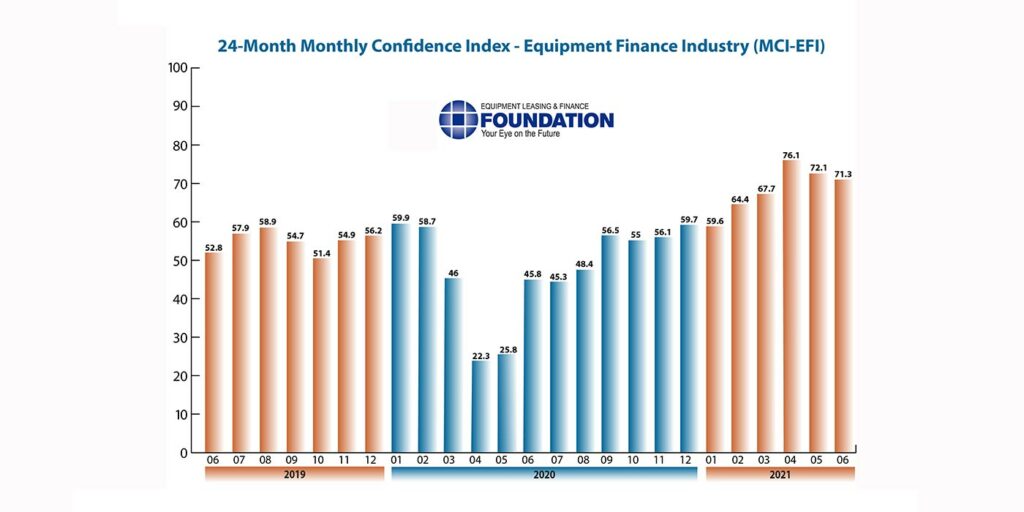

The Equipment Leasing & Finance Foundation released its June 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 71.3, steady with the May index of 72.1.

When asked about the outlook for the future, MCI-EFI survey respondent Alan Sikora, chief executive officer of First American Equipment Finance, said, “Companies across all industries are investing in new projects to stay ahead and better serve their customers, while also investing in technology and programs to better serve their employees in the ‘new normal’ hybrid work environment.”

June 2021 survey results

The overall MCI-EFI is 71.3, a decrease from the May index of 72.1.

• When asked to assess their business conditions over the next four months, 42.3% of executives responding said they believe business conditions will improve over the next four months, down from 53.6% in May. 57.7% believe business conditions will remain the same over the next four months, up from 46.4% the previous month. None believe business conditions will worsen, unchanged from May.

• 51.9% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 53.6% in May. 48.2% believe demand will “remain the same” during the same four-month time period, an increase from 46.4% the previous month. None believe demand will decline, unchanged from May.

• 32.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, 67.9% of executives indicate they expect the “same” access to capital to fund business, and none expect “less” access to capital, all unchanged from the previous month.

• When asked, 46.2% of the executives report they expect to hire more employees over the next four months, up from 39.3% in May. 50% expect no change in headcount over the next four months, a decrease from 60.7% last month. 3.9% expect to hire fewer employees, up from none in May.

• 22.2% of the leadership evaluate the current U.S. economy as “excellent,” an increase from 10.7% the previous month. 77.8% of the leadership evaluate the current U.S. economy as “fair,” down from 89.3% in May. None evaluate it as “poor,” unchanged from last month.

• 51.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 60.7% in May. 48.2% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 39.3% last month. None believe economic conditions in the U.S. will worsen over the next six months, unchanged from the previous month.

• In June 48.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 53.6% last month. 51.9% believe there will be “no change” in business development spending, an increase from 42.9% in May. None believe there will be a decrease in spending, down from 3.6% last month.

The Quote

“The equipment finance industry is nimble and will excel coming out of challenging times. I believe this will happen as we come out of the COVID-19 pandemic and its effects on businesses. I still remain cautious as to the assertive pricing in the market with little room to accept the volatility that still remains in the market,” said David Normandin, president and chief executive officer of Wintrust Specialty Finance.