Interact Analysis says rising deployments of hydrogen fuel cell vehicles (FCEVs) are fueling demand for hydrogen refueling stations (HRS) in China. According to Interact Analysis’ research for published policies in China, as of the end of 2023, 25 provinces and municipalities across China planned to build more than 1,200 HRS by 2025. Interact Analysis’ statistics on HRS construction projects show all provinces and municipalities in China have constructed at least one HRS, except Tibet. By the end of 2023, Interact Analysis says 354 HRS have been built and put into operation in China (excluding mother HRS and dismantled stations), with 50 more under construction, making China the country with the most hydrogen refueling stations in the world.

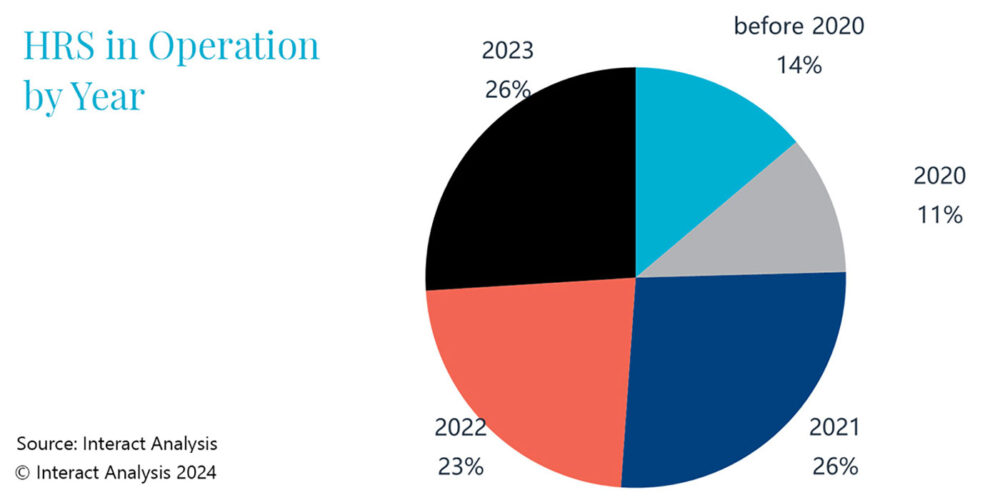

As early as 2006, China’s first stationary HRS (Yongfeng hydrogen refueling station located in Zhongguancun, Beijing) was put into operation, after which a number of hydrogen refueling stations came into operation—mainly in frontrunner regions like Guangdong, Shanghai—for promotion of hydrogen-powered vehicles, according to Interact Analysis. Since 2020, with the launch of demonstration city clusters for the application of hydrogen vehicles, the HRS construction has significantly accelerated. More than 80 stations commenced operation each year from 2020 to 2023, with construction speed particularly increasing in Shandong, Zhejiang, Hebei, and Jiangsu provinces.

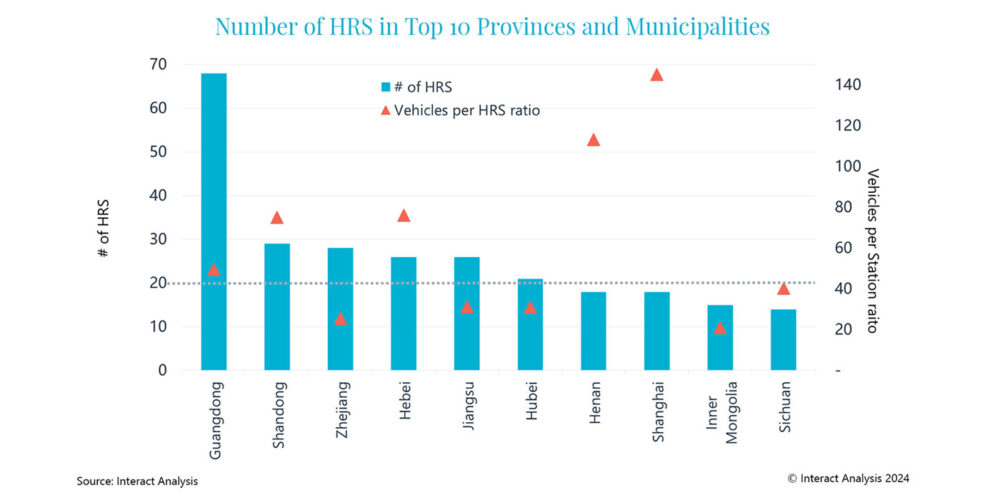

‘Vehicles per HRS ratio’ varies substantially from region to region

More than 10 HRS are in operation in 13 provinces and municipalities in China, which Interact Analysis says accounts for 84% of the overall total. Guangdong province is in the lead with 68 stations (centralized in Foshan and Guangzhou city), while Shandong, Zhejiang, Hebei, Jiangsu and Hubei all have more than 20 HRS in operation.

Compare these stations with the number of commercial FCEVs, the “vehicles per HRS ratio” varies significantly from province to province. Currently, the national hydrogen station ratio is about 58 vehicles for each hydrogen refueling station. Among the top ten provinces/municipalities for HRS in operation, the vehicle per HRS ratios in Zhejiang, Jiangsu, Hubei, Inner Mongolia, and Sichuan are well below the national level according to Interact Analysis, which means in these provinces, stations are ahead of the rate of FCEV deployments. In Zhejiang, Interact Analysis says HRS were mainly built at gas station sites (multi-fuel stations) by Sinopec and other petrochemical companies, while in Inner Mongolia, which is an important renewable energy base in China, HRS were built as part of the integration of hydrogen production and renewable energy.

In Shandong, Hebei, Henan and Shanghai, the vehicles per HRS ratio is much higher than the national level. In 2023, Hebei and Shandong saw exponential growth, with more than 1,000 commercial FCEV registrations each, making them the top two provinces for commercial FCEVs. Interact Analysis says this surge is propelling demand for HRS in these regions.

2025 will be a challenging target to hit

Compared with a construction target of more than 1,200 hydrogen stations by 2025, Interact Analysis notes that progress is lagging behind and the number of HRS in operation accounted for only 30% of the 2023 target. HRS construction in Guangdong, Zhejiang, Anhui, Hunan, Tianjin, Guangxi and Hainan is higher than the national average, and Tianjin has reached its planned target of 5 HRS already, while the HRS targets in Hunan, Guangxi and Hainan in 2025 are relatively low (no more than 10 stations).

Interact Analysis says based on current the construction process, achieving the 2025 goal of more than 1,200 HRS will be challenging, adding that the planning target in each province is dynamically revised in accordance with actual deployments of hydrogen vehicles and stations. Furthermore, on top of the high construction and operation costs, Interact Analysis says difficulties and delays in obtaining certificates for operation are also major challenges for HRS development. It is clear that problems relating to FCEVs without stations and HRS without operation certificates need to be addressed in order to promote hydrogen vehicle and infrastructure deployments, according to Interact Analysis. With FCEV demonstration projects approaching the deadline of 2025, the company expects applications of hydrogen vehicles and HRS construction to speed up during 2024 and 2025.