ACT Research: Used Class 8 value hits low last seen in 2021

Despite the drop in price, ACT Research vice president Steve Tam says 2023 sales volume increased considerably.

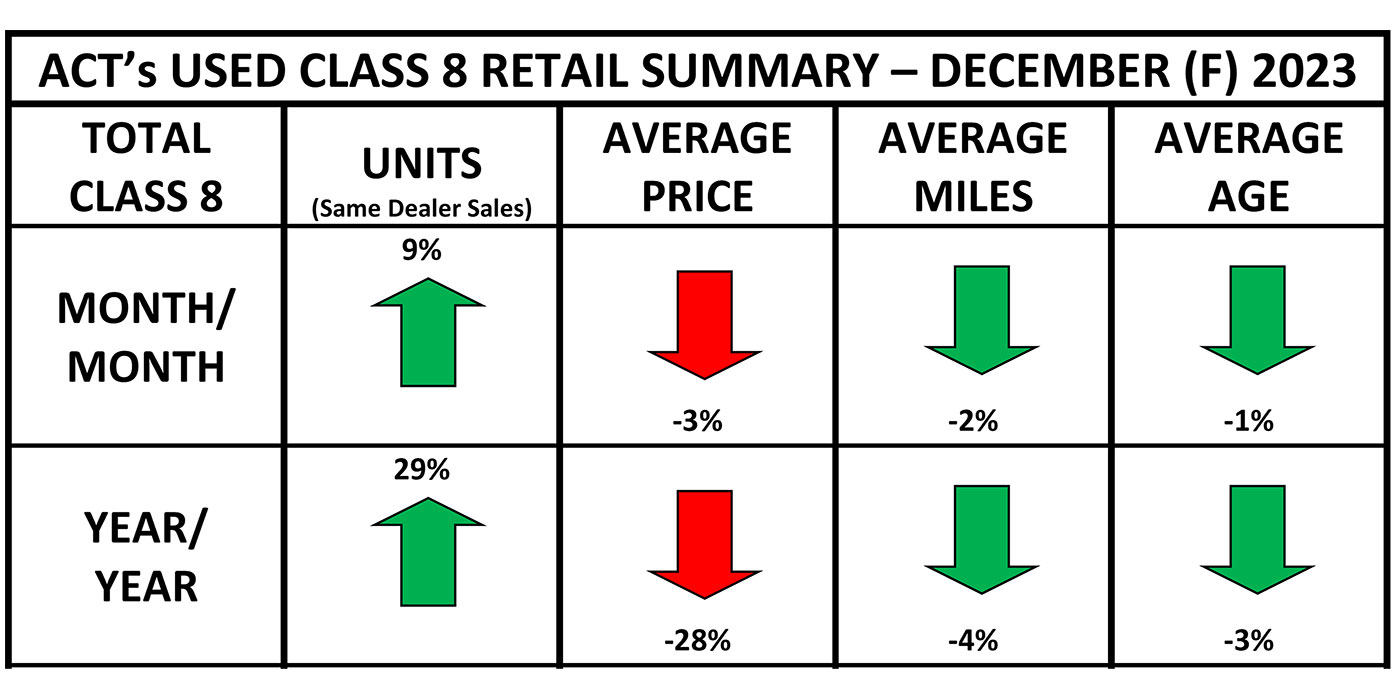

Used truck sales end 2023 with a strong showing

Significant increases for both month-to-month and year-to-year numbers.

