After a decade of growth, the commercial tire market now faces a host of challenges–from supply chain disruptions to fluctuating raw material costs. Some are calling 2024 a “correction year.”

Brian Sheehey, senior vice president at Ralson Tire North America, is one of those people. He says commercial truck tire demand is expected to remain stagnant or see modest growth in 2024 after a turbulent 2022/23 that combined oversupply with depressed pricing.

“There was such a backlog of supply that dealers were stretching out their supply chain orders just to get products,” he explained. “When the demand plummeted and the supply chain opened with a glut of tires going into the end of last year and the beginning of this year, supply far outweighed demand.”

Sheehey says Europe was the first economy to tank in the commercial tire segment in early 2021 and 2022, but it’s starting to come back. He sees the same comeback for the U.S. market soon, as manufacturers are shifting products back to be more even across the world instead of pushing everything to North America. The correction, he says, comes in the form of manufacturing, supply chain corrections and dealers correcting their inventories where they were heavy in the first half of 2023.

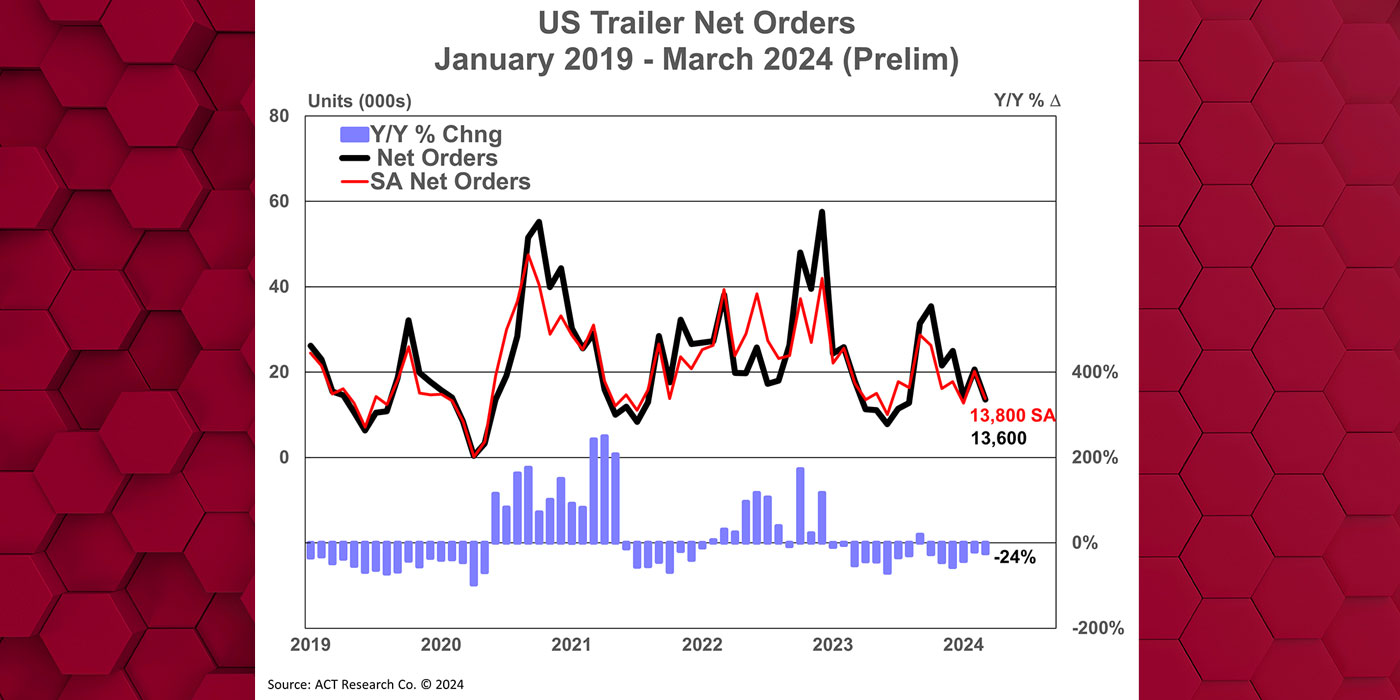

Sheehey believes certain segments like construction and trailer tires may see slightly greater demand due to economic stimulus funding construction projects and the need to replace aged trailer casings.

