Heavy Duty Aftermarket Dialogue (HDAD), hosted by MEMA and MacKay and Co., is the opening act for Heavy Duty Aftermarket Week. The event brings together heavy-duty vehicle suppliers, OEMs, and heavy-duty aftermarket participants to discuss the latest trends.

Prediction time: We’re expecting HDAD to cover supply chain challenges and market conditions; truck technology and electrification; and truck service and workforce challenges. Fleet Equipment has a front-row seat for the event and we’re blogging as it’s happening, so come along and join the conversation.

The real-world view of the heavy-duty trucking aftermarket

Here’s who’s on stage:

• Kent Jones, president–Americas, SAF‐Holland Inc.

• Rob Phillips, founder and CEO of Phillips Connect, and CEO, Phillips Industries

• Jeffery Porter, president and CEO, Velvac Inc.

• Moderator: Collin Shaw, chief commercial vehicle officer, MEMA

Here are the other top takeaways from the panel …

On the state of the supply chain.

Jones: On the supply chain: Cautiously optimistic. There are still suppliers struggling with supply. Sometimes the length of finding alternative supply in a market that is very, very busy–it’s taking a long time. If suppliers don’t come through with a solvent cash position, it’s difficult.

Phillips: I’m very positive. We’re not seeing nearly the issues [that we saw last year]. They’re still there but they are manageable.

Porter: On the supply chain: We’re cautiously optimistic. We’re still getting those Monday morning calls that something was supposed to be on the dock and it hasn’t left yet. I still think there’s a long way to go.

On electrification.

Jones: The commercial EV segment is still immature. It’s happening, but the overall aftermarket impact is minimal; folks at the show should pay attention to the EV transition. The transition from combustion engines changes to EV motors, cooling systems and subsystems for EV powertrains is doable for the type of parts supply that’s going to be in place. The heavy-duty space needs to look at what’s happening around EV automotive.

Phillips: We’re doing work with high-voltage harnessing, but there’s different training that’s required. How do you diagnose a trailer? Provide guidance and training and communicate what standard repair times should look like to ease the transition from combustion engines to EVs? Training is going to have a big impact.

On data and connectivity.

Phillips: Fleets are fearful of being inundated with data. It comes down to the user interface to prepare the information to be actionable. We have weekly meetings with fleets that use our data to teach them what to look for and how to identify trends.

Porter: Fleets have struggled with hundreds of gigabytes of video and using it for driver training. We’ve pioneered the use of cameras for blind spot detection and smart sensors and, in general, have allowed fleets to sift through the piles of data and grab information that’s relevant much more quickly than in the past. For example, if a vehicle has a lane departure warning and a blind spot object detection with a vehicle in the blind spot, you can display the events that have both of those triggers at the same time.

On “Amazon-like” fulfillment expectations.

Porter: There’s already a trend of vehicle data with dealer networks to improve uptime and availability. As suppliers, we need to be able to supply real-time inventory data, cross-reference tools for parts replacements, seamless order entry and so forth. We’re integrating our B2B and B2C systems so that we can have that rich visual data.