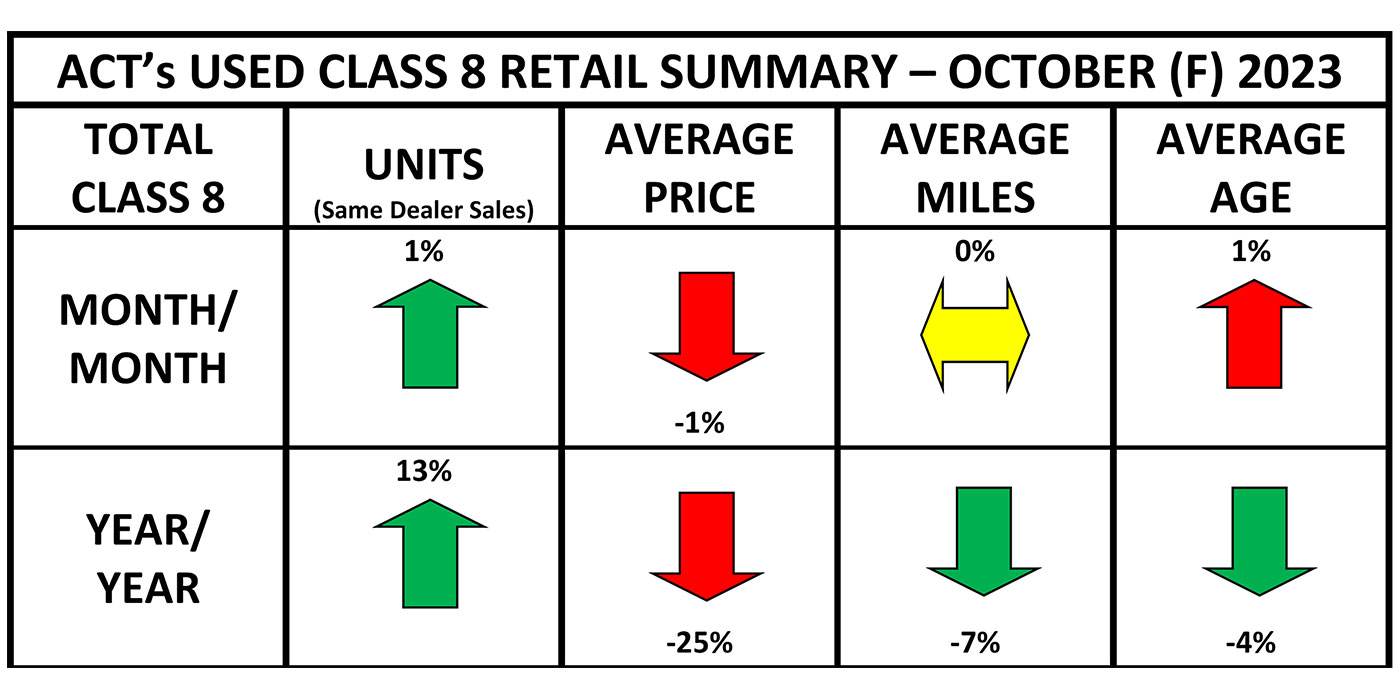

ACT Research: Used truck prices stabilize in October

The used Class 8 average retail sale price fell 1% month-over-month and 25% year-over-year.

