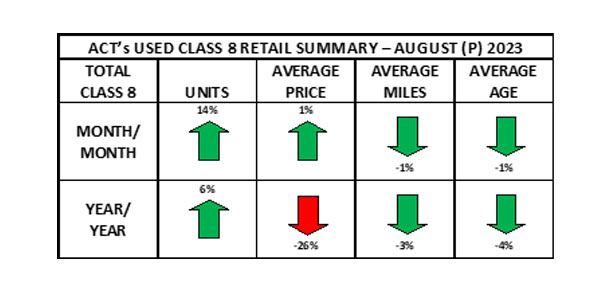

Preliminary Class 8 same dealer used truck retail sales volumes surged by 14% month-over-month in August, according to the latest numbers from ACT Research. ACT found that compared to July’s numbers, average retail price increased 1%, while miles and age both declined 1%. Compared to August of 2022, volumes improved by 6%, while price declined 26%, miles declined 3%, and age declined 4%, ACT notes.

“Historically, August is the second-best sales month of the year, more than 8% above average and 10% better than July,” according to Steve Tam, vice president at ACT Research. “The uncharacteristically large improvement this month is likely a reflection of the increased availability of units at more attractive prices.”

Tam observed that in three out of the last four months, the average retail prices for used Class 8 trucks have either depreciated below the usual or typical month-to-month levels. Looking forward to the next month, ACT expects the prices, which will serve as the basis for longer-term comparisons, to be significantly lower than what they have been in the first half of 2023.

According to ACT, this is happening alongside the process of reducing excess inventory in shippers’ possession, and as a result, the contraction in freight is anticipated to cease and potentially shift towards growth. Simultaneously, Tam notes that the number of trucks operating in the freight market continues to decline. These factors, he added, collectively set the stage for a rebalancing of capacity, paving the way for a return to a more typical used truck market.