The global economic and geopolitical overview

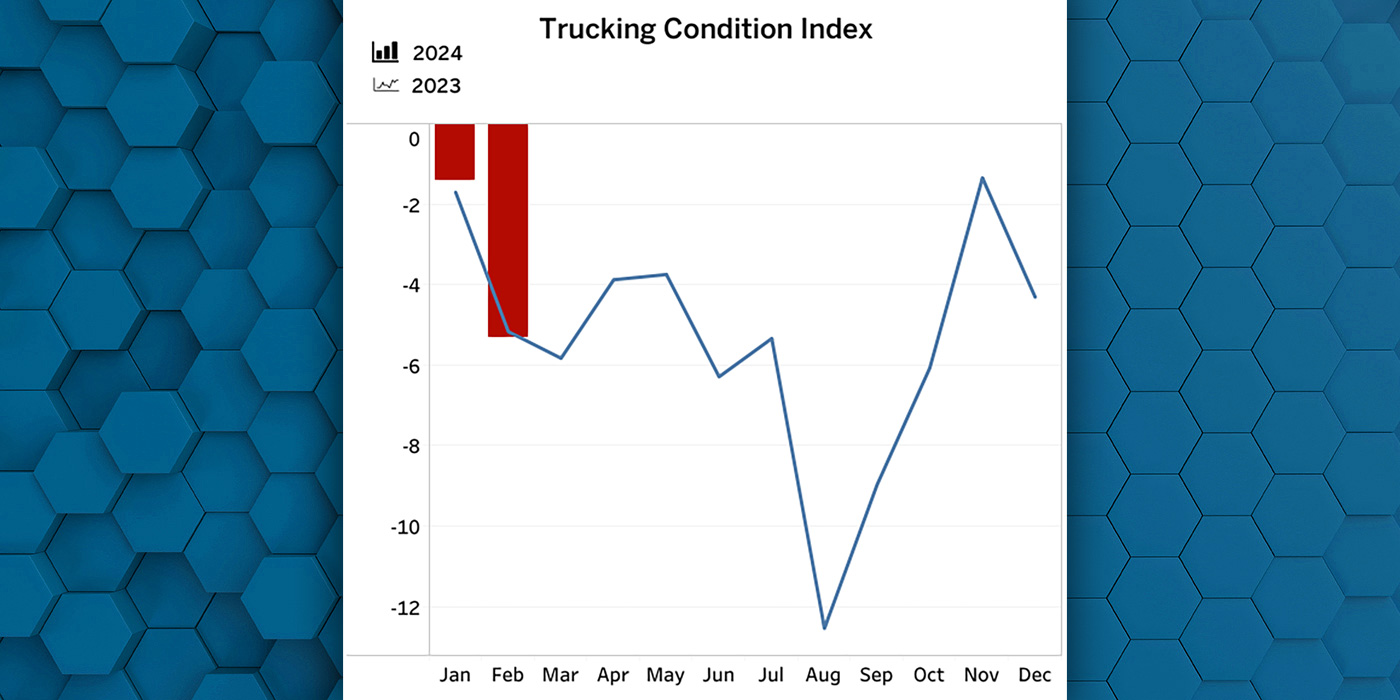

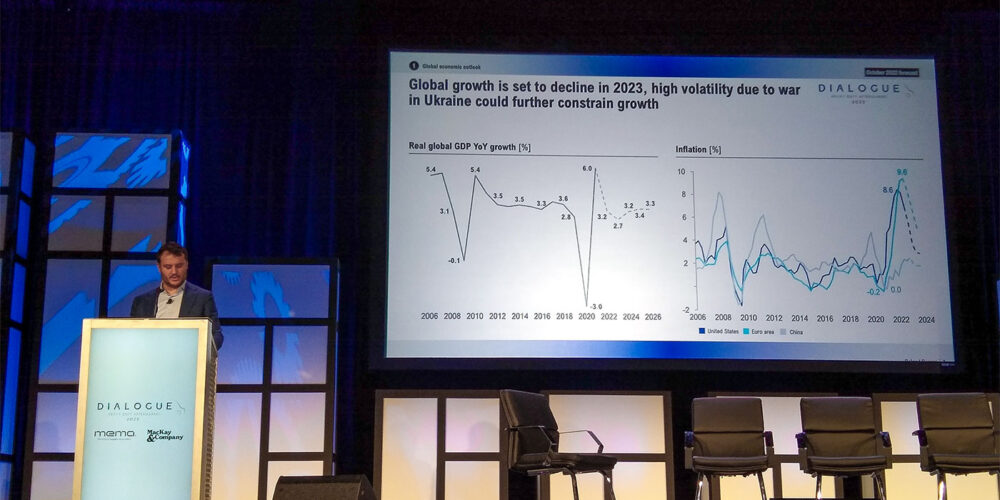

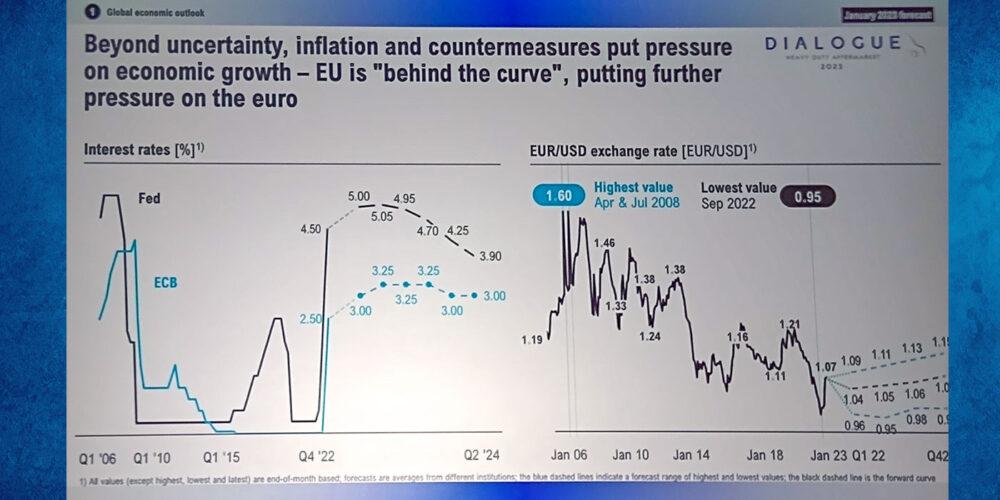

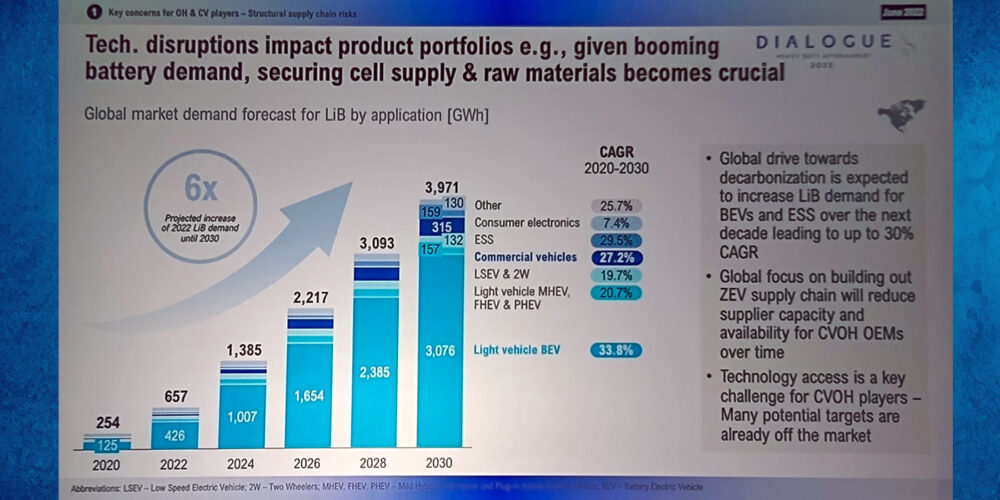

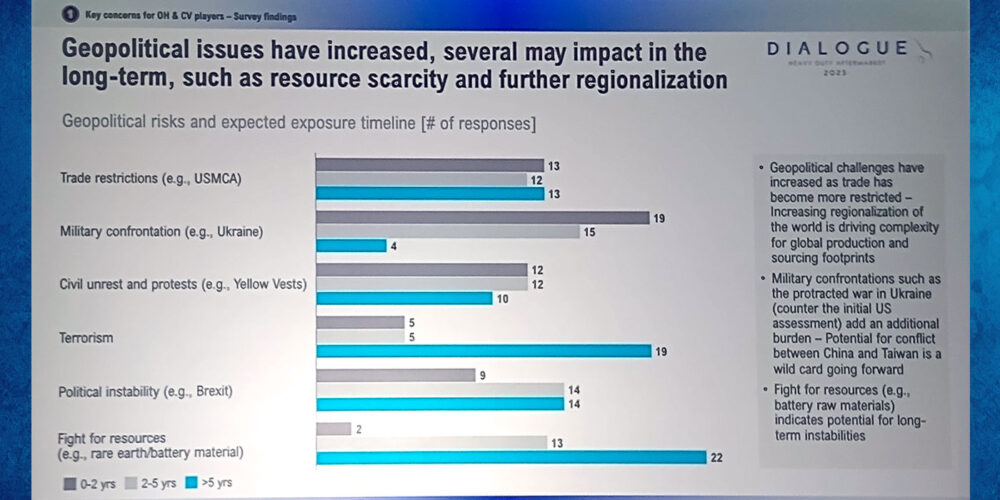

Piggybacking off of a portion of the first panel, Giovani Schelfi, partner, Roland Berger, took the stage to provide an in-depth look at global market conditions and how it impacts the heavy-duty aftermarket supply market. Here are a few of the top charts from his presentation.

Heavy-duty aftermarket parts pricing trends and predictions

Feeling the pain of parts pricing? Hopefully there’s some comfort in knowing that so is everyone else. Dave Kalvelage, client consultant and analyst, MacKay and Co., provided an insight-packed presentation on heavy-duty aftermarket parts pricing trends and predictions. So the big question is: Is parts pricing relief on its way? Watch the video below to find out.

Aftermarket OEM perspective: Daimler Truck North America

Brad Williamson, director of parts marketing and strategy, Daimler Truck North America, took to the stage for a conversation on the impact of parts data, commerce and how the pandemic reshaped aftermarket operations between suppliers, distributors and dealers. Watch a clip of the conversation below.