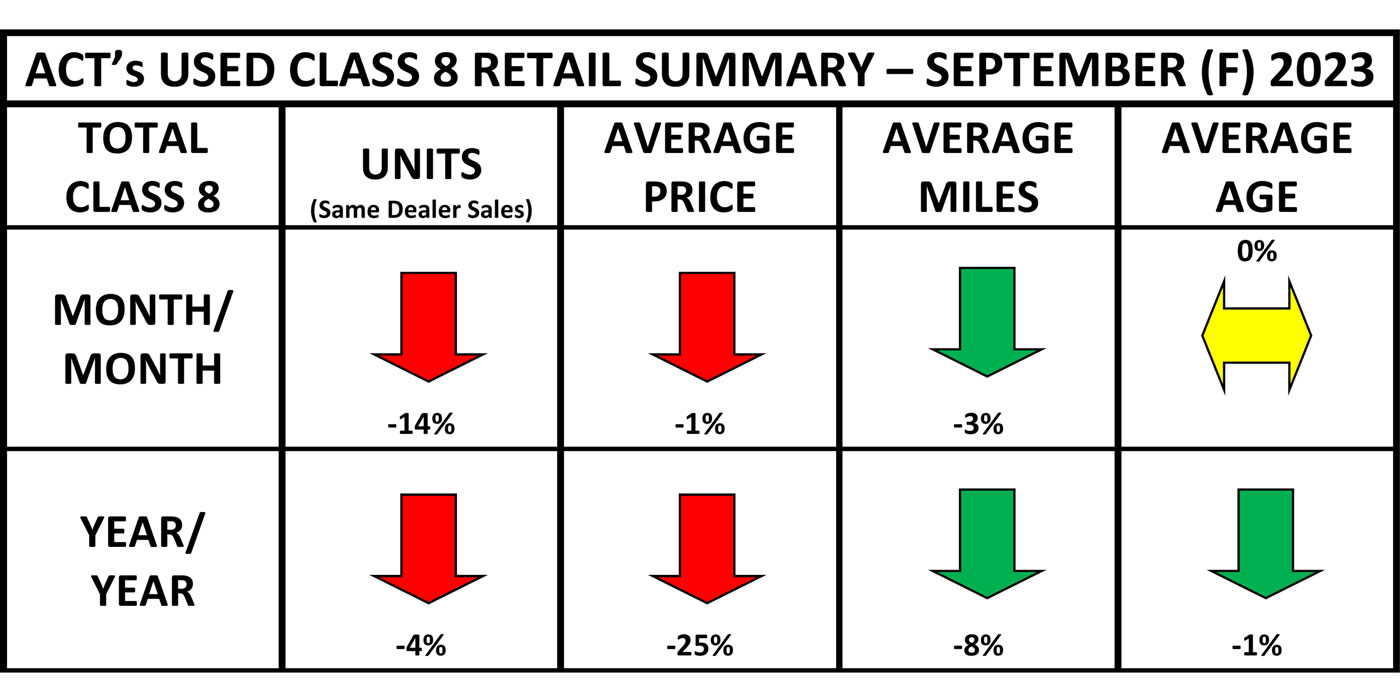

Used Class 8 truck prices fell slightly in September; auction prices rose

ACT Research expects lower prices through the end of 2023.

Daimler Truck North America launches Extended Optimum for used truck coverage

The extended coverage comes with genuine OEM parts and service through DTNA’s dealer service network.

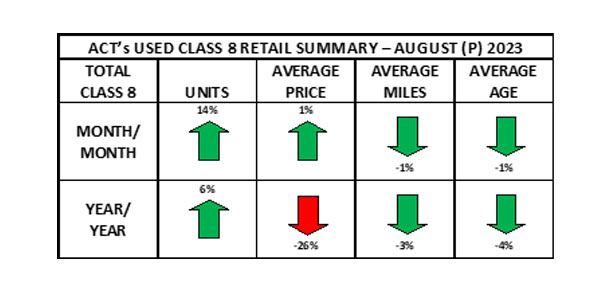

Used truck sales uncharacteristically high in August

Compared to July, average retail price increased 1%, while miles and age both declined 1%.

