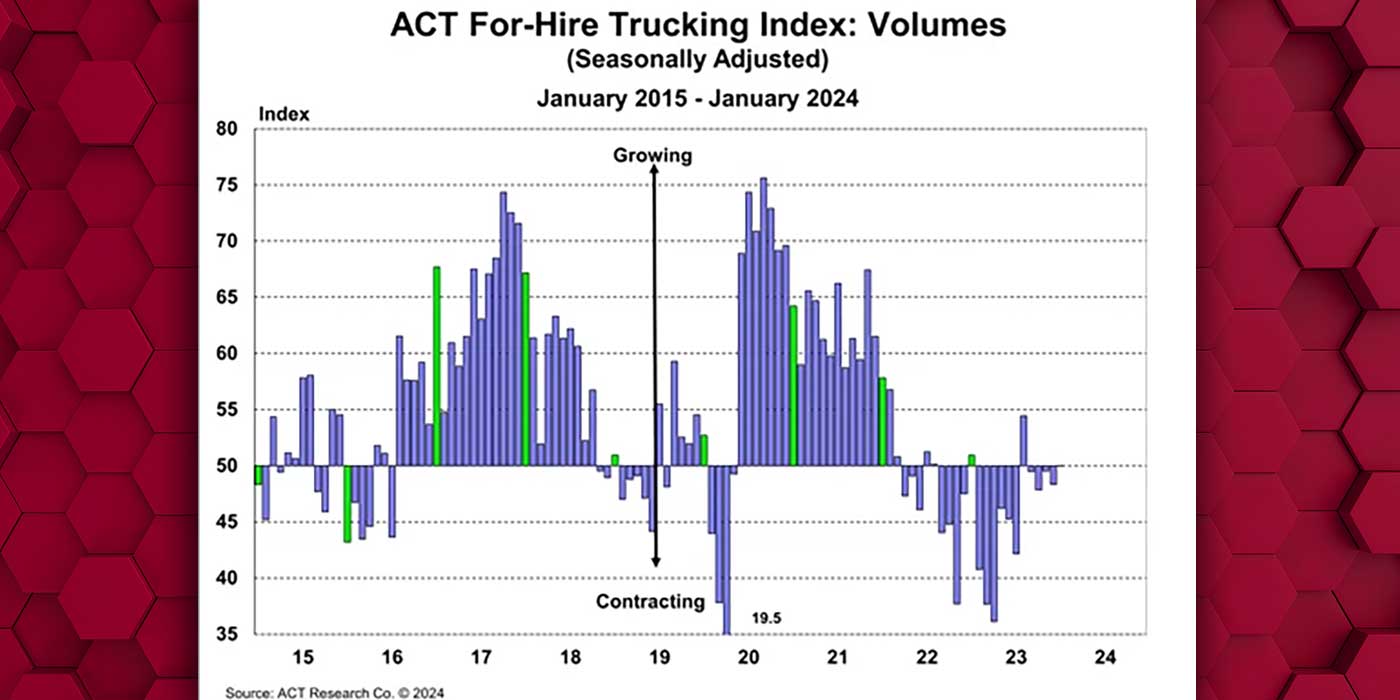

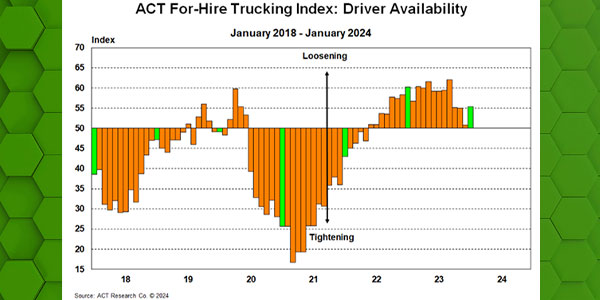

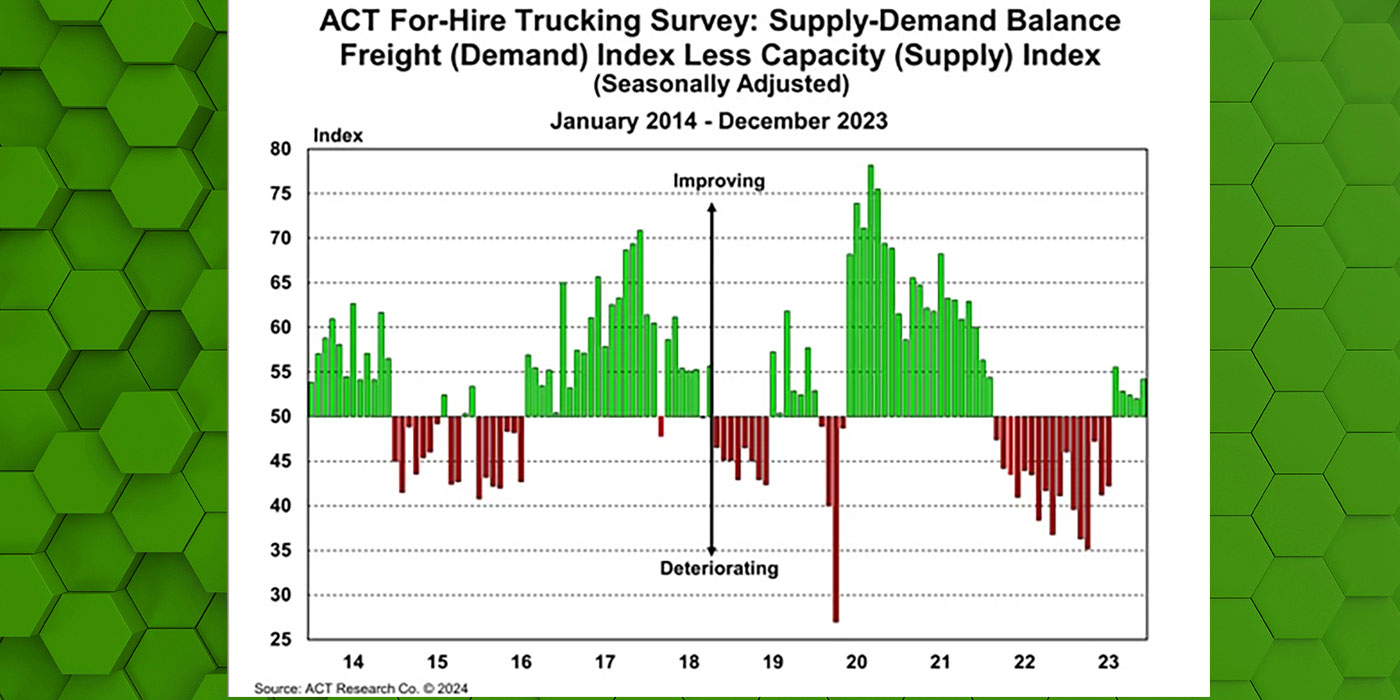

ACT Research: Freight capacity decline likely to continue

The latest release of ACT’s For-Hire Trucking Index reflects the slowly progressing freight market recovery.

Class 8 orders strong in February

Even when seasonally adjusted, ACT says preliminary order numbers for February are up 5% over January.