“Trailer casings are getting a bit old and, when there was a shortage, there’s not only a need for casings but there’s also a need for equipment to be replaced on the trailer side, especially whether it’s an on-road trailer or if it’s a chassis,” Sheehey says.

Regional trucking may also benefit as smaller businesses pivot from long-haul to shorter regional routes. Sheehey explained that many “mom-and-pop” operations that survived the pandemic hope to capitalize on resilient local economies.

“We see a lot of businesses going from linehaul into regional, even though there have been some LTL changes, the mom-and-pop businesses that survived over the last year or so should be very good locally versus a national economy,” he says.

However, Sheehey cautioned that raw material price increases, higher interest rates and global conflicts threaten to raise costs for fleets in 2024. Not to mention key commodities like oil, which jumped from $60 to over $90 per barrel this year. Oil is used to produce carbon black, natural rubber and other tire components, so, an increase in oil costs means an increase in manufacturing costs.

“Oil is making a significant shift upward in price, especially with what’s going on in the world right now, we don’t see it going down anytime soon,” Sheehey says. “These all have to be accounted for; whether it’s carbon black, natural rubber or all the tire components, including the steel, these are all going up in price.”

The price increase in multiple segments likely comes from inflationary pressures and global tensions. In terms of inflation, price hikes are a result of the Federal Reserve hiking interest rates. This is driving up borrowing costs significantly for fleets looking to invest in new equipment and replacement tires.

“The fleets and dealers have to be very conscious regarding their marketing, material and capital investments,” Sheehey explained. “This year, interest rates are the highest in 30 or 40 years. Most companies haven’t had issues with the cost of borrowing over that time until recently.”

Raw material cost increases may have something to do with conflicts around the world, Sheehey says. However, it’s not just the cost increase of the raw materials, but the transportation to get them to different areas, he explained.

Sheehey believes that all these factors indicate commercial truck tire prices will likely increase in 2024 after being down in late 2022 and 2023. During this period, excess industry capacity and inventory levels led to significant price declines not tied to material costs or supply and demand.

“Pricing trends have been depressed and it has to do with market conditions, not with measurables like raw materials and transportation,” Sheehey says. “There was just such an oversupply of tires that pricing, especially in the third and fourth quarter, was significantly depressed.”

What does this mean for commercial tire dealers? Well, with limited tire budget flexibility, Sheehey advised that fleets focus on extracting maximum value from every dollar spent. That means dealers and fleets work hand in hand to find the best options for that fleet, all while taking into account cost and supply availability.

“If your costs are increasing and you have what your spend is going to be for the year, you have to stretch that dollar,” Sheehey says. “[Fleets] really should start investigating value.”

Sheehey advises fleets to invest in new ideas and products, looking at all retread options and relying on manufacturer and dealer relationships to optimize how they spend money on necessary replacement tires for commercial vehicles.

“If a fleet has a $10,000 tire budget that’s not changing, they might need as many if not more tires, and they’re going to have to figure out how to do that without losing operational efficiency,” Sheehey says. “That’s where they can lean on their supplier, their manufacturer and the partnership.”

To help aid North American dealers keep their supply consistent, Sheehey said Ralson is opening a new warehouse in the US and ramping up factory capacity from one to two million tires, and expanding its sales force to adhere to its growing number of commercial tire dealer partners. The plant will provide 22 SKUs in the launch phase under each the Ralson and Accelus brands for the US market and both brands will focus on segments like regional, pickup and delivery, and waste haul/construction applications.

“Our goal is to have as many sales reps as some of the Tier Two brands within the next two years,” he explained. “We’ll be in the field personally representing our products and working on solutions together with dealers.”

Looking ahead, Sheehey emphasizes that in periods of market uncertainty, developing strong partnerships will be key for dealers to maximize profits. By leveraging manufacturer and supplier relationships and evaluating innovations that add value, dealers and fleets alike can stretch every dollar in challenging conditions.