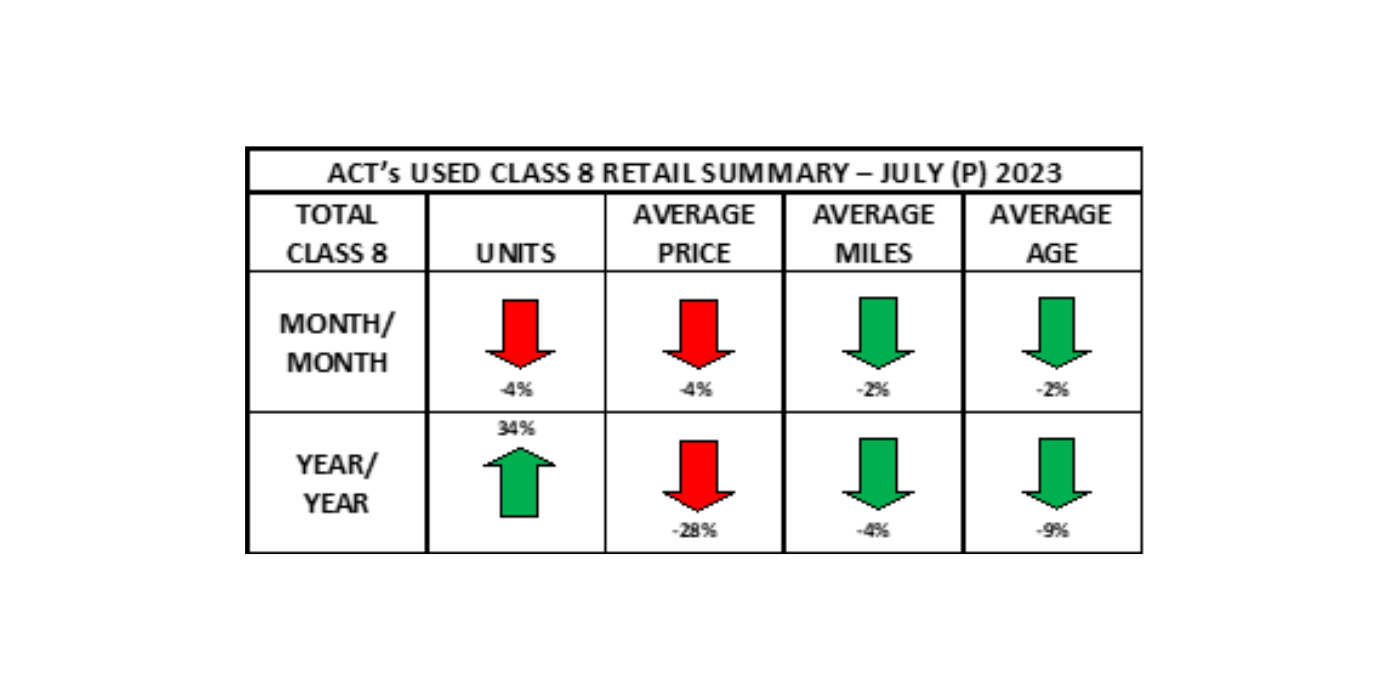

Used truck market declined in July

Compared to June 2023, average retail price declined 4%, while miles and age both declined 2%.