Young people! How to recruit them, connect with them and mentor them to grow your company

• Julie Alfermann, director, central region Sales, Allison Transmission

• CJ Biank, global market manager (networks), Grote Industries

• Jack Chung, vice president, product management, Noregon Systems

• Tanya Miracle, director, OE truck/trailer, Bridgestone

• Moderator: Emily Poladian, president, Bridgestone Mobility Solutions‐Americas

All companies are working through the mix of generations in (and outside of) the office–young people coming into the industry ready to punch above their professional weight class, experienced millennials moving into middle management, and seasoned senior leadership. It’s a complicated mix of skills and experience. Of course, the children are our future, so here’s some advice for how to teach them well and let them lead the way.

How service locations are sourcing heavy-duty parts

• Ryan Bugai, sales and marketing specialist, Northwest Drive Train

• Jason Gildenmeister, vice president, fixed operations, TEC Equipment

• Toni Nastali, CEO, Spring Align Group

• Troy Willich, CEO and co‐founder, TDI Fleet Service

• Moderator: John Blodgett – Vice President, Sales & Marketing, MacKay & Company

We’ve heard about heavy-duty aftermarket parts pricing and the impact of e-commerce, but the heavy-duty truck service location is where the maintenance rubber meets a profitable road. Here’s the panel of truck service experts on how they’re sourcing parts amid pandemic-induced supply challenges and increased parts prices, and the role of the fleet in that process. Watch the video for all of their insight.

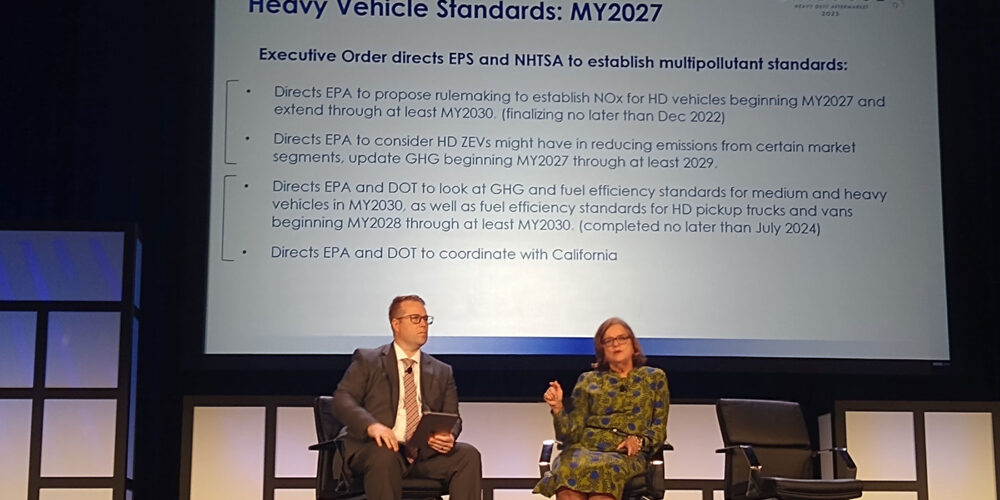

The government impact on the heavy-duty trucking aftermarket

Ann Wilson, senior vice president, government affairs, MEMA, knows her stuff. She mixes biting wit with supremely insightful knowledge of Washington, D.C., inside baseball. There’s no shortage of relegation and legislation topics to unpack. So much so that it requires its own story. Stay tuned for a full write up. In the meantime here’s a top takeaway:

“Fuel efficiency [regulation] is going to come at us like a hot knife through butter. They have to finalize those regulations before mid-point next year or else a new congress or president can overturn it. This is going to be the year of fuel efficiency.”

Fleets that are dealing with supply challenges

• Taki Darakos, vice president, vehicle maintenance and fleet services, PITT OHIO

• Scott Ewell, director of maintenance, H.R. Ewell

• Adam Wolk, director of maintenance, Challenger Motor Freight

• Moderator: Molly MacKay Zacker, vice president, operations, MacKay and Co.

“If you don’t have orders on the board, you’re in trouble,” Darakos said with a laugh on stage.

Oh and by the way, those orders that Darakos mentioned were placed in April 2022.

Clearly supply chain challenges on both the OEM and supplier networks are impacting fleets–from equipment acquisitions to extended equipment lifecycles to having to carry a larger parts inventory to make service ends meet. The panel was candid, clever and insightful. Watch a clip of the conversation below.

That’s a wrap on HDAD 2023!

But it’s just the start of our Heavy Duty Aftermarket Week coverage.