FTR Shippers Conditions Index for May falls

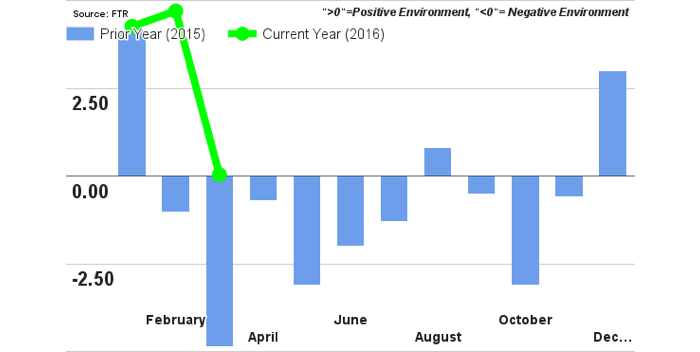

FTR’s Shippers Conditions Index (SCI) fell back into negative territory in May to a reading of -2.8, following five months of positive (favorable to shippers) readings. Market signals remain very mixed with some seasonal increase in spot freight rates negatively affecting the SCI. Overall, the index should remain close to neutral until Congress decides if

FTR’s Trucking Conditions Index hits lowest level since 2011

FTR’s Trucking Conditions Index (TCI) for May fell to its lowest level since 2011 at a reading of 1.69, nearly five points lower than the previous month. Negatively affecting truckers are lower freight rates and capacity utilization that has dropped below 95%. The TCI is currently forecasted by FTR to rise into the mid-single digits

Class 8 orders fall in June, according to preliminary numbers

FTR’s preliminary data for June 2016 has been released, placing Class 8 net orders for June at 13,000 units, 8% below May and -34% year-over-year. June 2016 order activity was the lowest monthly total since July 2012 and the worst June since 2009. All OEMs were equally impacted by slow order intake. The annualized rate

FTR Shippers Conditions Index improves in April

FTR’s Shippers Conditions Index (SCI) for April rose marginally to a reading of 1.5, up from 0.4 in March. The new reading reflects improved market conditions for shippers as freight demand remains sluggish. The SCI is at its highest sustained level since 2011; however, conditions for shippers should reverse in 2017 as fuel prices rise

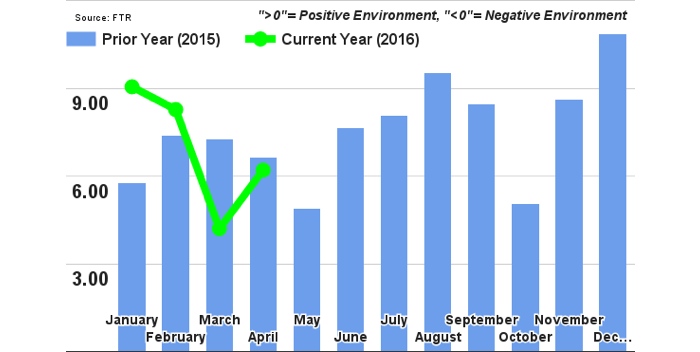

FTR’s Trucking Conditions Index remains at a low level

FTR’s Trucking Conditions Index (TCI) for April at a 6.2 reading, while up month-over-month, reflects soft market conditions affecting the trucking sector. The market is mired in a slowdown with truck freight growth slowing and a modest amount of excessive equipment. FTR is currently forecasting a transition to moderate growth toward the end of the

May Class 8 orders tick up, medium-duty sales fell

According to preliminary numbers from FTR and ACT Research Co., heavy-duty truck orders were up for May, while medium-duty sales fell. FTR has released preliminary data showing May 2016 North American Class 8 truck net orders only up slightly from April to 14,100 units, a 4% m/m comparison. Orders for Class 8 vehicles remained subdued

FTR’s Shippers Conditions Index falls after four improved months

FTR’s Shippers Conditions Index (SCI) fell to a near neutral reading of 0.4 in March after improving for each of the four previous months. The risk of diesel prices rising has put pressure on the fuel cost component of the index, reflected in the current month’s decline. However, FTR expects the SCI to remain in

FTR’s Shippers Conditions Index reads favorable for shippers

FTR’s Shippers Conditions Index (SCI) continued to improve for the fourth consecutive month to a reading of 4.7 in February. The measure will remain relatively positive for shippers in 2016 before starting a steady move downward towards year end and likely lasting through 2018 as a regulatory-driven capacity crunch takes hold, save any onset of

Once again, truck sales drop

Across the truck industry, sales numbers have been dropping. Preliminary numbers are in for April, and according to both FTR and ACT Research Co., heavy-duty sales are down for the month. ACT’s preliminary numbers show 33,800 new orders from Classes 5-8 (13,700 from Class 8 and 20,100 from Classes 5-7). That’s a 16% drop from March and a

Trailer orders disappoint in March

According to the latest numbers from FTR, U.S. Trailer net orders for March came in at 13,800 units, down 35% from February and 39% from March 2015. The monthly order activity was the lowest since July 2013, and well below FTR’s expectations. Despite the weak numbers for March, backlogs are down only 6% year-over-year. Dump trailers were the

FTR Trucking Conditions Index continues to fall

FTR’s Trucking Conditions Index (TCI) continued to soften in February due to a weakening of the freight environment early in 2016. The current reading at 8.27, as seen in the above chart, reflects FTR’s forecast for a slowdown in truck loadings from an average of 4% thus far in the recovery to 2% for full

March Class 8 orders at lowest level since September 2012

FTR has released preliminary data showing that March 2016 North American Class 8 truck net orders fell for the third consecutive month to 15,800 units, the lowest level since September 2012. March 2016 orders were 12% below February and down 37% year-over-year, the weakest month of March since 2010. Class 8 orders have now totaled