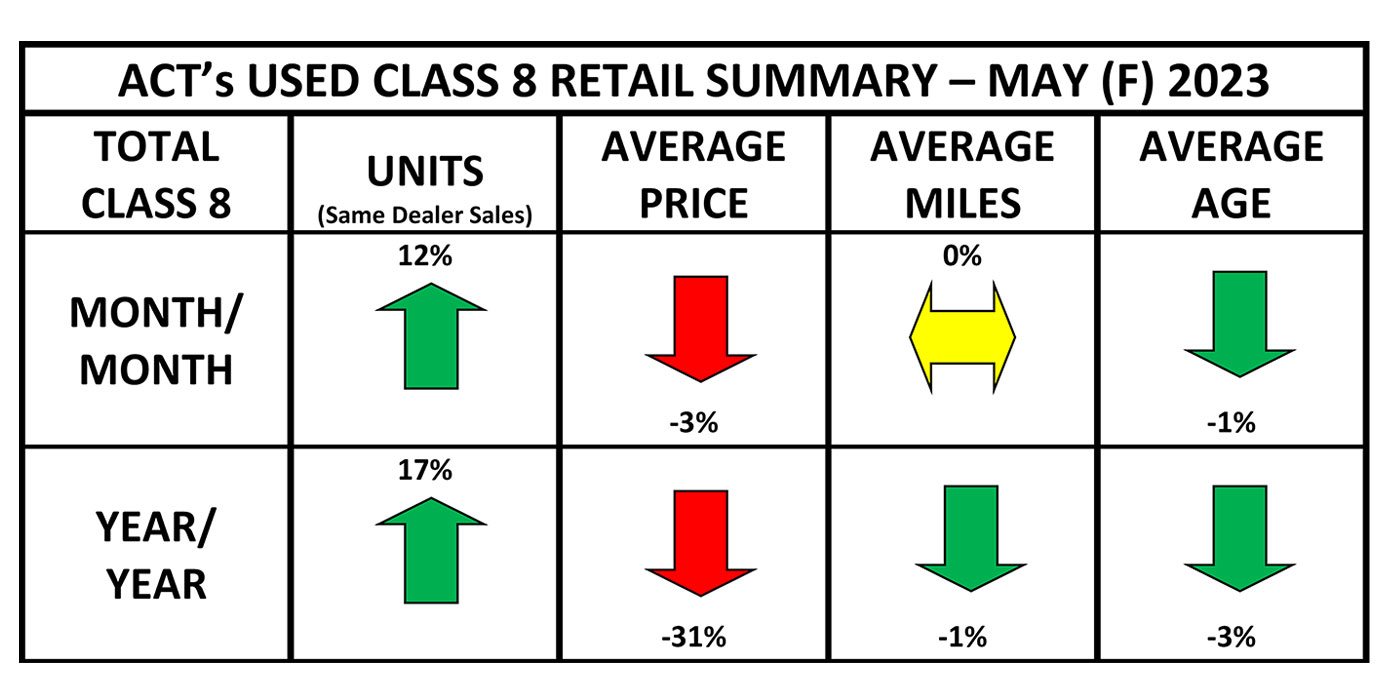

Used Class 8 sales high in May amid economic, freight environments

Tam concluded that even though the economy, freight conditions are currently weak, the comparison emphasizes the circumstances faced in 2022.

Used truck same dealer retail sales improved 10%

Combined, the used truck industry saw preliminary same dealer auction, retail, and wholesale sales advance 19% m/m.

Used truck same dealer retail sales ballooned 23% M/M in March

Retail volumes, price, miles, and age fluctuate for trucks in March.

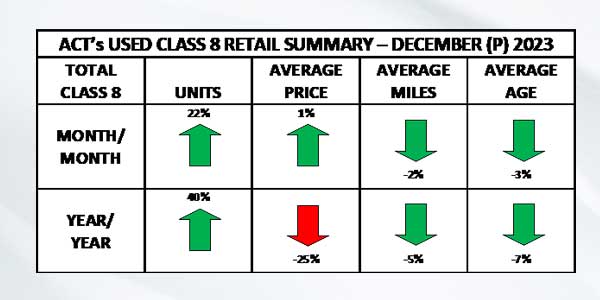

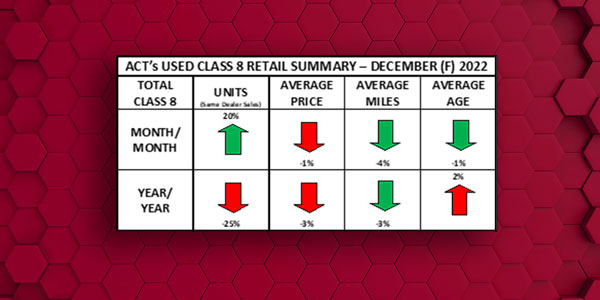

December used truck retail volumes reflect solid demand

Class 8 used truck retail volumes up 20% MoM, but 25% down YoY according to ACT Research.

Penske expands used truck center footprint

In response to continued industry demand for used vehicles, Penske has increased the footprint of its network of used truck centers with four recently opened locations in Kansas City, Missouri, Chicago, Miami, and Tampa, Fla. “While the majority of our used vehicle sales continue to take place online, our physical used truck centers also remain