ACT Research: 2024 could see trucking recovery

Despite trucking demand remaining weak, ACT Research says imports and international data indicate positive trends in 2024.

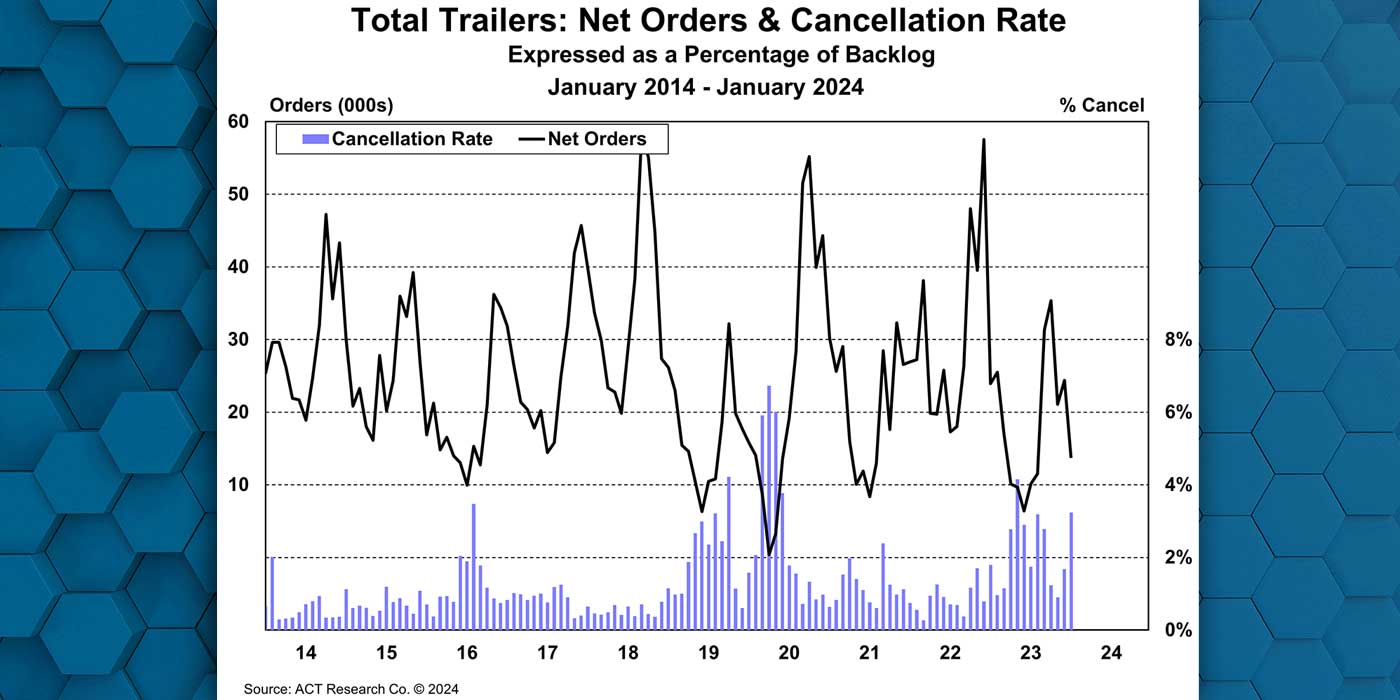

ACT Research: Trailer orders dip as cancellations climb

Preliminary data for net trailer orders in January seems to follow a continued softening trend, according to ACT Research.

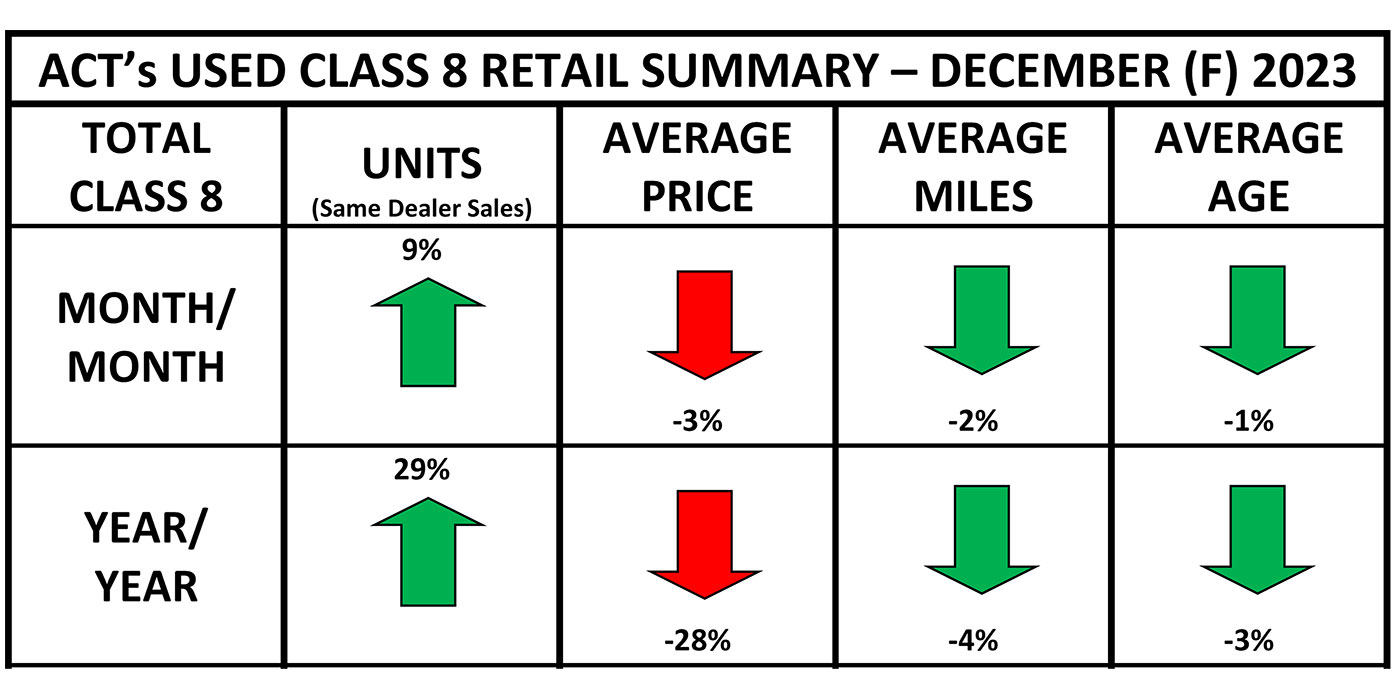

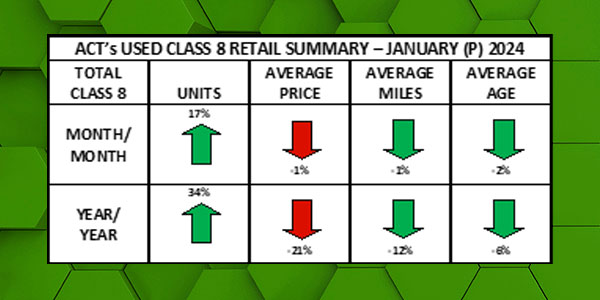

ACT Research: Used Class 8 sales start 2024 strong

The preliminary numbers for January show used Class 8 trucks are selling well compared to both last month, and last year.

ACT Research: January Class 8 demand above replacement level

Despite the increase in Class 8 tractor orders, ACT president Kenny Veith still sees a risk for rapid inventory escalation, this year.

ACT Research ups 2024 Class 8 production and sales expectations

Looking at demand, activity, orders and backlogs, ACT Research expects an Class 8 production and sales to rise for the first time since last July.

ACT Research: For-Hire Trucking Index reflects recovering freight market

ACT Research says their survey data sows conditions are gradually moving in the right direction.

ACT Research: Used Class 8 value hits low last seen in 2021

Despite the drop in price, ACT Research vice president Steve Tam says 2023 sales volume increased considerably.